Bitcoin (BTC) began the new year on a positive note. The original crypto rallied past the $20k mark while other currencies followed suit. This resulted in one of the best year openings for the industry in years. Ethereum (ETH) crossed the $1500 mark, while Solana (SOL), which went down 95% at the end of 2022, has rallied by over 100% in two weeks.

However, not everyone is convinced that the current rally is genuine. Many have voiced concerns about possible market manipulation.

Why do some suspect market manipulation for Bitcoin?

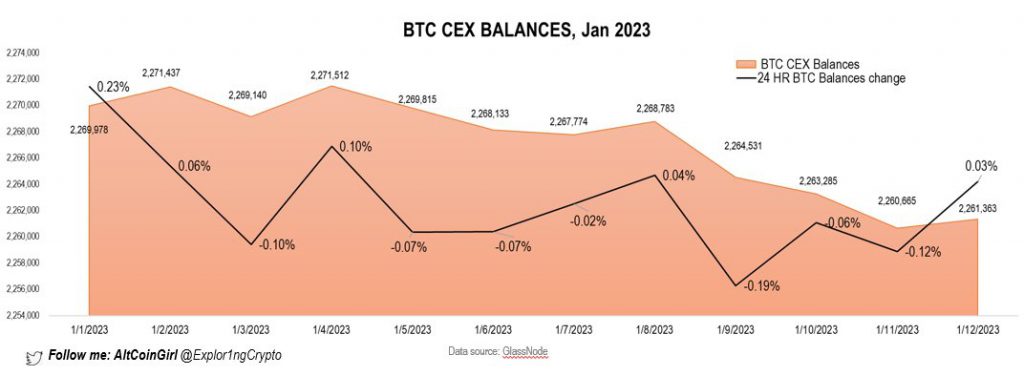

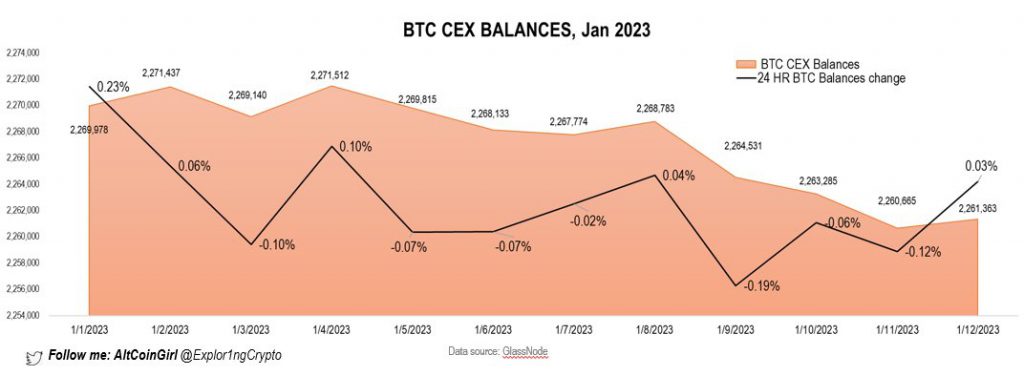

Firstly, people have pointed out that BTC spot balances on CEXs (centralized exchanges) are flat. This means that very little new money is flowing into the market. Now, one of the reasons for the consolidation of CEX balances might also be the rising distrust in centralized exchanges. Notably after the entire FTX fiasco, a rise in interest was witnessed with self-custody, which led to the increasing demand for Bitcoin wallets.

Secondly, addresses holding Bitcoin (BTC) are going down while BTC prices moved up.

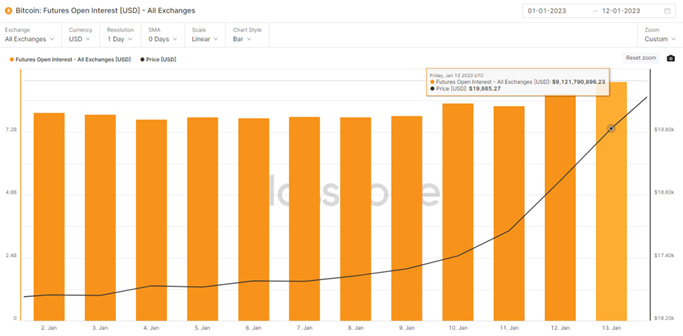

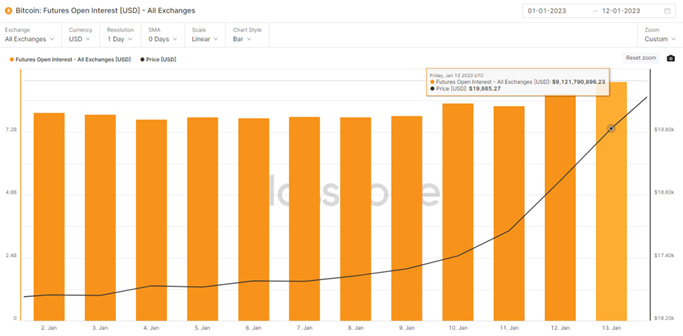

Additionally, leverage trading activity has gone up on derivatives platforms. Glassnode notes a 13% increase in Bitcoin (BTC) OI (open interest), or an additional $1.1 billion in volume.

Some have even pointed to fake trade volume on many exchanges. An analysis by Forbes from 2021 found that 51% of Bitcoin trading volume on exchanges was fraudulent.

The points above do hold some credibility for the markets being played with. However, there is no concrete evidence to support the claim. Although spot Bitcoin balances on centralized exchanges are flat, over $73 billion in funds have flowed into Bitcoin (BTC) over the past week. Moreover, BTC’s market cap crossed the $400 trillion mark (currently $407 trillion). On January 8th, BTC’s market cap was around $326 billion.

Additionally, the global crypto market cap, on the other hand, is currently at $1.03 trillion after spending months below $900 billion.