The idea of utilizing Bitcoin as a Medium of Exchange is long-forgotten. There is a reason why some market analysts often compare Bitcoin to other valuable commodities such as Gold. Other cryptocurrency proponents deem the network slow, and hence other protocols have risen in utility over the past few years.

Yet, recent data suggested that BTC’s lightning network is not completely down and out. In this article, we will try to evaluate the current situation and establish a ground, whether BTC’s MoE credentials are relevant or not.

Bitcoin Lightning Network resurgence in play?

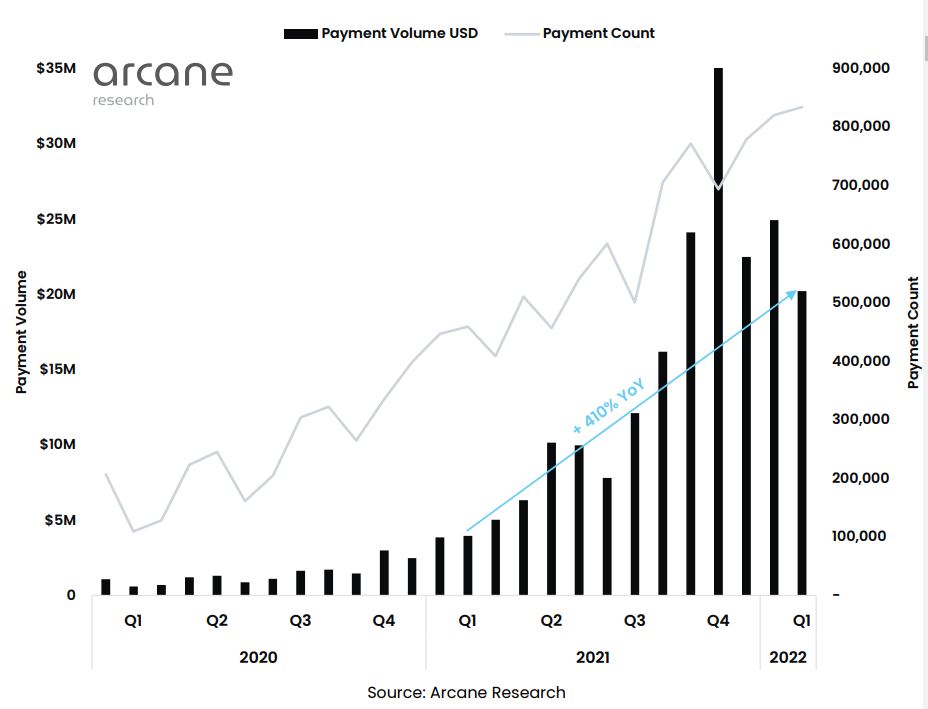

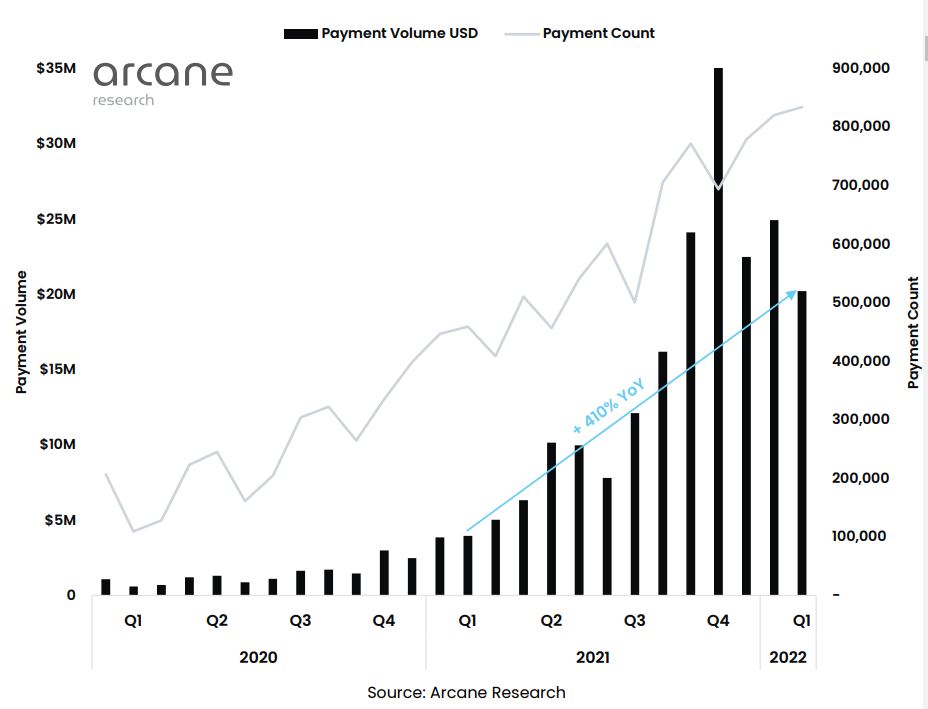

While the article introduction was a little far-fetched, the activity registered by the lightning network has been legit. In November 2021, the amount of payment volume in USD and payment count reached an all-time high, indicating a rise in adoption. The number of payments from Q4 2020 to Q4 2021 had increased 400% and at press time, it hadn’t dropped a lot in 2022.

