Shiba Inu is positioned delicately on the chart, with single support arguably separating it from decline. With pessimism still lingering among large holders and new investors, here’s why Shiba Inu is in danger of a weekend correction.

Since its Robinhood listing, Shiba Inu’s price has declined steadily within a weak broader market, breaking below $0.00002540 and $0.00002466 support levels. A near-term bearish bias still exists, with $0.00002340 support the only difference between SHIB’s price and another sell-off.

With SHIB at a pivotal position, Ethereum whales and large holders had a difference of opinion. Of late, several articles have outlined that Ethereum whales were constantly buying SHIB tokens after the Robinhood announcement. Shiba Inu featured once again in the most purchased tokens on the day, with top Ethereum whales purchasing an average of 1.13 Billion SHIB tokens.

Looking outside of Ethereum whales’ activity, other large holders did not share similar sentiments. SHIB’s large holder’s NetFlow, which measures the activity of wallets holding above 0.1% of the circulating supply, declined by 138% this week. This suggested that most large holders were selling SHIB and remained bearish despite whale activity.

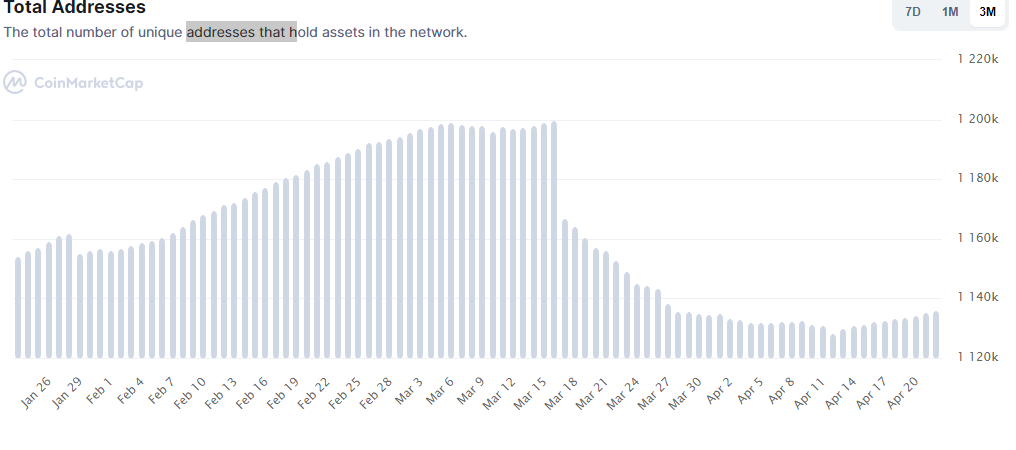

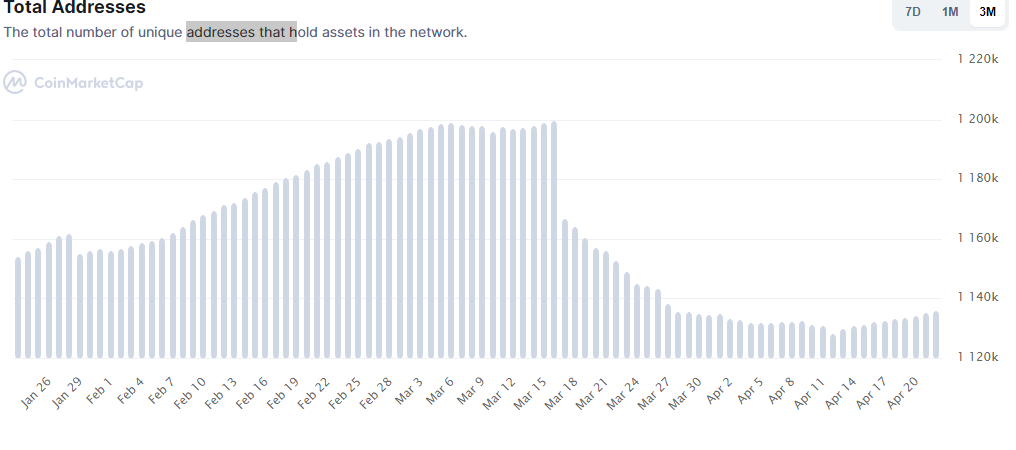

Even though the total number of unique addresses holding SHIB tokens recovered slightly over the week, the figures were still visibly lower than their March levels. The reading showed that new investors were not as eager to buy the dog-themed token in its current market cycle as before.

Shiba Inu Daily Chart

SHIB’s market dynamics leave its price in a spot of bother. The candles were trading close to $0.00002340 support and a breakdown could trigger another 8.5% correction, with $0.00002206 the next defensive option. Although a bullish double bottom could help fuel some retail interest, it’s unlikely SHIB’s price would hold above its near-term support in a risk-off broader market.

Those in anticipation of further losses can take up short calls. A short position can be opened at $0.00002360 and exits can be made at $0.00002206. A stop-loss can be kept at $0.00002471. The trade setup carried a 1.58 risk/reward ratio.