Bitcoin is threading under $20,000 yet again. The king coin was consolidating under $19,000, and the weekend could get even worse. While the short-term trend is highly bearish, it might also be short-lived.

This article analyzes one of the most accurate indicators that have regularly timed a Bitcoin bottom. While there might be months of recovery ahead, the base price could be extremely close.

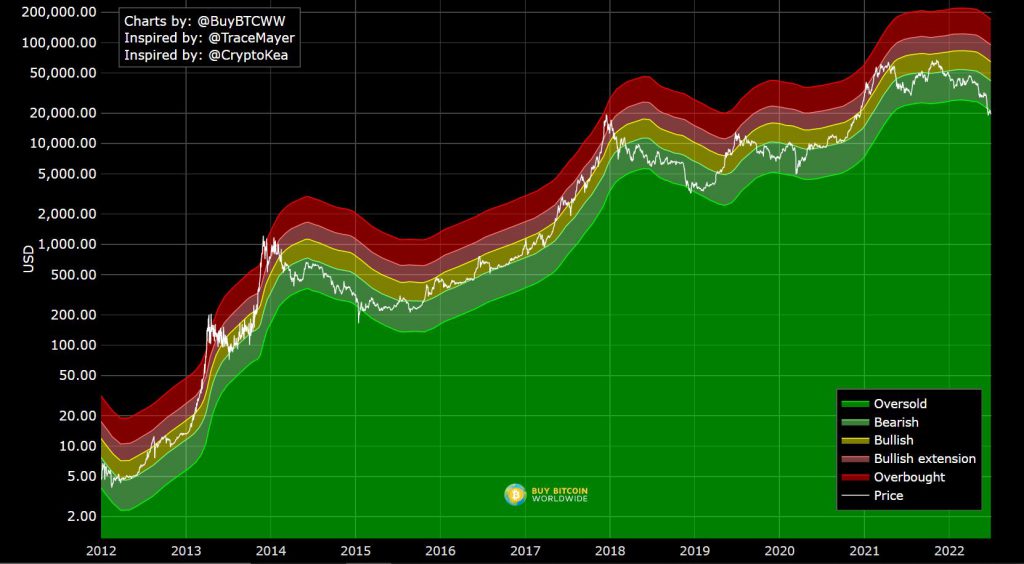

A Mayer-Multiple Flip in the books?

The Mayer Multiple for Bitcoin is assessed by taking the valuation of Bitcoin and dividing it by the 200-Moving Average. Now, comparing the average long-term price of Bitcoin with its current price allows investors to gauge under or over-valuation.

As observed in the chart above, Bitcoin’s price has tested the oversold region(green) 3 times in the past since 2015. The price has bounced back on every occasion and registered a long-term recovery. There have been prolonged periods of sideways movement, but a low range has been attained after reaching the oversold region.

This indicator is not a 100% confirmation of a bottom, but historically, it has been enormously accurate.