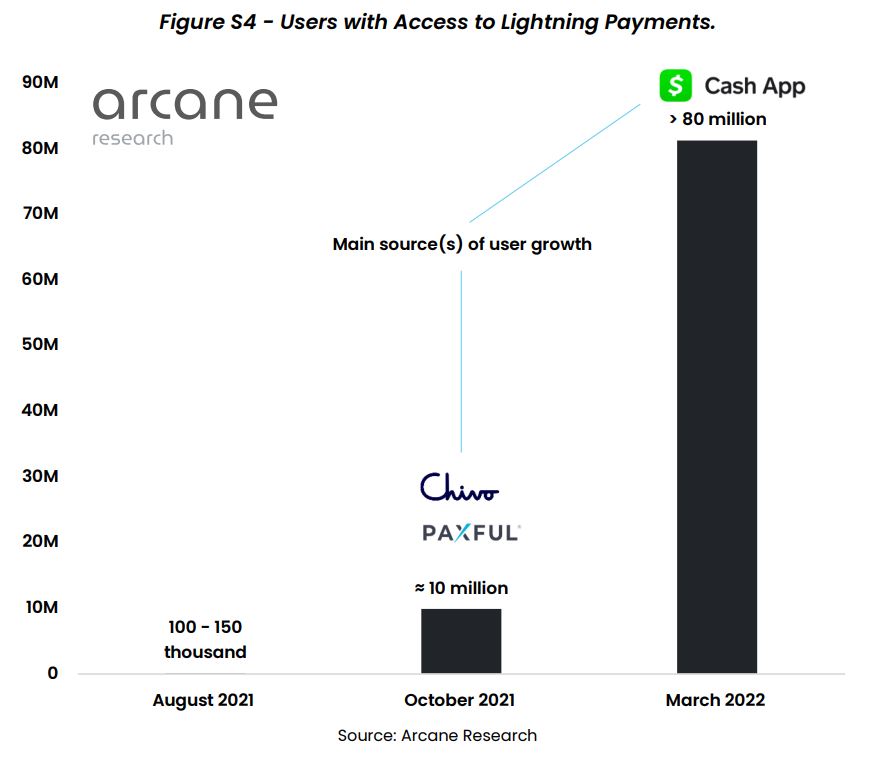

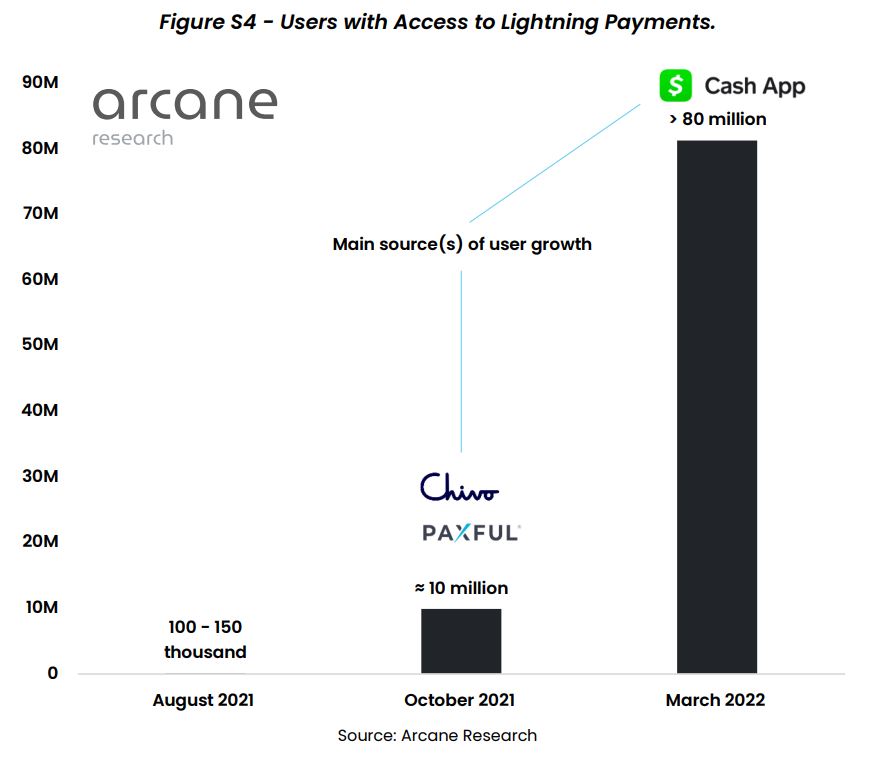

According to data from Arcane Research, lightning networks payments have dipped since November 2021 adoption remains on the rise. One of the most striking statistics is the increasing number of users.

In October 2021, the estimated number of users with access to lightning payments was less than 10 million. However since, Cashapp’s integration, the user base is expected to be more than 80 million at press time.

In terms of categorization of these payments, almost 50% o the value transacted was between different individuals in 2022. Around 20% of the payments were towards purchases of goods and services. The rest of the lightning payments volume was met by deposits and withdrawals transactions.

Will Bitcoin lightning network reach mainstream adoption?

According to the World Bank, $600 billion were sent in remittances between low to middle-income countries in 2021. 6.4% of it was taken in remittance fees and the highlighted fact was that about $40 billion did not reach its intended recipient. With the lightning network in effect, remittance payments are much cheaper, and there is seldom a loss of funds between sender and recipient. Hence, that $40 billion lost in transit, could be largely reduced figuratively.

Now, recent reports also suggested that Chicago-based payments services Strike has integrated with global e-commerce giant Shopify to accept Bitcoin payments via the Bitcoin Lightning Network. This could be a huge development altogether if BTC’s lightning network becomes accessible to around 2 million global merchants on Shopify.

Keeping these developments in mind, it seems like Bitcoin might resurface its image as a utility token, again, after all.