The market’s largest meme coins price has evidently been dwindling of late. Over the past 7-days, DOGE has shed up to 10% of its value. It was, in fact, seen trading at a level as low as $0.17 at the time of this analysis.

The aforementioned data-set is, of course, not very intriguing but looks like the downtrend would not be able to persist for long. The main reason is the coin’s improving fundamentals.

Decoding DOGE’s fundamental nitty-gritties

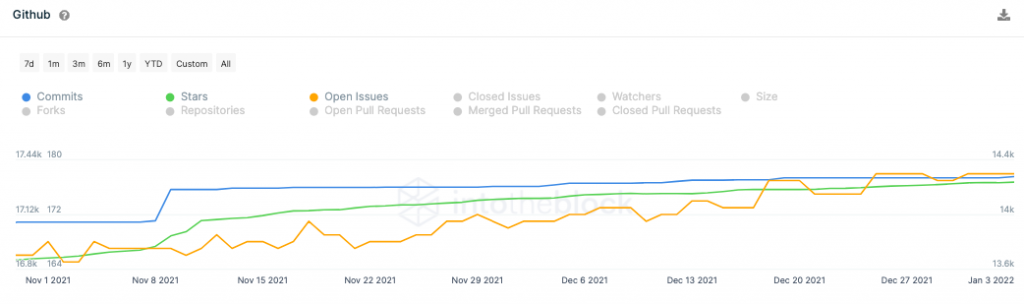

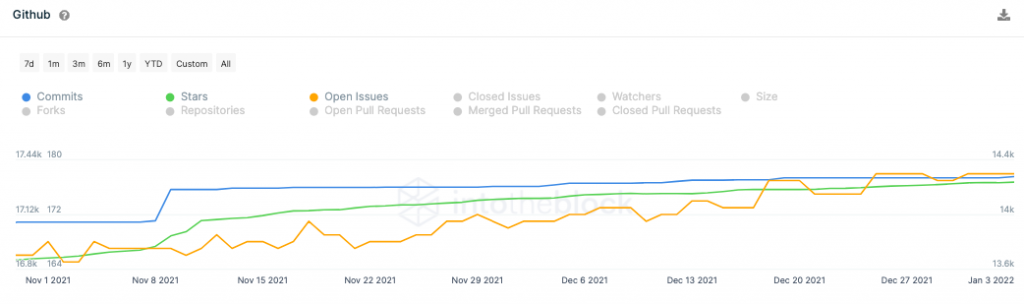

Consider DOGE’s GitHub indicators, for starters. As such, they provide insights regarding development activity based on commits, stars, and open issues.

To simplify it further, upticks in the aforementioned metrics more or less indicate the improving ecosystem dynamics as they track developer activity alongside the interest and engagement shown by the community.

As can be seen from ITB’s chart attached below, all the three – commits, stars, and open issues, have been slowly and steadily rising on the macro-frame. This is, by and large, a healthy sign.

Further, Santiment’s chart also highlighted that the developer count metric has been able to maintain a consistent number of late, indicating that the developers are keenly working to improve things on the coin’s network.

What’s more, Messari’s data highlighted another interesting trend with respect to DOGE’s network-value-to-transaction ratio. The aforementioned ratio, as such, gauges the relationship between the market cap and the transfer volumes.

Now, whenever the NVT is high, it indicates that the network value is outpacing the value being transferred on the network. Usually, such trends tend to rub off positively on the long-term valuation of any alt.

So, the fact that the coin’s NVT is hovering close to its yearly highs, is just the cherry to DOGE’s fundamental cake.

Well, the polished state of fundamentals does not have a prompt impact on any asset’s price. The same, however, manages to shield the mid and long-term future of coins.

So, if DOGE manages to sail past the next few weeks smoothly, then the fundamentals would, in most likelihood, aid the price to recover and reclaim highs going forward.