The US Consumer Price Index numbers were out a day back. Notably, inflation for September dropped to 8.2%, the lowest since February this year. Initially, as equity futures plummeted, even Bitcoin dropped. However, it initiated a recovery right after and embarked on a recovery towards $20k. Consequentially, Bitcoin was trading in the green on the daily on Friday, after inclining by more than 3.5%.

Read More: US inflation falls to 8.2% in September

Even though the asset re-claimed a $380 billion market cap, its social dominance remains to be malnourished. As far as this metric is concerned, it shares a direct correlation with Bitcoin i.e whenever BTC’s social dominance is high, prices typically rise and vice versa.

As illustrated below, whenever the discussion rate on social platforms has exceeded 20%, green candles have been registered by BTC. So, the same hovering around 13% at the moment indicates that the community is not essentially pumped.

Will the not-so-pumped community pop Bitcoin’s rally balloon?

Well, maybe not. The market had evidently been in its consolidation phase for quite some time now and was waiting for one catalyst to kickstart its recovery. Now, it seems like yesterday’s CPI data release just did that and shaped up prospects for an “Up-tober” for Bitcoin.

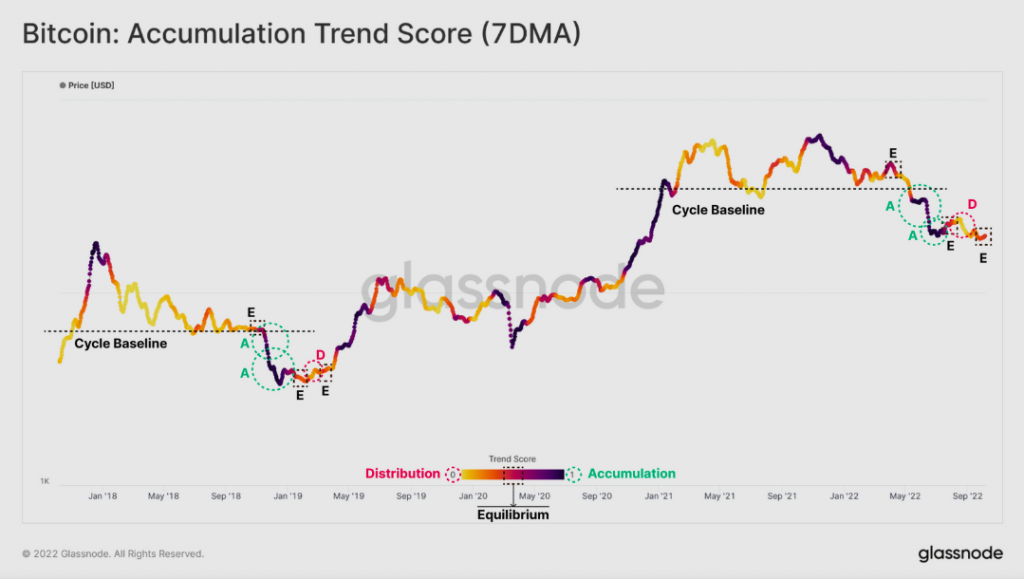

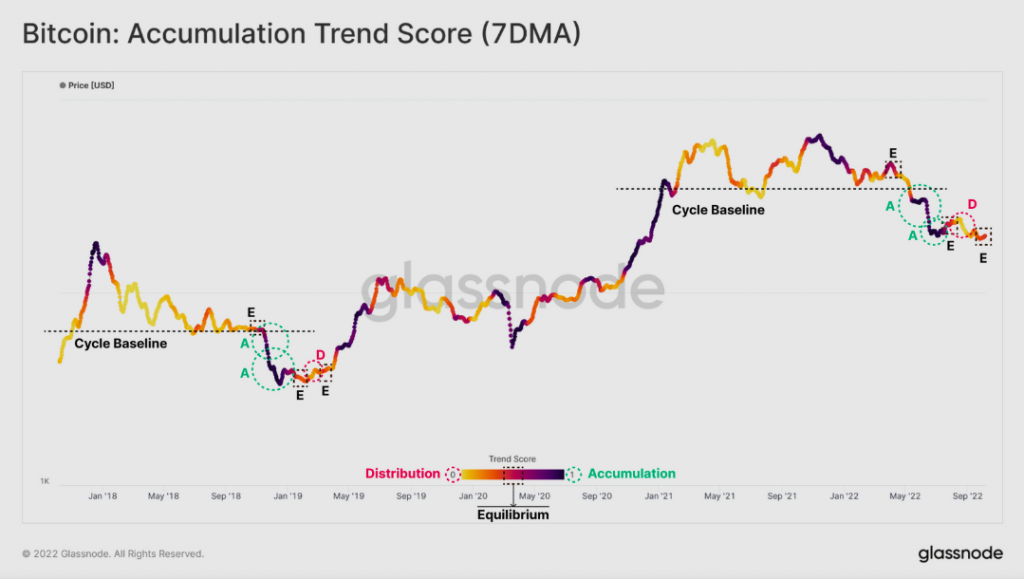

On the fundamental front, things seem to be on track for Bitcoin. As illustrated below, throughout the capitulation in early 2022, the accumulation trend score depicted significant piling-up by large entities. At the moment, this metric suggests an equilibrium [neutral] structure in the market.

