The hype behind a lot of meme coins is beginning to subside in the market. While the likes of Shiba Inu, Dogecoin continue to remain in the top-20, there are plenty of other assets that presently represent an abysmal market structure. Floki Inu can be considered in that category as the market is beginning to show little sign of bullish pressure.

However, a flipside or an upward trajectory could be available during such bottom price ranges. In this article, we will analyze if there is an opportunity in the FLOKI charts going forward.

A 4-month downtrend for Floki Inu

As observed in the chart, Floki Inu has been on a consistent downtrend since the beginning of November 2021. After reaching an all-time high on 4th November, the meme coin has continued to slide in the market, reaching a low of 0.000014 on 23rd January. Right now, the average price target at $0.00012 remains approx 300% away from its current price of $0.00003. Trading Volumes remain minimal but the social sentiment and statistics are a little worse.

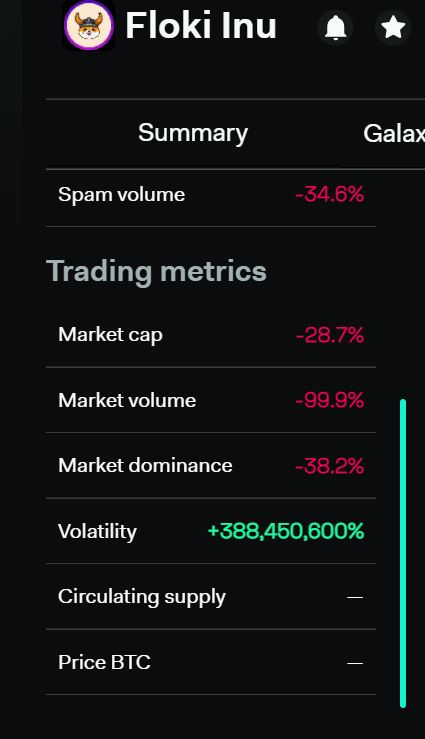

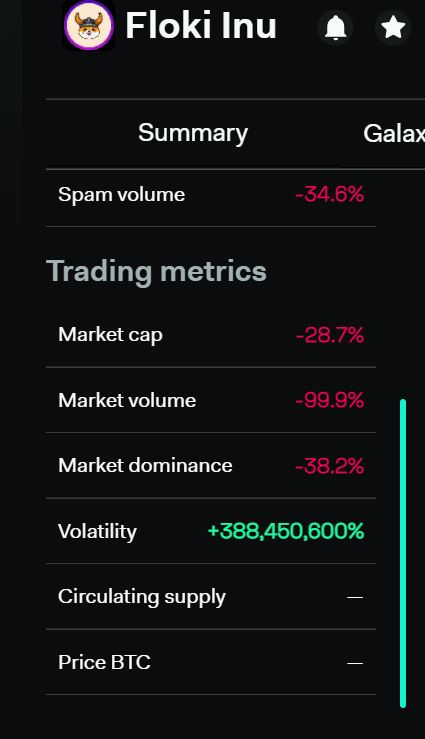

According to LunarCrush, market volume over the past month is down by 99.9% which means that there is minimal activity for the asset. Bullish sentiment is down by 47% and Social dominance has dropped down to -15%, according to the website. These are extremely unfavorable odds for Floki Inu at the moment, and consolidation is the best outlook for the meme coin.

So, Is there an upside?

Technically, there isn’t one that can be identified in the current ecosystem. However, the best-case scenario for Floki Inu in the immediate future would be to breach the downtrend(descending white line). It may re-invigorate buying pressure amongst the investors and FLOKI may register a brief bullish leg for some form of recovery.

However, at the moment, it is suggested that investors should remain patient with Floki Inu. Any risky bets should be avoided.