The bullish crypto market is dragging every new and old protocol in. Even the one that began as a lookup system for decentralization on Ethereum, is coming up with its own token. Yes, the coin in discussion is the new Ethereum Name Service token. Binance listed the token recently and now market speculators are already expecting/hoping for a bullish outlook. However, before jumping the gun with another crypto prospect, it is essential to understand the protocol.

What is Ethereum Network Service and what is so special about it?

Similar to the DNS system, ENS is a service built on Ethereum which links information to a name. It converts complex numbers into a human-readable resource. The protocol is extremely secure since it is built on Ethereum’s smart contract. The team behind ENS sees internet naming infrastructure as a fundamental component that therefore should be open, decentralized, community-driven, and not-for-profit.

Overall, it is a legitimate project which is empowering the eventual switch to a Web3 medium. However, a token release changes the ecosystem. ENS airdropped 25 million tokens in the market, and its market cap doubled in less than 48-hours. ENS had a market cap of $534 million on 8th November. Currently, its market cap is above $1 billion. Early adopters were rewarded and ENS provided them with a governance token. According to the team, lower level tiers received an average of 200 ENS tokens with the most active participants receiving 1,000 ENS.

Is ENS token looking to be a part of the bullish now?

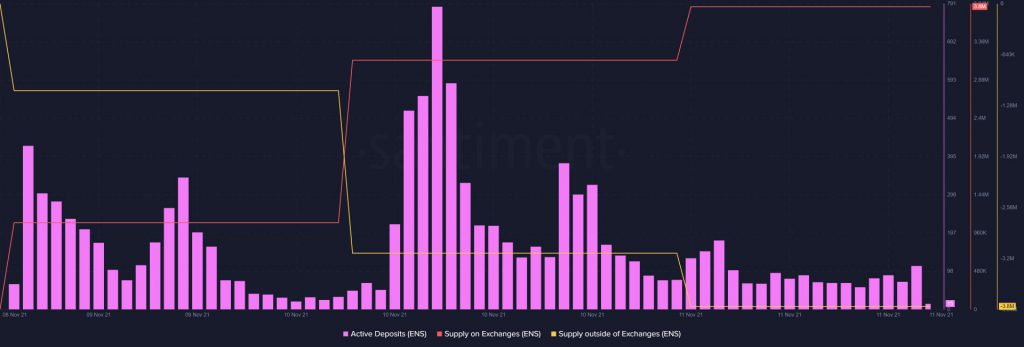

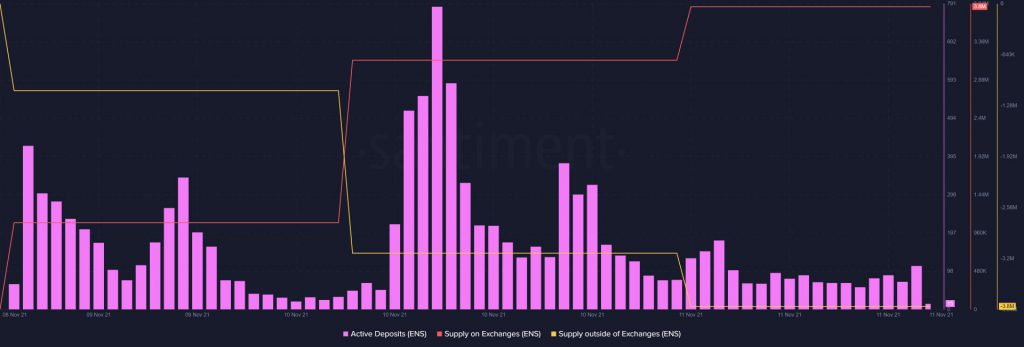

ENS registered massive social volumes over the past few days. Active Addresses are surging on the network and it is currently trending in the market. However, it is too early for the project. Right now, active deposits and exchange inflows are rising for the token. It means profit-taking has already started from the project. Early adopters are possibly cashing in as illustrated in the chart below.

Supply on Exchanges is rising which is also a sign of possible dumping. Surprisingly, the asset was still able to claim a new all-time high of $84. However, at press time, it was down to $64.22, indicative of its high volatile state at the moment.

All aboard the ENS train?

It is important to note that ENS was quick off the tracks, gathering $1 billion in market cap. Yet, at this moment, there is no assurance of price direction, hence it will be better for an investor to be cautious, and analyze further over the next few weeks.