Alongside the broader bearishness and the de-pegging risk still lingering, the total value locked in DeFi has dried up and the yields are down on their knees. Consequentially, the DeFi Index price has crashed to new lows of late.

As highlighted below, this index’s reading has dipped by almost 8% just over the past day and stood at merely $3777 at press time. For context, the DeFi Index price was as high as $12.7k back in November last year when tokens from this niche were all rallying.

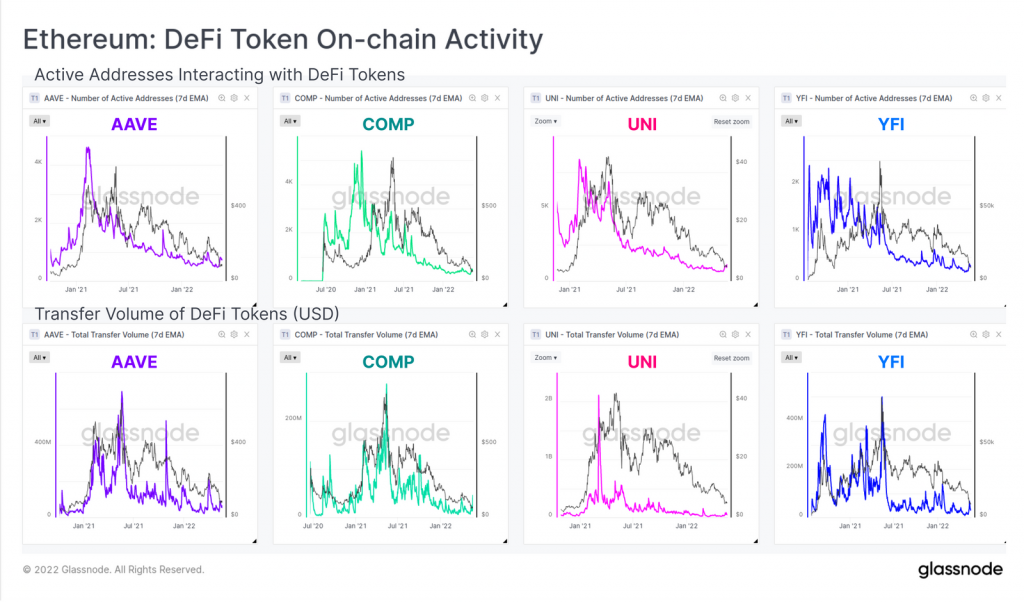

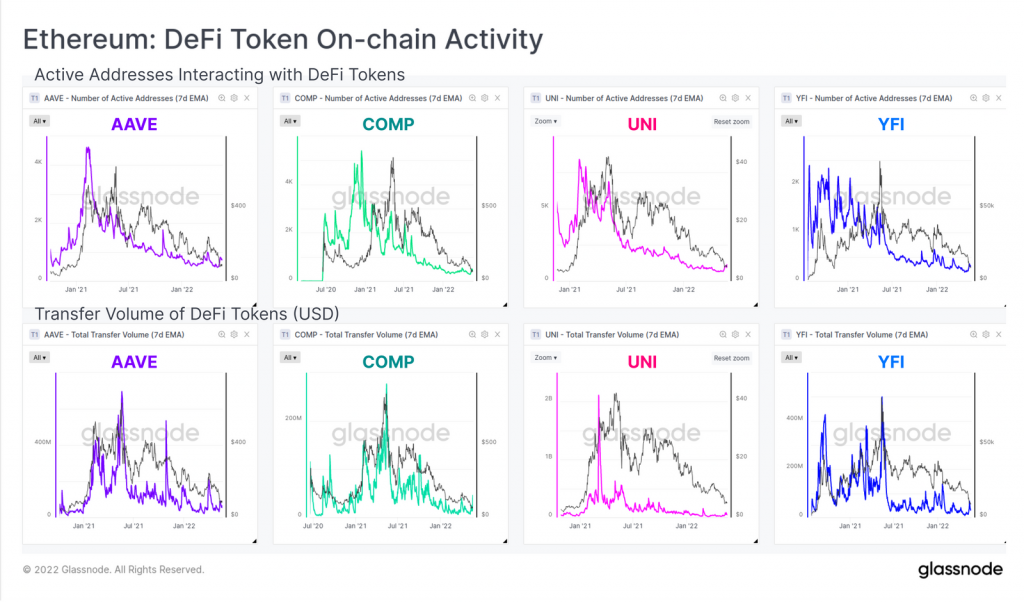

The dip in the index’s price has been accompanied by sluggish on-chain activity. As illustrated below, the number of active addresses interacting with DeFi tokens like Aave, Compound, Uniswap, and Yearn Finance continue to maintain their macro-downtrend. Likewise, their transfer volumes remain suppressed.

When closely observed, it can be noted that there is a strong correlation between on-chain activity and DeFi token price performance. At the moment, both remain fairly uninspiring across the board.

How to thrive in such a market condition?

Well, bear markets usually take their toll, and this particular bear has done just that. So now, until and unless the market approaches some form of the sustained bottom, the state of the market is set to get worse before getting better.

Thriving during such market conditions is usually tricky, but when planned, plotted, and executed properly, investors usually reap benefits from the same.

Outlining the same via a Twitter thread, a particular user highlighted how market participants ought to dynamically adjust their allocation to both stable coin farming and blue-chip token farming depending on the supply/demand outlook. Elaborating on the same he brought to light a particular low-risk innovation strategy called “Skew Farming” that opens up arbitrage opportunities for users.

Other similar tips and tricks can be found in the same thread.

For users not wanting to tread on the said waters, the rule remains simple:

“Short euphoria and buy extreme fear. Take profits and enjoy the summer.”