XRP leads a major change in finance with ISO 20022’s launch on November 24, 2024. This new messaging system will change how banks handle global payments.

According to Ripple’s official statement, “Ripple is part of the ISO 20022 Registration Management Group (RMG) standards body and the first member focused on Distributed Ledger Technology (DLT). This membership enables us to meet the needs of our 300+ customers by helping define the future direction of cross-border payment standards to evolve the ISO 20022 standard.”

Also Read: Shiba Inu: SHIB Eyes 351% Surge To $0.000081, Analyst Predicts

ISO 20022’s Impact: XRP’s Role in the Future of Global Payments

Strategic Integration

RippleNet stands out for using this global standard for financial data exchange when nobody else was interested. As InvestorPlace reports, “A win for ISO 20022 will be a huge win for Ripple. By becoming a member of the ISO 20022 committee, Ripple is positioning XRP as a key player in the future of global payments.”

The new data format simplifies cross-border payments, reduces payment errors, and facilitates compliance checks. This fixes many problems in international banking, like high fees and slow transfers.

Also Read: Solana-Based Popcat Hits All-Time High: Can It Hit $2 Next?

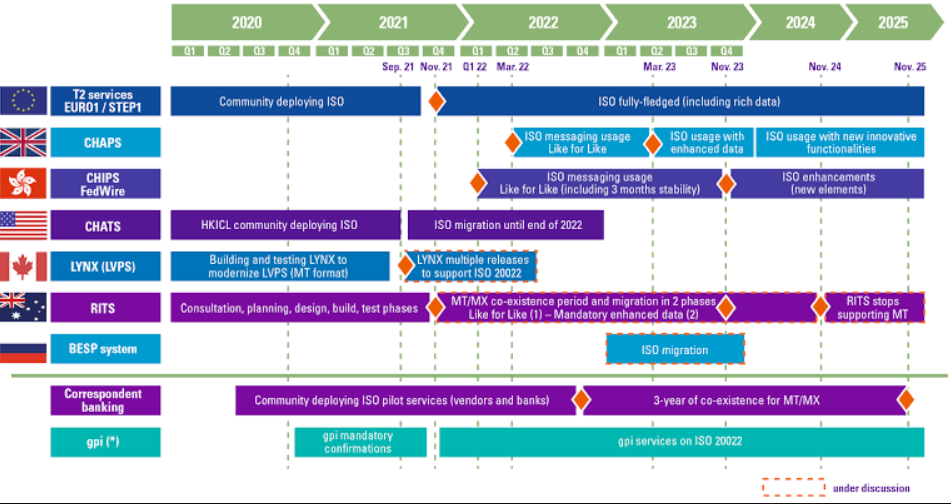

Implementation Timeline

By 2025, ISO 20022 will power 87% of global money transfers. Banks and payment companies will use one shared system. This marks a significant change in how banks send money worldwide. It fixes the problem of different payment systems not working together. Central banks are already updating their systems to use the new standard.

Technical Framework

ISO 20022 uses better data systems for payments, which helps money move smoothly between different banks. RippleNet got ahead by using these standards early. Now, it fits perfectly into the new banking system. The network can send payments instantly, which matches what this global standard for financial data exchange aims to do.

Market Impact

ISO 20022 strengthens XRP in several ways. Banks looking for better ways to send money abroad might choose XRP more often. They can use Ripple’s On-Demand Liquidity service to send money. Banks won’t need to keep money in different accounts anymore, and fees and delays will drop.

David Schwartz, Ripple’s Chief Technology Officer, explains that while XRP isn’t ISO 20022-compliant, it works perfectly with Ripple’s payment system to make international transfers faster and cheaper.

Also Read: Can Binance Coin (BNB) Reclaim Its All-Time High Before Bitcoin?

The new standard helps more banks use the system and process payments better, increasing the chances of XRP being used in regular banking.