Your guide: Is Webull Good for Day Trading?

Day trading has become very popular, especially among youth and new investors who want to make money from short-term changes in the market. People are interested in the Webull platform in this area. This online brokerage, which opened in 2017, has many features that are meant to draw day traders. But is Webull a good choice for people who want to do day trading? This piece will talk about different parts of Webull, such as its features, pros and cons, and how it stacks up against other trading platforms.

Also read: BRICS Deny Plans to Create Cross-Border Payment System at 2024 Summit.

A Look at Webull

For a company that just started, Webull has become very popular very quickly. It was started by Wang Anquan, who used to work for Xiaomi and Alibaba. Its goal is to make trade easy for everyone. Webull has done away with trading fees on stocks, options, and ETFs, which makes it a great choice for day traders compared to traditional brokerages that charge costs.

Compliance with Regulations

One of the main things that makes Webull trustworthy is that it is regulated by the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Traders feel safer knowing that their investments are safe under set financial laws because of this regulatory oversight.

The Base of Users Grows

Since its app came out in 2018, Webull has grown by leaps and bounds, and by 2020, it will have over 10 million users. Many of these new traders came from Robinhood and switched to Webull because it has more advanced trading tools and an easier-to-use interface.

Ability to Trade Every Day

How do you trade every day?

When you do day trading, you buy and sell financial instruments during the same trade day. This approach tries to make money off of small changes in prices, so traders need to know a lot about market trends and analytics.

Day Traders on Webull

Webull does offer day trading, which means that users can buy and sell stocks several times a day. But there are important things to think about before you jump in.

The Rule for Pattern Day Traders

According to the SEC’s Pattern Day Trader (PDT) rule, traders must keep at least $25,000 in their trading account at all times if they want to make more than three-day deals in a five-day period. A lot of new buyers find this rule hard to follow, but there are ways to get around it.

Different Types of Orders

To be successful at day trading, you need to know about the different types of orders. Webull takes many kinds of orders, such as:

- Limit orders: limit orders let you say how much you are ready to pay for a stock at most.

- Market Orders: You can buy or sell a stock at the current market price with a market order.

- Stop loss orders: Use stop loss orders to sell a stock automatically when it hits a certain price. This will help you avoid losing too much money.

- Trailing stop orders lets buyers set a stop price that changes based on how the market price changes.

- These types of orders can help you trade better and respond more quickly to changes in the market.

Pros of Trading Here

Interface that is easy to use

Webull’s platform is made to work for both new and expert traders. The app’s layout is clean and easy to understand, making it simple for users to switch between charts, market info, and trading tools. This ease of access is especially helpful for new traders who might feel confused by trading systems that are too complicated.

Trading with no fees

One great thing about Webull is that you can trade without paying any fees. This means that day traders can make trades without having to worry about extra costs cutting into their earnings. Traders can try out different methods without worrying about getting hit with big fees with this zero-commission model.

