Is Boston Dynamics publicly traded?

The field of robotics has been experiencing rapid growth and innovation in recent years.

Robots are no longer confined to factory assembly lines; they are now used in various industries, including healthcare, logistics, and entertainment.

The advancements in artificial intelligence (AI) and machine learning have further propelled the capabilities of robots, making them more intelligent, agile, and adaptable.

Also read: How Much is Prime Hydration Worth?

Boston Dynamics: Pioneers in the Field

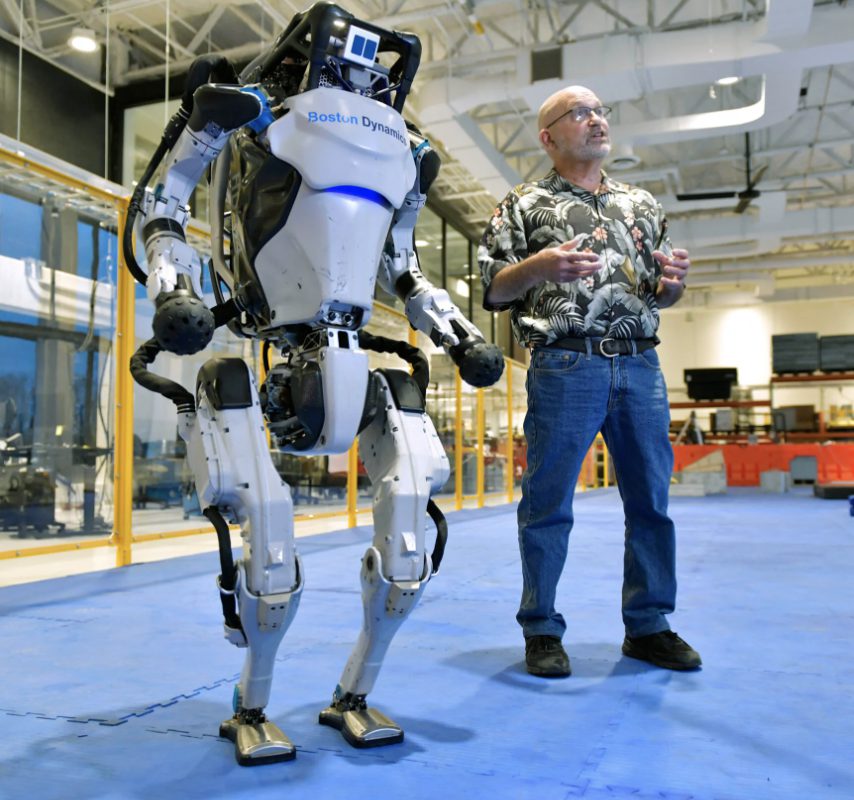

Boston Dynamics is a renowned robotics company at the forefront of this technological revolution.

Founded by Marc Raibert in 1992, the company has been pushing the boundaries of what robots can do.

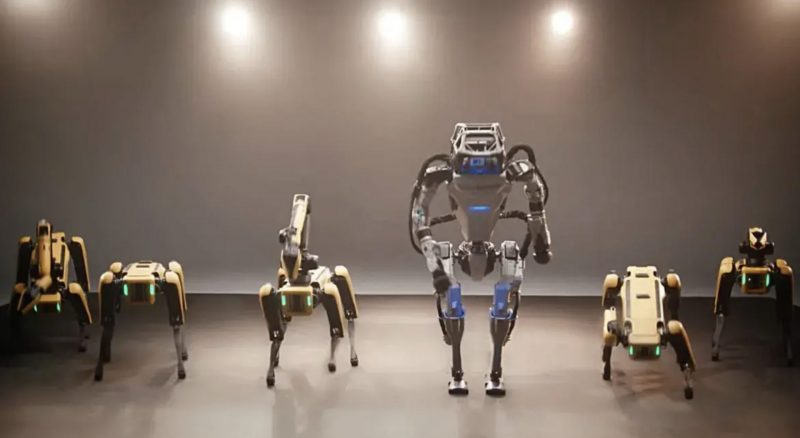

Boston Dynamics’ robots, such as Spot, Atlas, and Handle, are known for their remarkable agility, dexterity, and speed.

Furthermore, these robots have captured the imagination of both the general public and industry experts, showcasing the potential of robotics technology.

Understanding Boston Dynamics

A Brief History of Boston Dynamics

Boston Dynamics was founded in 1992 with a mission to create robots that could surpass human capabilities in terms of mobility and physical performance.

Additionally, over the years, the company has developed a series of groundbreaking robots that have garnered widespread attention and acclaim.

From the four-legged robot, BigDog, to the humanoid robot, Atlas, Boston Dynamics has consistently pushed the boundaries of what is possible in the field of robotics.

Also read: BRICS Influence in the Oil Sector Grows, Puts US Dollar in Danger

Key Innovations and Products

Boston Dynamics has introduced several robots that have revolutionized various industries. Some of their notable robots include:

- Spot: A versatile, four-legged robot designed for a wide range of applications, including inspection, data collection, and autonomous navigation.

- Atlas: A humanoid robot capable of performing complex tasks, such as walking on uneven terrain, opening doors, and even doing backflips.

- Handle: A wheeled robot with a unique design that combines the agility of legs with the efficiency of wheels, making it ideal for warehouse and logistics applications.

