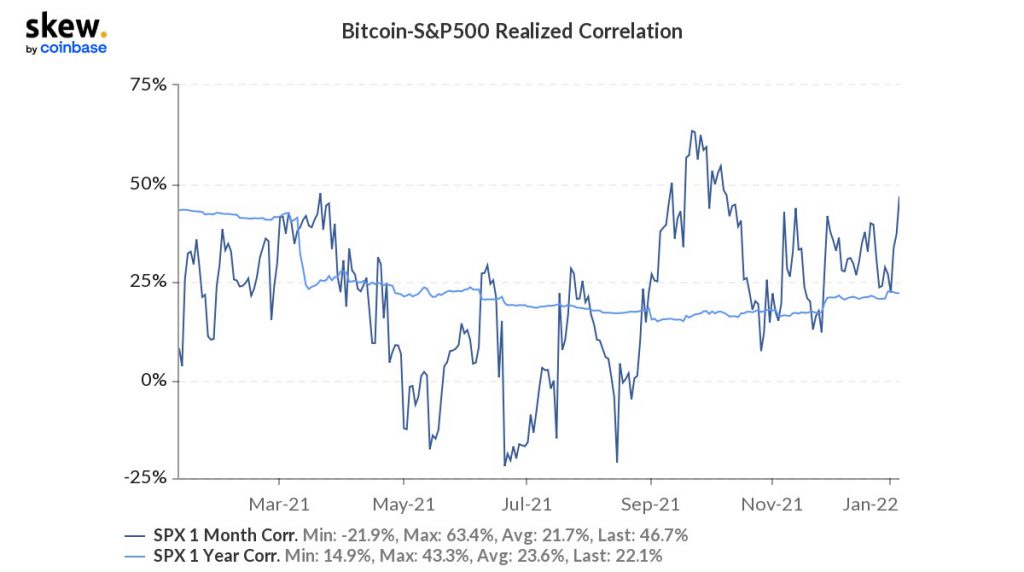

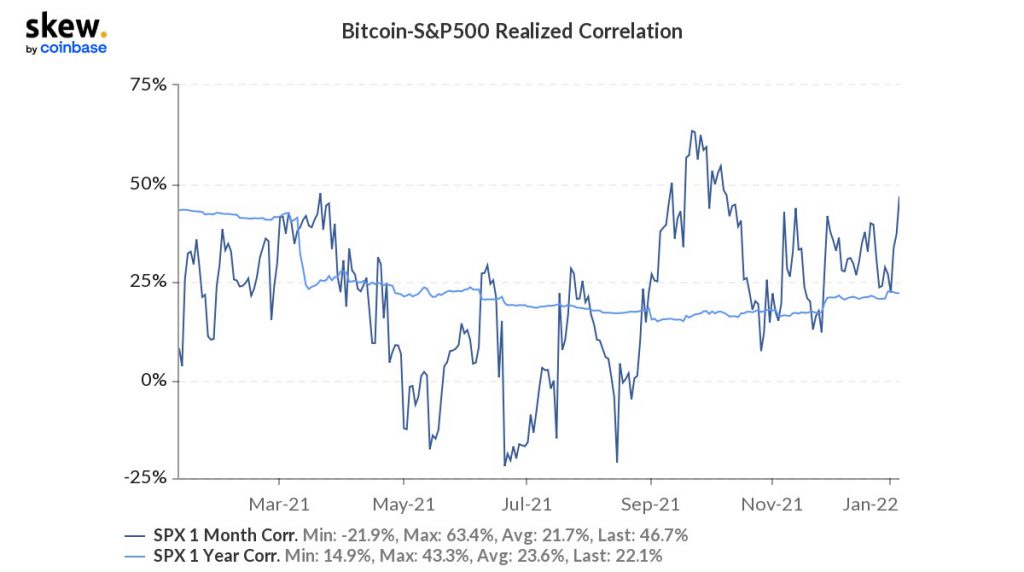

Financial markets all across the board have been in dire straits over the past day. The crypto market dip was well aligned with the S&P index’s meltdown. Well, It is a known fact that both these markets have maintained an on-and-off relationship with each other throughout history.

However, both markets have witnessed similar price trajectories lately. Simply put, their up and downtrend phases have, to a fair extent, been in sync. During the initial leg of the Coronavirus pandemic, it was evinced that the crypto sphere wasn’t shielded from the crashes noted in the traditional financial landscape. In fact, right after that in April last year, it was again proven that bull runs also go hand in hand.

Interestingly now, their mutual dependency has witnessed a sharp incline over the last couple of days. As per data from Skew, Bitcoin and the S&P-500 index currently share a correlation of 46.7%. This level was, notably, last observed towards the end of October last year.

