The bear market has taken a huge toll on the crypto industry. Bitcoin [BTC] took a backseat while altcoins were prepping for major upgrades. Despite all of this, the price and the sentiment around the crypto-verse in general remained dull. Bitcoin in particular witnessed a steep decline in interest over the last couple of weeks.

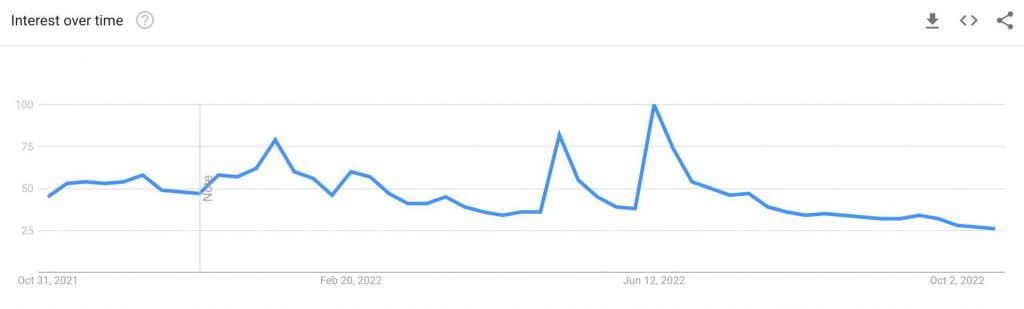

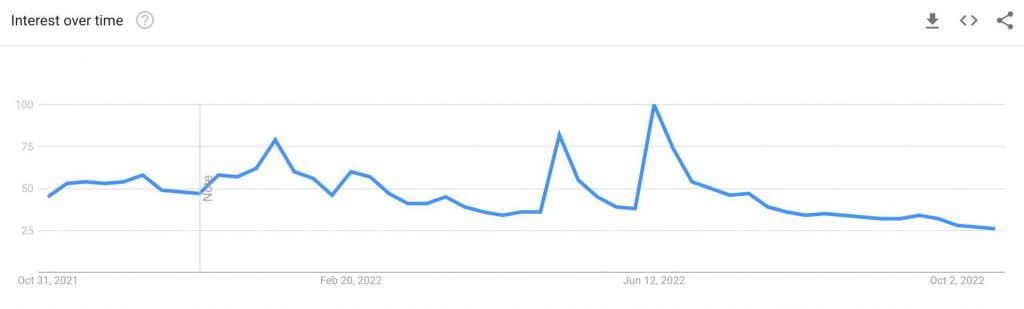

As per Google Trends interest in the term “Bitcoin” recorded a sharp plummet.

The above-seen image points out how the inclination towards the king coin peaked in June 2022. This, however, did not last too long as the interest in the king coin was on a downward spiral ever since.

This notion is aligned with Bitcoin’s price action over the last couple of months. BTC has struggled to move beyond $25K. Currently, the asset continues to trade 70 percent below its all-time high of $68,789. It should be noted at press time, the king coin was trading for $20,238 with a 4.71 percent daily surge.

While the latest Google Trends data noted that the sentiment around BTC is quite dull, several analysts remain optimistic about the asset.

Kraken expects Bitcoin to surge to $356,841

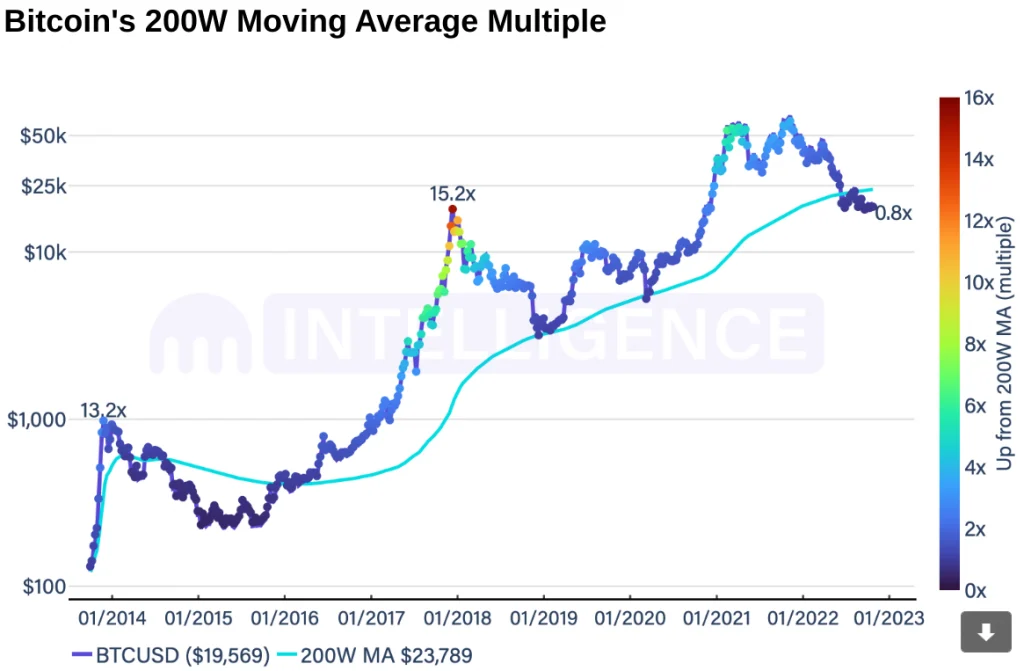

In a recent newsletter, Kraken forecasted that Bitcoin would soon witness a prominent rise. This prediction was made keeping in mind Bitcoin’s previous charts. It was found that BTC’s price has often traded above the 200-week moving average during bull runs that previously occurred.

Following this, the king coin has managed to rise by 10x and even 15x. Therefore, Kraken predicted BTC to sooner or later trade between $237,894 to $356,841.

While this prediction is certainly far-fetched, Bitcoin’s move beyond $20K restored hope in the community. An array of them took to Twitter and noted how the asset wouldn’t drop below the $20K zone anymore.

A few others tweeted,

“Can’t believe this is the last time we see Bitcoin under $20K”

Therefore, despite the decline in interest in Bitcoin, the community was clearly optimistic about the asset.