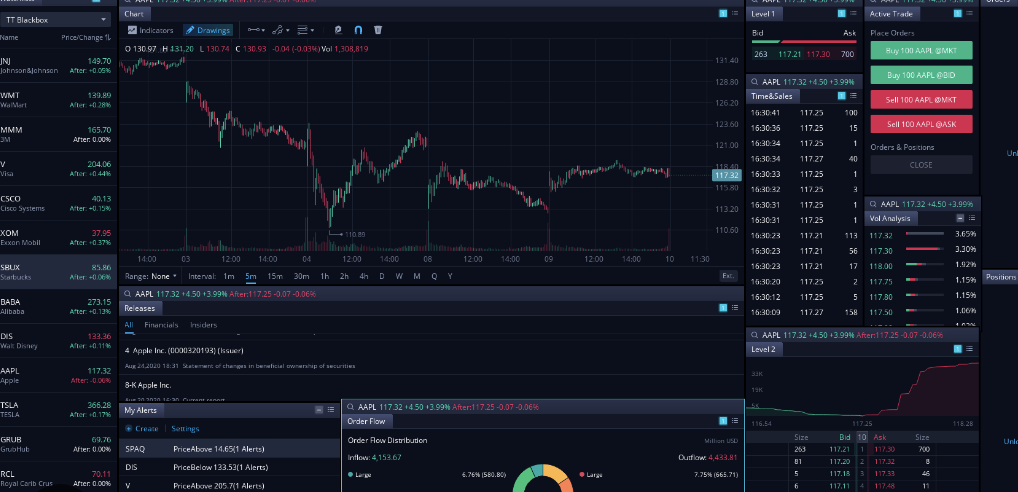

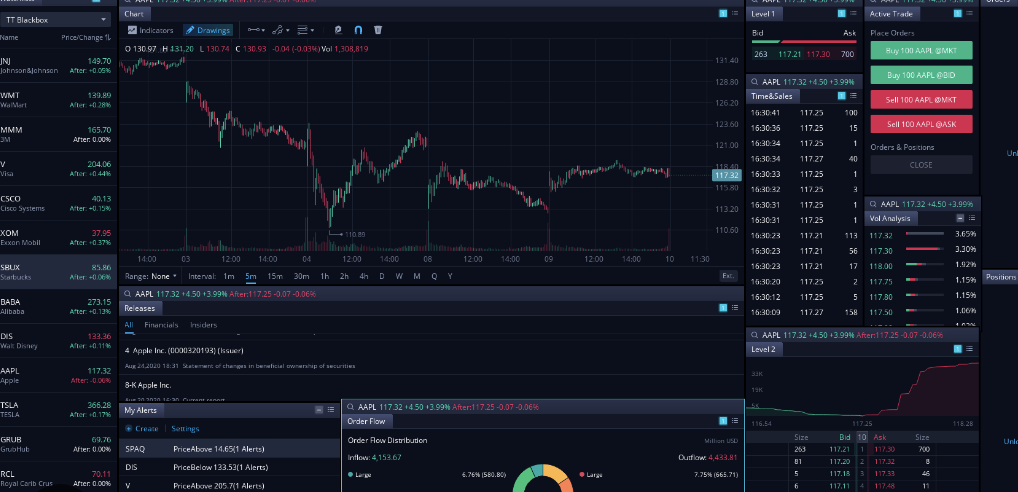

Better Tools for Trading

Webull has several tools that are meant to help buyers make smart choices. Some of these are:

- Real-Time Market Data: Traders can stay up to date on price changes by getting live rates and market trends.

- Technical Analysis Tools: The platform has many indicators and charting choices that let you look at how stocks are doing in more detail.

- Paper Trading: This feature lets new traders try out their methods without taking any risks by using virtual currency. This function is especially helpful for people who want to get better at trading before they risk real money.

Some other factors to consider

Not Many Technical Indicators

Webull has a good selection of tools for technical analysis, but some users might think there aren’t enough to choose from. There aren’t many popular indicators on the site, which might not be enough for traders who rely on advanced technical analysis.

Simple Stock Screener

There have been complaints that Webull’s stock screener doesn’t let you change many things. It does offer basic filtering tools, but more experienced traders may find that it lacks the detailed data they need to spot possible trading chances.

Not having hotkeys on the mobile App

Speed is very important for day trades. When you use hotkeys, you can make trades quickly, but Webull’s mobile app doesn’t have this function. On the desktop version of the app, users can use hotkeys, which could be a problem for people who like to trade on their phones.

The costs and fees of trading

How to Understand Fees?

Even though Webull advertises a system with no commissions, it’s important to know that there may still be some fees. Some of these are:

- FINRA Fees: A trade activity fee of $0.000119 per share on the sale of stocks, with a low of one cent and a high of $5.95.

- To pay SEC fees, you have to pay at least one cent plus $13 for every $1 million in stock sales.

Also, if you trade stocks every day on margin, you should know that Webull’s margin rates are competitive, but they can be higher than those at some other brokerages.

Other options besides Webull

Robinhood

When people think of options for Webull, Robinhood is often one that comes to mind. Robinhood has a lot of users, especially younger buyers because it lets people trade without having to pay any fees. It doesn’t have as many complicated trading tools as Webull, though.

The TD Ameritrade

TD Ameritrade is a well-known rival as well. This brokerage has been around since 1975 and has a lot of training materials that make it a great choice for new traders. It also lets you trade without paying any fees, but options contracts cost money, which day traders might want to think about.

Lightspeed

LightSpeed is a good option for people who want speed and advanced features. This platform is made just for day traders; it has direct market access, hotkeys, and a strong trading interface.

Also read: BRICS: 85% Trade Settled in Local Currencies, Not US Dollar

Techniques for Managing Risk

Day trades need to be able to handle risks well. Think about using techniques like these:

- Setting stop loss orders: To keep trade costs to a minimum.

- Diversification: Diversifying your portfolio means not putting too much money into one stock or area.

- Limit Emotions: Keeping your emotions in check means being disciplined and following your trade plan no matter how the market changes.

Conclusion

In the end, Webull is a great choice for day buyers, especially those who are new to the stock market. It’s a good choice because it doesn’t charge any fees for trading and has advanced trade tools and an easy-to-use interface. But people who might use it should also think about its flaws, like the fact that it doesn’t have some technical signs or mobile hotkeys.

At the end of the day, your trading needs and preferences will determine whether Webull is the right tool for you. It can help you reach your financial goals and improve your day t