The first five months of last year were quite splendid for MATIC. After opening at $0.018 on 1 January, the coin peaked at $2.7 in mid-May. However, the flash crash managed to change the market dynamics completely and MATIC wasn’t spared from the macro-downtrend.

In July, the token revisited $0.6, but post that, it gradually started faring better. After overcoming the barriers on its path, MATIC re-peak at $2.92 and ended December on quite a high note.

The evolving MATIC market

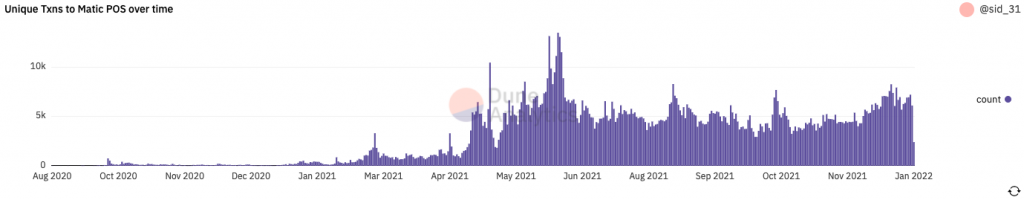

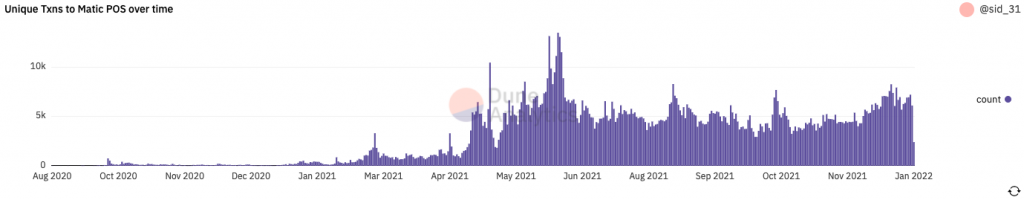

Change is indeed the only constant in the crypto market. MATIC’s price-rise phase earlier last year was quite organic and utility-driven. In fact, its rally was accompanied by quite a prominent rise in its transactional activity. Notably, this period coincided with Ethereum’s rising gas fee and the same acted like a blessing in disguise for the Polygon network.

However now, even though the number of unique transactions has been increasing since October, they are yet to match last year’s May-June levels.

Before the aforementioned void could be felt, MATIC whales took charge. They’ve stood up and successfully been able to bridge the gap. These big players have been loading tokens in large numbers over the last couple of days.

Yesterday’s article highlighted that two prominent Ethereum whales – “Light” and “Saitama” had bought 1.33 million and 782k tokens respectively. However, later during the day, two other whales bought around 4 million tokens in conjunction in two separate transactions involving approximately 2 million tokens each.

With the broader sentiment associated with MATIC inclining more towards ‘mostly bearish,’ it is quite evident that the aforementioned whales are taking full advantage of the state of the market and are buying the dip.

In effect, when the network activity becomes even better and starts setting new records again, the price of the underlying token, in most likelihood, would surge. When that happens, whales would be in the right space to relish gains.