These innovations have positioned Boston Dynamics as a leader in the robotics industry, with their robots being used in diverse sectors, including manufacturing, defense, and research.

Also read: Finance Minister Warns BRICS, Says De-Dollarization Leads to Disaster

Valuation and Funding of Boston Dynamics

Valuation of Boston Dynamics

As a privately held company, Boston Dynamics’ valuation is not publicly disclosed.

However, according to reports, the company was valued at $1.1 billion in previous funding rounds.

Industry experts predict that Boston Dynamics’ valuation has likely increased significantly given the rapid growth and advancements in the robotics and AI sectors.

Funding Sources

Boston Dynamics has secured funding from various sources throughout its history.

One of the major stakeholders in the company is Hyundai Motor Group, a global conglomerate interested in automotive manufacturing and advanced technology.

In 2020, Hyundai acquired a majority stake in Boston Dynamics, further strengthening their partnership and supporting the development of innovative robotics solutions.

SoftBank, a multinational conglomerate, has also made significant investments in Boston Dynamics, providing the company with the resources to continue its research and development efforts.

Ownership Structure

Hyundai Motor Group: Majority Stakeholder

Hyundai Motor Group currently holds an 80% stake in Boston Dynamics.

This strategic partnership allows Hyundai to leverage Boston Dynamics’ expertise in robotics technology to enhance their own capabilities and develop a comprehensive robotics value chain.

The collaboration between the two companies can potentially revolutionize industries such as manufacturing, logistics, and mobility.

SoftBank: A Significant Investor

SoftBank, a Japanese multinational conglomerate, holds a 20% stake in Boston Dynamics.

SoftBank’s investment in the company has been instrumental in supporting Boston Dynamics’ research and development initiatives and accelerating its growth.

SoftBank strongly focuses on investing in innovative technologies, and its partnership with Boston Dynamics aligns with its vision for the future of robotics.

The potential for an IPO

Speculations and industry buzz

While Boston Dynamics has not announced any plans for an initial public offering (IPO), industry insiders and investors have been speculating about the possibility.

The company’s rapid growth, groundbreaking technologies, and influential partnerships have fueled speculation that Boston Dynamics may eventually decide to go public.

Factors Influencing an IPO Decision

The decision to go public is a complex one for any company.

Factors such as market conditions, growth potential, and strategic objectives play a crucial role in determining the timing of an IPO.

As Boston Dynamics continues to innovate and expand its market presence, the company’s leadership will likely carefully consider the potential benefits and risks of going public.

Investing in Boston Dynamics

The Importance of Due Diligence

Investing in a private company like Boston Dynamics requires thorough due diligence. As a private company, Boston Dynamics is not required to disclose the same financial information as publicly traded companies.

Therefore, investors must conduct comprehensive research and analysis to evaluate the company’s growth prospects, competitive landscape, and potential risks.

Investing in private companies

Investing in private companies offers unique opportunities and challenges.

While private companies may offer higher growth potential than established public companies, they also carry higher risks.

Additionally, investors should consider factors such as the company’s financial health, leadership team, and market position before making investment decisions.

Employee stock options

Employee stock options can be an attractive way to invest in a private company like Boston Dynamics.

Furthermore, these options allow employees to purchase company shares at a predetermined price, often lower than the market value.

Investing through employee stock options can provide employees with the opportunity to participate in the company’s growth and potentially benefit from a future IPO.

Investing in Hyundai Motor Group

Another way to indirectly invest in Boston Dynamics is through Hyundai Motor Group.

As the majority stakeholder in Boston Dynamics, Hyundai’s success in the robotics industry could positively impact its overall performance.

Investors interested in the robotics sector may consider investing in Hyundai stock to gain exposure to Boston Dynamics’ potential growth.

IPO Date and Ticker Symbol

Stay informed for updates.

As Boston Dynamics has not announced an official IPO date, investors must stay informed about any developments or announcements from the company.

Following Boston Dynamics’ official channels, such as their website and social media accounts, can provide valuable insights into their future plans and potential IPO.

Ticker Symbol Speculations

Moreover, although it remains undisclosed, industry experts and investors have speculated about potential ticker symbol options for Boston Dynamics.

Ticker symbols typically reflect the company’s name or a shortened version.

It is important to note that these speculations are not official, and the exchange will determine the actual ticker symbol if and when Boston Dynamics goes public.

Growth prospects and market potential

The Growing Demand for Robotics Technology

We anticipate continued growth in the demand for robotics technology in the upcoming years. Industries such as manufacturing, healthcare, and logistics are increasingly adopting robotics solutions to improve efficiency, productivity, and safety.

Boston Dynamics, armed with its cutting-edge robot technology, stands in an excellent position to capitalize on the increasing market demand.

Competitive Advantage

Boston Dynamics’ competitive advantage lies in its ability to develop highly advanced and versatile robots that outperform traditional robotic solutions.

The company’s focus on agility, dexterity, and speed sets its robots apart from competitors.

Additionally, Boston Dynamics’ strong partnerships with industry leaders like Hyundai Motor Group provide access to extensive resources and expertise in manufacturing and mobility.

Conclusion

In conclusion, Boston Dynamics has established itself as a leader in robotics, pushing the boundaries of what robots can do with their groundbreaking innovations.

As the demand for robotics technology continues to grow, Boston Dynamics stands ready to seize market opportunities and pioneer future advancements in the industry.