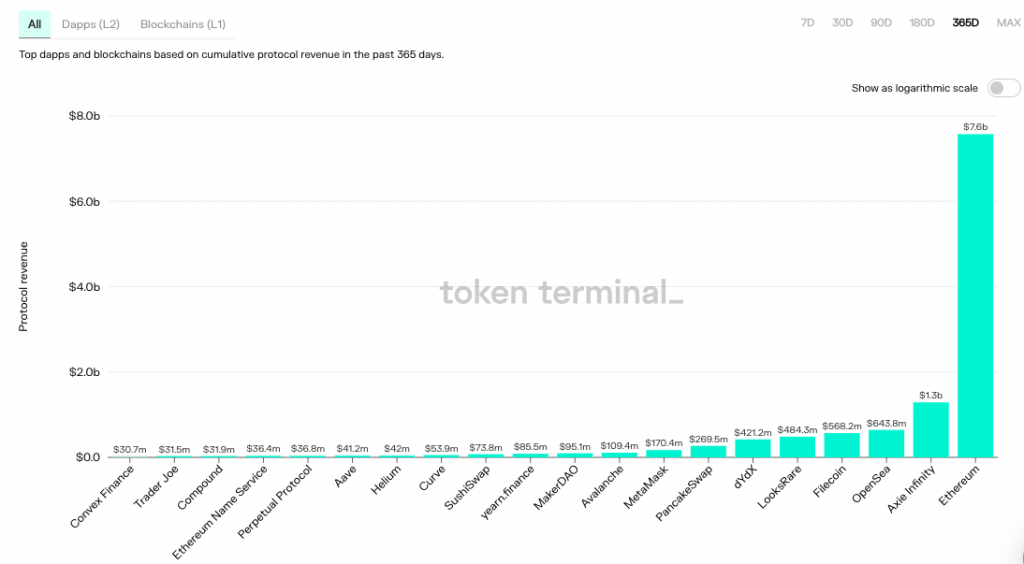

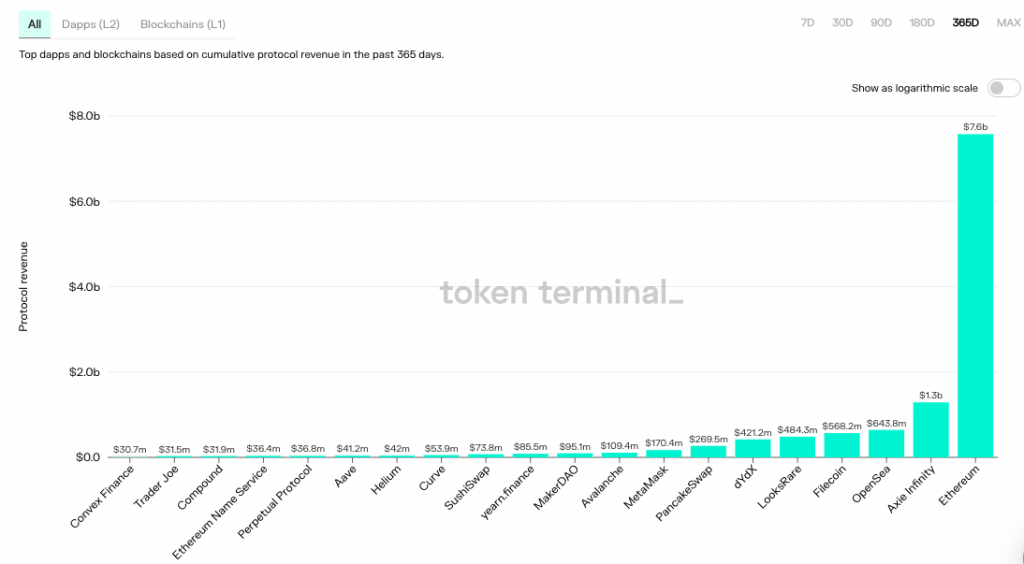

When compared to top dApps and blockchains, Ethereum has managed to earn the most through its revenue. Such has been the case for quite some time now. This protocol, single-handedly, has been able to overshadow the cumulative proceeds amassed by the likes of Axie Infinity, Filecoin, PancakeSwap, Avalanche, SushiSwap, etc.

Over the past year alone [365 days], Ethereum’s figures on this front have been as high as $7.6 billion. Barring Axie Infinity’s $1.3 billion, all other protocols’ earnings merely reflected values in millions at press time.

A sneak peak into Ethereum’s spendings

If you paid attention in your Physics classes, you would know – for every action there is an equal and opposite reaction. This Newton law doesn’t only apply to motion. It holds in quite a few real-life crypto scenarios too. Buying and selling, longing and shorting, and of course, earning and spending are quite literally actions and their opposites.

