With the cryptocurrency market cap hovering around $1 trillion, most asset prices continue to reflect green returns on a weekly chart. While Bitcoin and Ethereum’s numbers stood at a modest 1%-2%, meme coins like Dogecoin stood 9% higher.

The broader bullish sentiment in January helped Dogecoin rise higher on its charts. However, the refined state of its on-chain metrics placed DOGE in a much better position when compared to the rest of the clan.

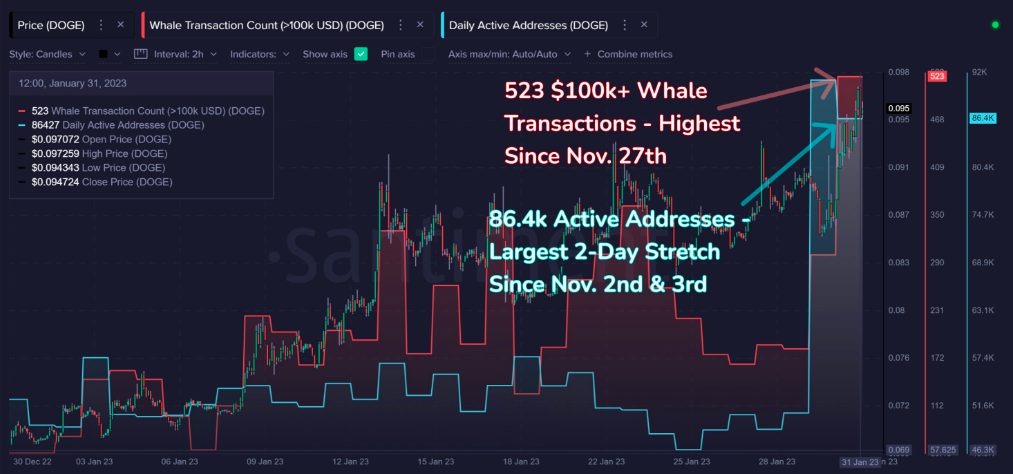

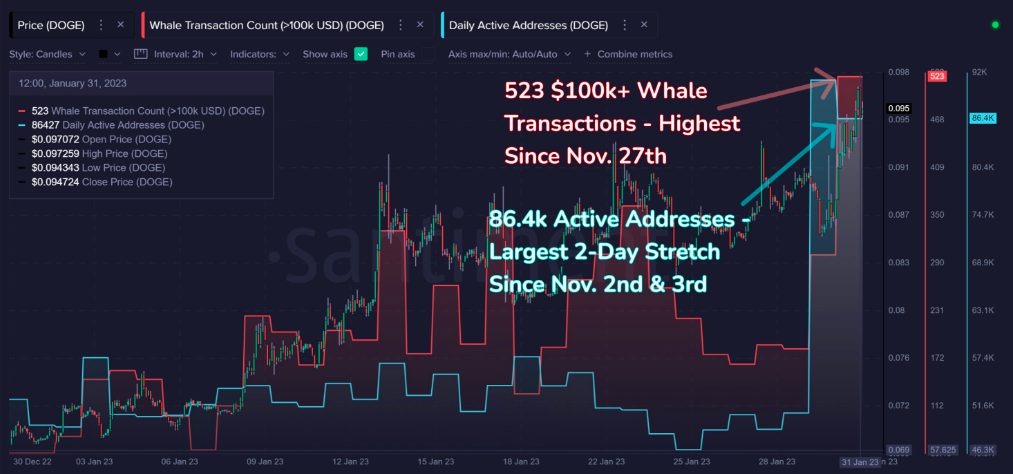

Data from Santiment revealed that Dogecoin large whale transactions spiked to “the highest of the year.” Standing at 523 at press time, the number of $100k transfers stood at its highest since the end of November.

Additionally, the active address also inclined to 86.4k. The analytics platform labeled the same to be the “largest 2-day stretch” since Nov. 2 and 3.

Dogecoin Price

Santiment resultantly attributed the said factors to the price rise and tweeted,

“The polarizing coin is up +40% since December 29th, and is back above $0.095 for the first time since December 10th.“

Also Read: Dogecoin Thrives Amidst 91% of ‘Dead Coins’ Since 2014

At the moment, Dogecoin is bound by an important “demand wall” at around $0.086. At the said average price, around 89k addresses bought 14 billion DOGE in aggregate, indicating that the price level can act like a cushion for Dogecoin.

So, what does Dogecoin need more to continue inclining? Currently, it has a major resistance cluster around $0.099. Here, around 21k addresses bought 8.25 billion tokens. Only when that level is broken by the bulls, can the price progress toward the psychological $0.1 mark.

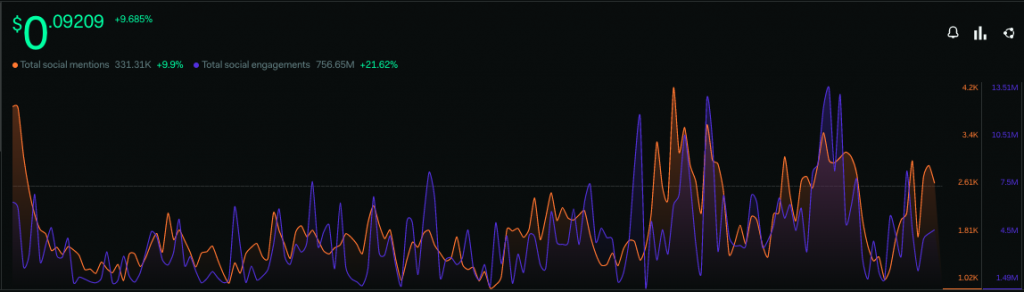

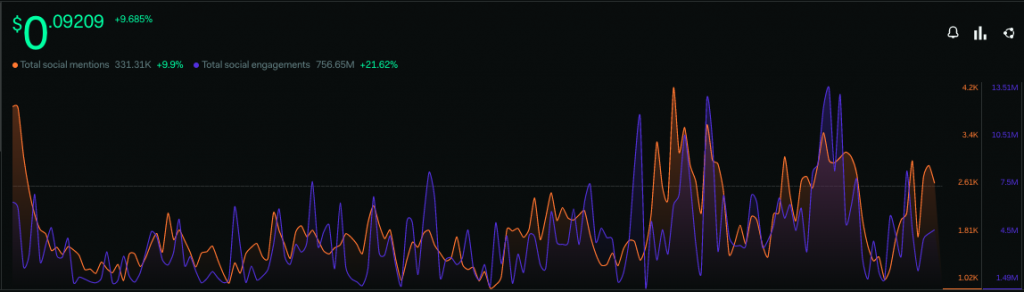

Sentiment-wise, DOGE seems to be in a comfortable position. The number of social mentions and engagements has inclined by 9.9% and 21.6% over the past seven days. The same indicates that the crowd is likely gearing up for another incline phase.

Also Read: Bitcoin, Dogecoin Aren’t Securities But Ethereum, XRP Are: Gene Hoffman