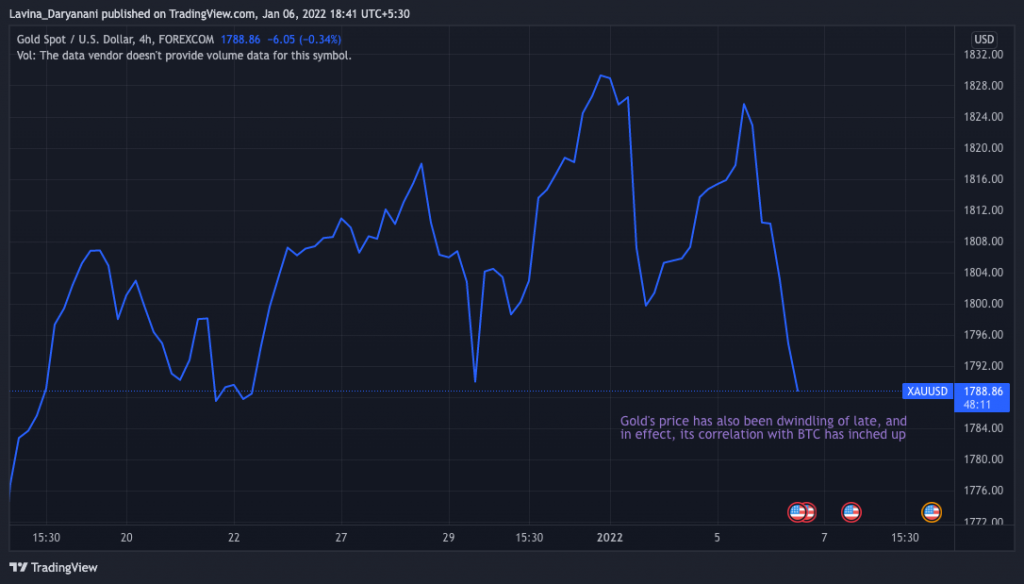

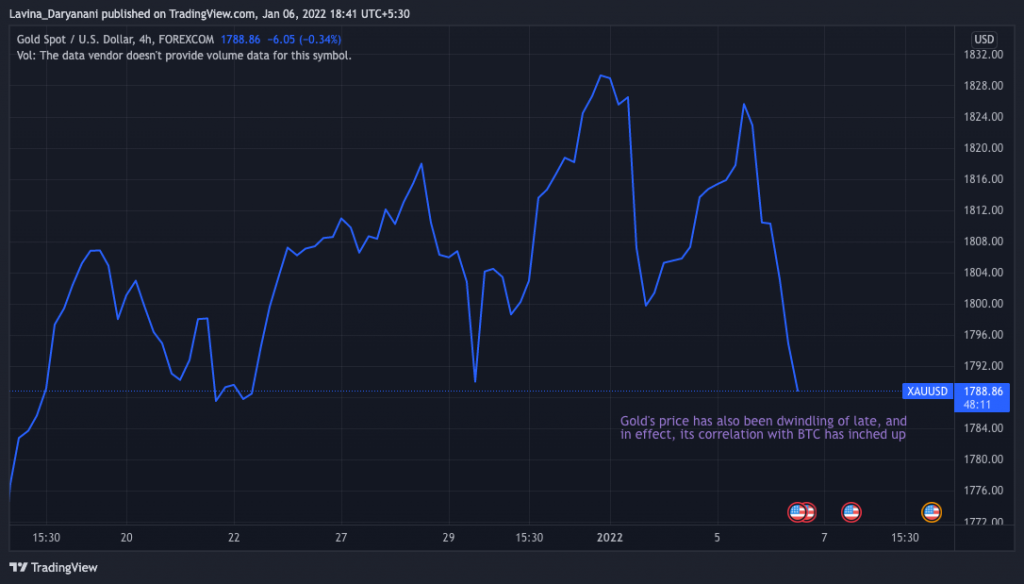

The ‘golden’ touch

Apace with the premier US stock index and the crypto market, even gold has substantially shed value over the past day. The sharp decline can be observed in the chart attached below.

The back-to-back chain-dip reaction exhibited by the stock index, Bitcoin, and gold highlights their ever-evolving relationship.

So, what does this mean?

Well, corrections are a part and parcel of every market phase. However now, the novel concerns surrounding the Omicron variant seem to have knit all the markets closer. As new restrictions are getting imposed by governments across countries, the economic activities have gradually started getting hampered. If the situation becomes even more tense going forward, then these markets would likely start witnessing a deficit buy-side momentum and could tumble even further.

Alongside the aforementioned concern, the Fed’s ‘hawkish‘ view has substantially contributed to the downtrend of the assets over the past day.

However, it shouldn’t be forgotten that Bitcoin and Gold, alongside equity, is the flag bearer of the ‘inflation hedge’ tag. So, if any sort of cash crunch situation arises going forward, the odds of these assets stepping up by rallying would increase.

Ergo, even if one particular market ends up recovering in the days to come, others would likely follow suit, given the healthy correlation they share with each other.

All hope ain’t lost

The wild roller-coaster ride of the markets has undoubtedly managed to instill chaos amongst investors who have parked their funds in the underlying assets. Nevertheless, the past year in the capital markets boldly narrates a tale of resilience. And hopefully, better and healthier markets await us on the other side of the long, dark COVID-19 tunnel.