So, now that we have a rough idea about Ethereum’s earnings, it is time we have a look at its spending as well. The Ethereum foundation recently released a report revealing the same.

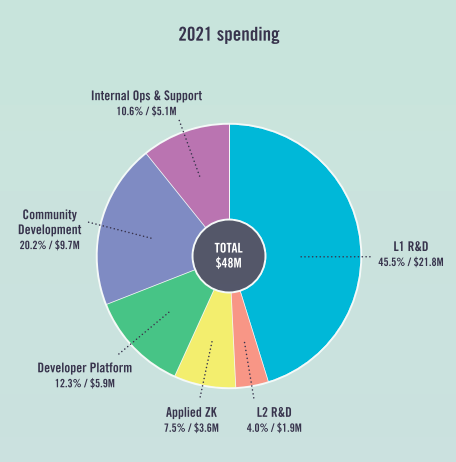

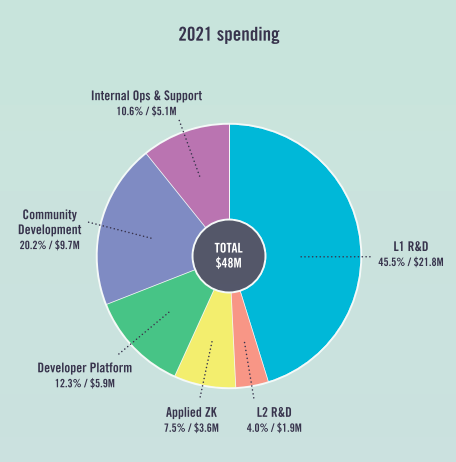

In 2021 alone, the EF spent approximately $48 million. $20 million of the same was in the form of external spending that included grants, delegated domain funding, bounties, and sponsorships. The remaining $28 million was used to fund the teams and projects within the Ethereum Foundation community.

As such, the foundation divided the entire spending balance into unique categories which included layer one (L1) research and development (R&D), layer one (L2) R&D, applied ZK research, developer platform, community development, and internal operations spending.

Yeah, EF HODLs ETH too

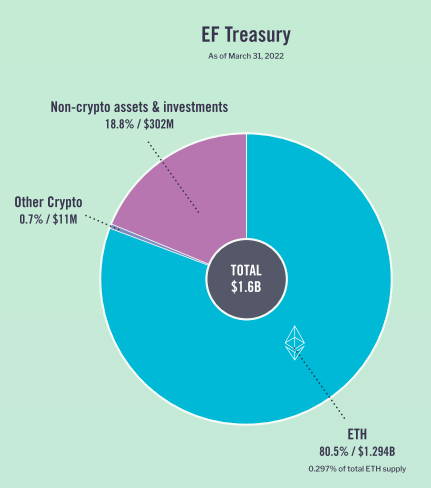

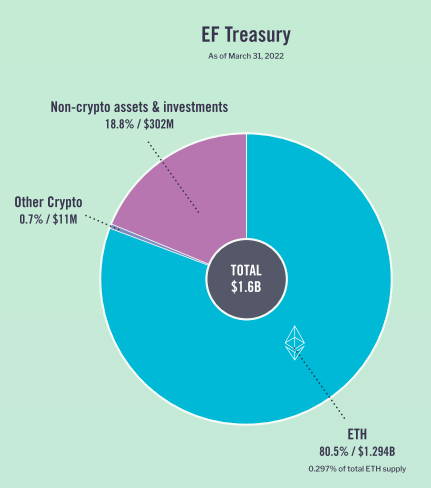

As of 31 March 2022, the EF’s treasury was approximately $1.6 billion, split between $1.3 billion in crypto, and $300 million in non-crypto investments, and assets.

The vast majority of their crypto holdings were held in Ethereum. Notably, this ETH represented 0.297% of the March-end total supply of the asset.

EF further explained that it followed a “conservative treasury management policy” to ensure funding for the core objectives even during a multi-year market downturn. It noted,

“This part of our budget is immune to changes in the price of ETH on a significant timeline.”

They also keep increasing their non-crypto savings in response to rising ETH prices, and that, provides a greater safety margin for the foundation’s core budget, enabling them to continue funding non-core but high leverage projects through a market downturn.

On the other hand, the EF also “believes” in Ethereum’s potential, and thus ETH holdings represent that long-term perspective.

At this stage, the earnings, spendings, and treasury HODLings all seem to be pretty well balanced. Ethereum’s price has also started recovering post the dip noted at the beginning of the week. After noting a 5% incline over the past day, ETH was valued at $3050 at press time.