However, as illustrated below, the fractals created by the trend score over the past few weeks are very similar to early 2019. Post attainment of ‘E’, along with the rise in the score, Bitcoin’s price also took off to rally in 2019.

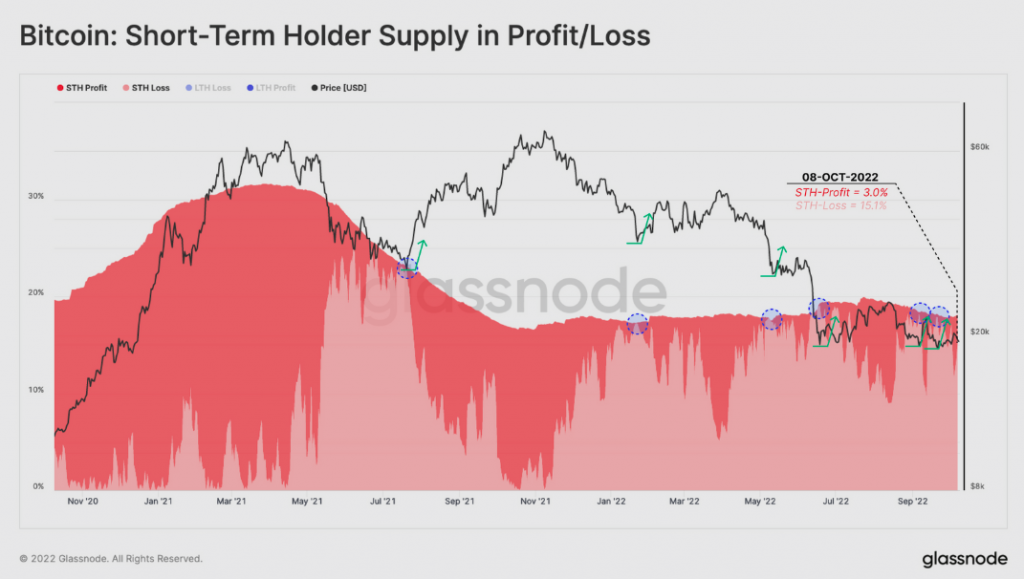

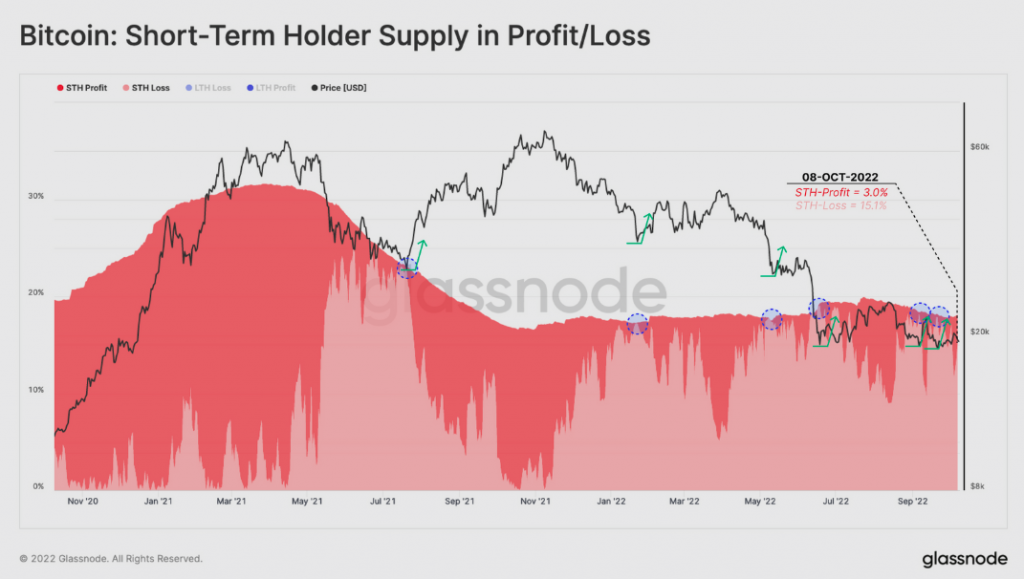

Alongside, at the moment, 18.1% of the total supply is in possession of short-term HODLers. They have around 15.1% held at an unrealized loss. Per Glassnode, they are approaching a point of “seller exhaustion.” Elaborating on the same, one of its recent reports noted,

This leaves just 3% of supply held by STHs and in profit, which after such a prolonged downtrend, is likely approaching a degree of seller exhaustion.

On any given day, short-term HODLers are the ones who influence the near-term price action. So, with the selling pressure on the verge of extinguishing, and the broader accumulation score likely set to ameliorate, we might finally see a gradual Bitcoin recovery.