On 22 January, Bitcoin’s price had created a local low at $34,008. By 24 January, it had already stooped down to $32,917. Nevertheless, the next couple of days saw the coin recover and surpass $39,000.

Over the week, as BTC tried to pick up its pieces, the US Dollar Index started showing signs of weakening. After peaking at 97.4 towards the end of January—a level last seen in July 2020—DXY commenced its downtrend.

Opining on the same, Lyn Alden, the founder of Lyn Alden Investment Strategy tweeted,

Market/Fed reached a fever height last week in terms of making more and more aggressive tightening scenarios. Now walking back the pace of tightening outlooks slightly, as economic deceleration / weak PMI data takes center stage.

Outlining the broader state of the economy

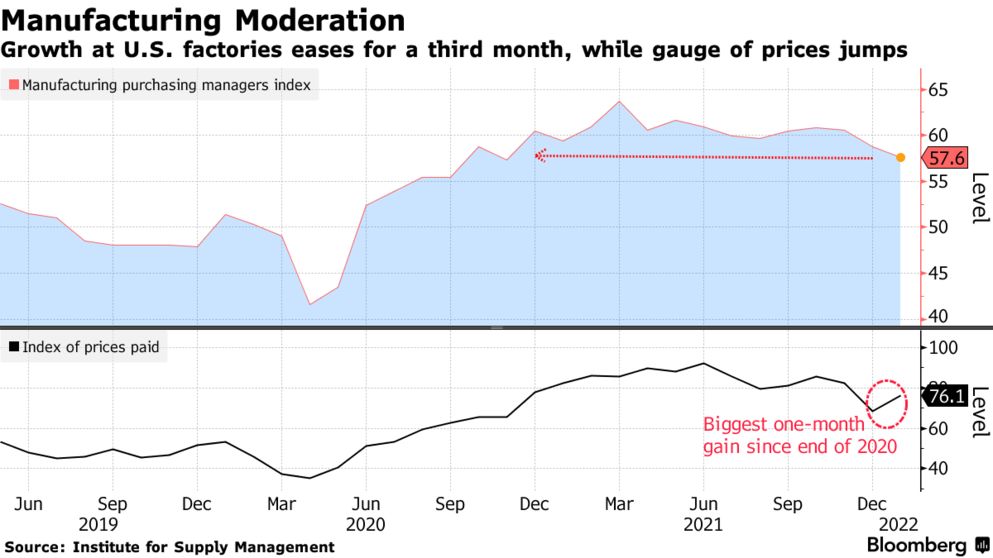

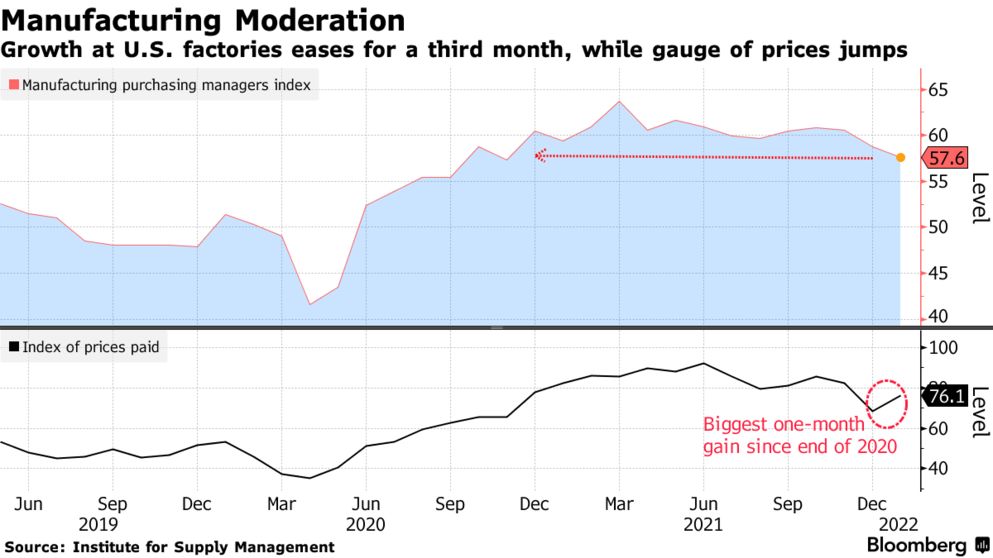

Well, the economic deceleration has already started re-materializing in the United States. The pace of manufacturing growth lost a fair more amount of steam in January. The Institute for Supply Management’s gauge of factory activity fell to 57.6, the third straight decline and the lowest since November 2020.

Additionally, the group’s measures of production and new orders, both, dropped to the lowest since mid-2020, hinting that the recent Omicron wave might have hampered the on-site operations.

In fact, the employment rates continued to dwindle. The same across regional companies dipped by 301,000 in December 2021, the highest since the initial days of the pandemic.

Powell’s hawkish outlook in the latest Fed meeting, in addition to the said factors, managed to make things worse. As of now, the U.S. rate futures hint at four to five rate hikes this year.

The Chairman’s remarks, by and large, converged with the US Dollar peeling off its gains and Bitcoin recovering.

Of late, a host of investment banks have published revised forecasts, and collectively predict one thing – the Federal Reserve will raise interest rates at a quicker pace this year.

The latest was from Goldman Sachs, which now sees five rate hikes this year (up from four), joining Deutsche Bank at that number. BoA, on the other hand, thinks that the central bank would be even more aggressive. It predicts seven 25-basis-point hikes this year, one for each of the remaining Federal Open Market Committee (FOMC) meetings. That would bring the Federal funds rate to 1.75% to 2% by the end of the year, essentially hiking up borrowing costs for Americans after years of rock-bottom lending rates.

This, when viewed in conjunction with other macro-factors, makes the case stronger for analysts to turn bullish on Bitcoin at this stage.

Beware of the unanticipated twist though

Well, one of the main reasons behind the Fed’s rate hike plans was a recovery in the employment rate. But now, with that number not doing very well of late, the back door remains open, as in, the central bank could retrace and deviate from its tightening plans.

If that indeed happens and inflation and other concerns are tackled, then the Dollar would start strengthening again. In effect, Bitcoin would not have the inflation cushion to hedge its investors and could begin down-sliding.

Even as far as the shorter time frame is concerned, Bitcoin’s recovery path is still not completely clear. It has to overcome a couple of obstacles around its current price range to an inch higher. If it is hindered, then it wouldn’t take much time for the coin to slip down to the lower $30k range.

In fact, over the past day, Bitcoin had already shed 6% of its value and was seen trading around $36.5k at the time of press.