Since 6 January, Bitcoin’s price has remained rangebound in the $39.6k to $44.6k region. Over the past 7 days, the candlesticks have been spending more time towards the low side than the up-side. In effect, Bitcoin has depreciated by 5% in the said timeframe.

Macro Impact on Bitcoin and the rest

Bitcoin-associated products have, more often than not, performed well whenever Bitcoin has. Conversely, they’ve underperformed during BTC’s sluggish/bearish phases.

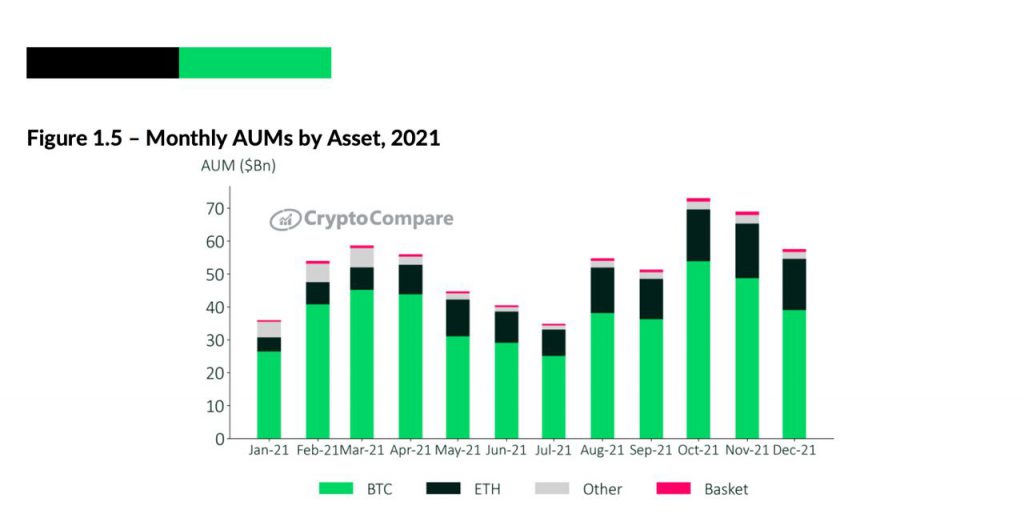

Well, owing to its ‘not-up to-the-expectation’ performance, Bitcoin has been losing its say in crypto-centric product market. The cumulative assets under management have been on the fall, owing to the withering community interest. Highlighting the same in its latest ‘Market Dynamics and Evolving Trends’ report, CryptoCompare asserted,

The dominance of Bitcoin-based products has fallen notably this year – from 74.9% in January 2021, to 67.8% of total AUM by year end. Institutional investors, who most prominently utilise digital asset management products for crypto exposure, are shifting their attention towards other cryptocurrencies.

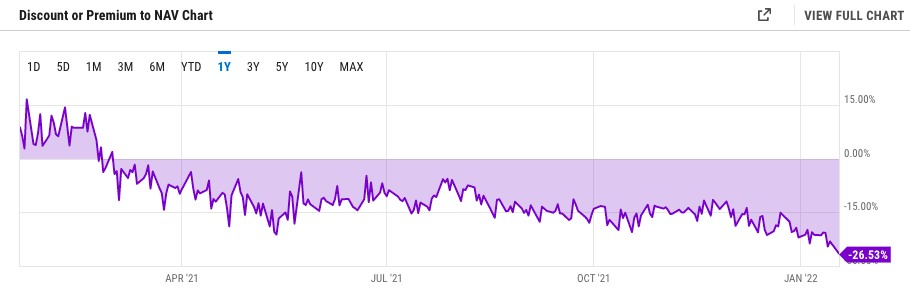

GBTC’s discount widens alongside

Well, Grayscale’s Bitcoin Trust is definitely one of the worst-affected victims. The $27.054 billion fund has shed almost 18.2% until now in 2022, outstripping Bitcoin’s 13% plunge in the same time period.

In retrospect, GBTC’s price closed 26.53% below the value of the Bitcoin it holds on Wednesday. Thus, the trust’s shares have been trading at record-low discount rates of late.

Well, GBTC started trading at below-par levels at the end of February last year and has evidently not been able to recover since then. The launch of pot-based ETFs in Canada and the ProShares Bitcoin Strategy ETF (BITO) managed to dent GBTC’s prospects even further.

The relentless discount could also be attributed to investor skepticism with respect to Grayscale’s own plan to convert its fund into a spot-based ETF. The company has already filed the papers, by the US SEC hasn’t yet approved the same.

Well, it is a known fact that GBTC has been one of the most preferred investment vehicles for institutional investors to park their funds into Bitcoin indirectly. But owing to its underperformance and the entrance of new competitors, the demand for the product has shrunken.

So, only when Bitcoin manages to resurrect itself, one can expect GBTC’s discount gap to narrow down. However, if the downtrend continues, then we might witness GBTC create new low records going forward.