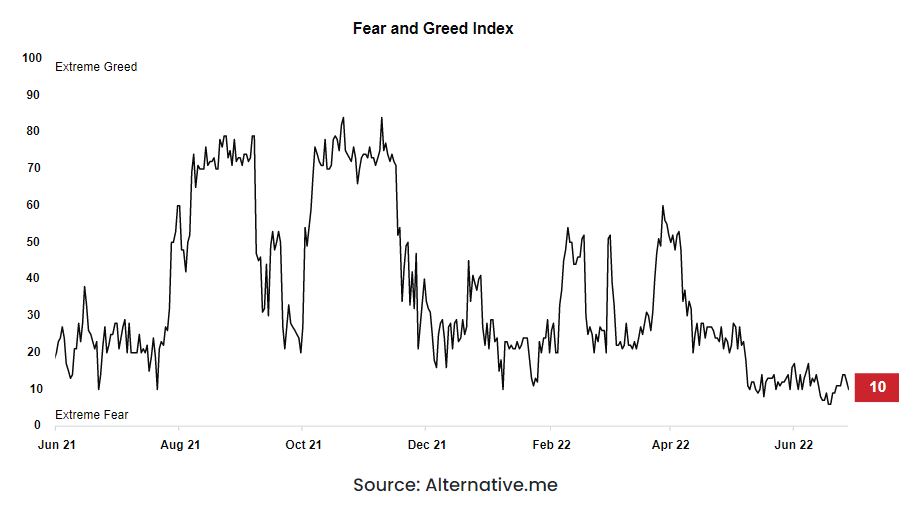

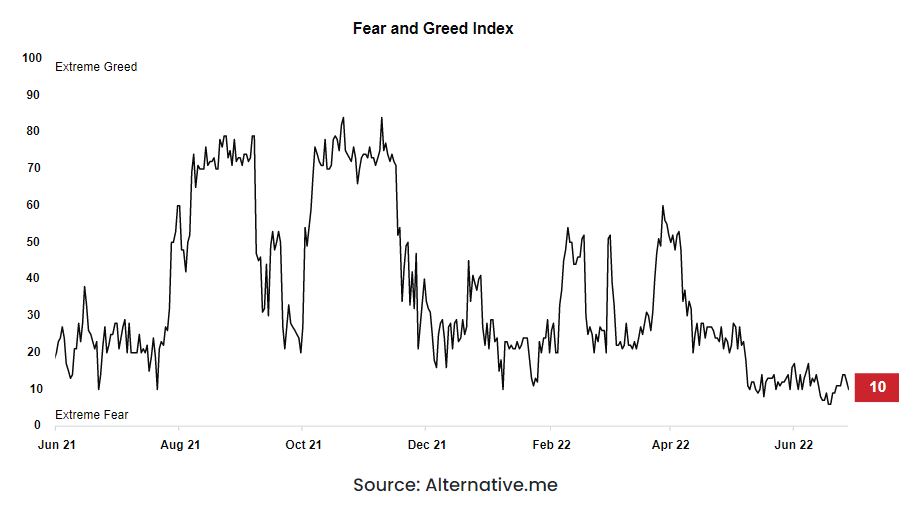

Extreme Fear and Spot Volume Deficit

The sentiment in the crypto market has also continued to remain extremely fearful. As illustrated in the chart, it is currently a 10 rating, but it climbed one point to 9 last week. It is important to note that extreme fear is also a window of opportunity to buy; hence there is a little correlation with the presumed bottom prediction.

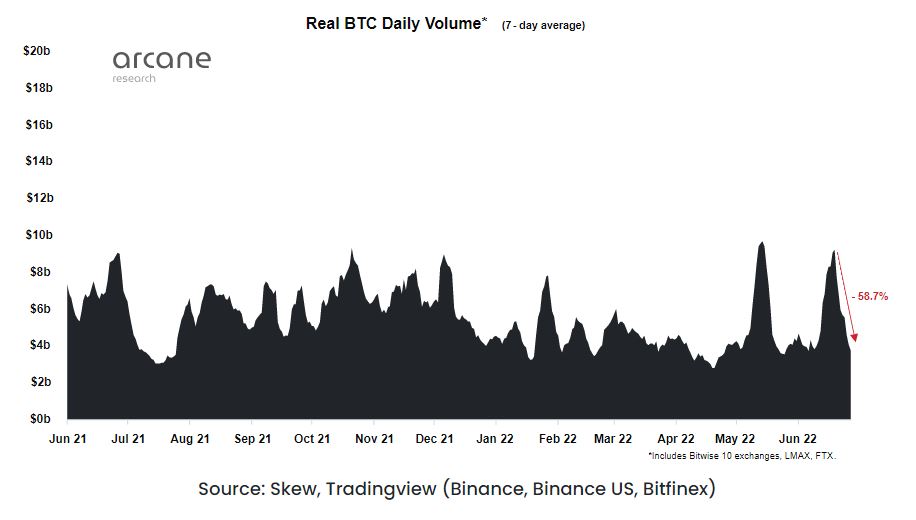

Another significant indication of stabilizing Bitcoin price is related to Bitcoin’s spot trading volume.

It is currently down 58% monthly as investors are more cautious because of market volatility. Any increase in spot trading volume would automatically cause a strong recovery, and the price would be receptive to only buying pressure at the moment.

Is it time to get in?

Bitcoin is an opportunity right now. At $20,000, long-term structured investment in the form of DCA or holding makes sense because once the economy stabilizes, the markets are bound to bounce back. So, an allocation can be made into Bitcoin, but risk management should be taken care of.