Ethereum, the market’s second-largest crypto, is valued at $6,128, or about 180% of the crypto’s current price, as per a discounted cash-flow model. Per the same, Ethereum’s upcoming “merge” upgrade could further convert the cryptocurrency into an “equity-like instrument,” according to a recent report by Bloomberg Intelligence.

Well, the said price might seem too far-fetched at the moment, for Ethereum is currently priced at only around $3.3k.

As highlighted in an earlier article, Ethereum’s upgrade, known as the “Merge,” will shift the blockchain’s consensus mechanism from proof-of-work (PoW) to proof-of-stake (PoS), where validators would contribute, or “stake”, their cryptocurrencies to verify transactions. Currently, under the proof-of-work mechanism, Ethereum uses the mining mechanism where miners compete with each other to validate transactions. Post the upgrade, stakers of Ethereum would be entitled to a portion of the future revenue, or transaction fees generated on the network.

Per the said report, as blockchains have no direct cost, the revenue represents profits, allowing the use of traditional financial ratios such as P/E multiples. The report went on to assert,

“If demand for blockspace and total fees paid increases, stakers will enjoy both higher payouts and reduced issuance, with the opposite also true.”

The report estimated Ethereum would generate $12.7 billion as revenue this year, up 30% from 2021. What’s more, it further projected a 30% annual rise in cash flow over the next three years.

Based on the data, the report arrived at an Ethereum value of $6,128, $5,539, and $9,328 using three different discounted cash flow models, with an average of $6,998.

What to expect post Ethereum’s “Merge”

Ethereum is already well on path to become deflationary in nature. Back in August last year, Ethereum underwent its London hardfork, with the improvement proposal 1559 taking the centre stage.

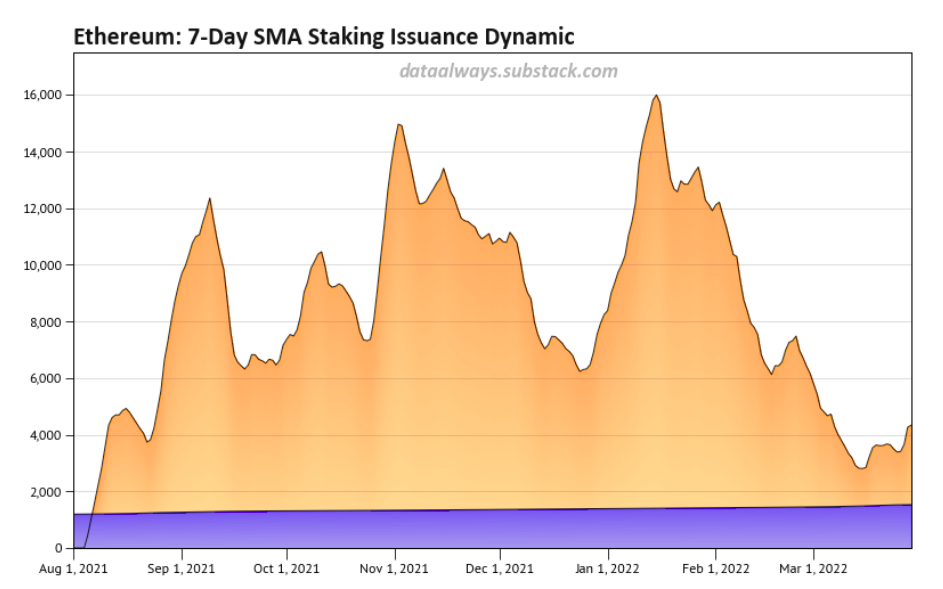

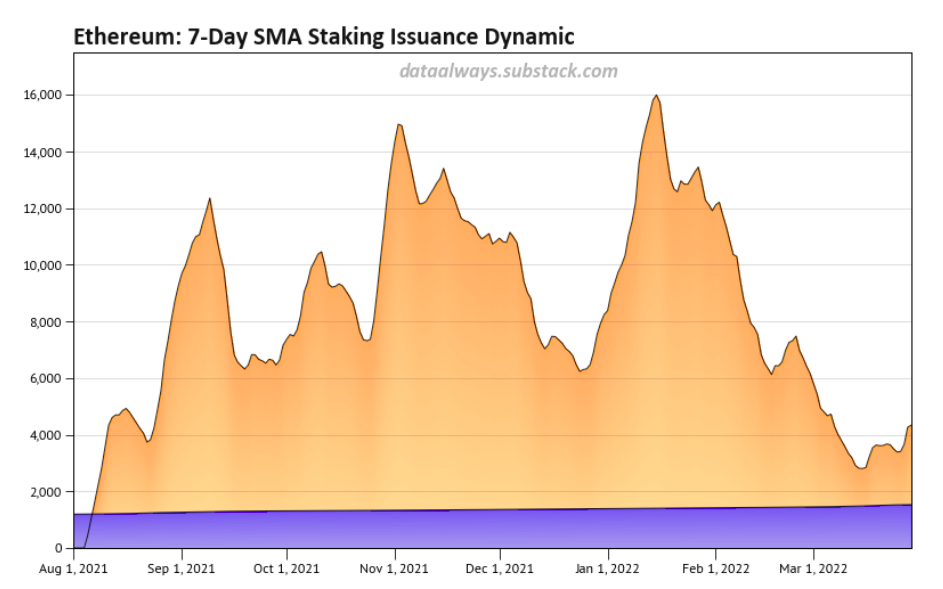

Since then, there hasn’t been a single day where the staking rewards have been larger than token burn. The same, single-handedly, gives even more credence to the “deflationary” narrative.

Post the Merge, the supply of new Ether is also set to decline because fewer tokens are expected to be issued. Analytics platform ITB highlighted the following in its recent newsletter:

“Following the merge, the amount of ETH issued is projected to drop by 90%, which would lead similar levels of fees to reduce Ether’s supply by as much as 5% a year.”

In effect, people from the space—like Mark Cuban—strongly believe that Ethereum would become a deflationary asset going forward, and with its declining supply, it can further be used as a store of value, after the merge.