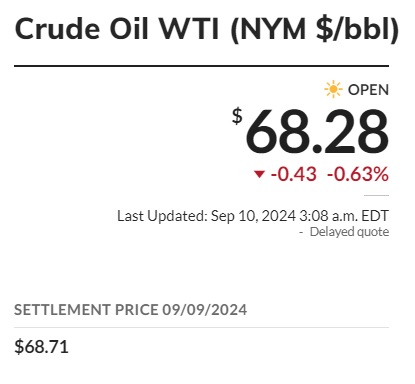

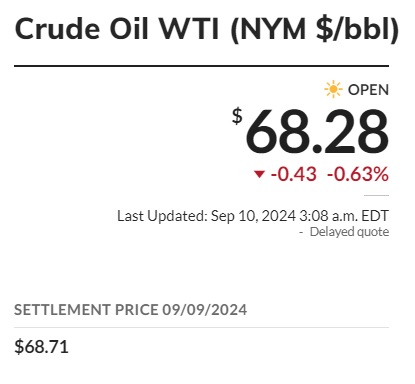

The West Texas Intermediate (WTI) oil prices fell below the $70 mark on Monday’s closing bell. Tuesday’s opening bell further slumped the index as oil prices hovered around the $68 level.

It is just a stone’s throw away from reaching its 52-week low of $67.17, which officially means that oil prices have turned bearish and traders are staying away from the commodity.

Also Read: 2 Countries Agree To Settle Trade in Local Currencies, Not US Dollar

WTI crude saw its worst performance this month, dipping by nearly 8%. This is the lowest drop since June 2023, when it slumped to $71.06 a barrel. Oil prices are now among the least-performing assets in the commodity markets, delivering nothing but losses.

Also Read: Commodity Markets: Copper Prices Sink Below $8,800

What Next For Oil Prices?

Weak Chinese economic data and a reduction in oil output from Libya are weakening prices, leading to bearish sentiments. In addition, investors’ net long positions for both crude and Brent oil have dropped dramatically.

Bloomberg reported that investments in Brent have been slashed from 99,889 lots to just 139,242 lots this month. Therefore, investments in the sector are drying up, with a reduction of nearly 30% in the last ten days.

Also Read: Putin’s Bitcoin Boom: $3 Billion Gain Last Year, Now Eyeing Market Dominance

Additionally, investment in WTI crude oil prices was reduced by 62,000 from the previous 125,000 lots. The numbers could fall further if prices do not recover this month.

Traders are not even interested in buying the dips in these commodity prices as fears of a bigger slump loom. “Including the three fuel products the net long slumped to 121k contracts, lowest recorded energy exposure since 2011 when ICE began collecting data,” said Ole Hansen, Head of Commodity Strategy at Saxo Bank.

For oil prices to pick up steam, the US economy needs to turn robust with better growth and job openings. “We find both the fiscal and monetary policy stance less accommodative than desired and insufficient to revive domestic demand growth,” said Bank of America.