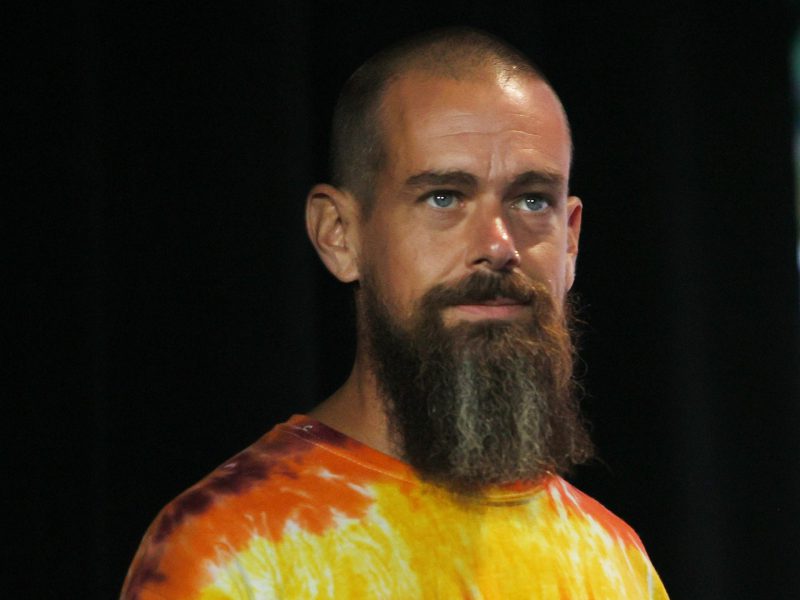

Jack Dorsey’s Block Inc. says it will buy Bitcoin every month with 10% of its gross profit from BTC products. In a memo released today, Block shared its corporate balance sheet dollar cost average (DCA) program. According to the company, they will be investing 10% of Block’s monthly gross profit from bitcoin products into purchases of bitcoin for investment.

In a post on X, Dorsey says “Block is DCA’ing bitcoin every month. here’s how your company can do it too.” Dorsey proceeds to share a link to its “Bitcoin Blueprint for Corporate Balance Sheets.” The blueprint reveals that Block Inc. plans to purchase Bitcoin on a monthly cadence utilizing TWAP orders. This initiative reportedly began in April 2024.

Furthermore, Block’s memo/blueprint states: “By allocating a portion of our monthly bitcoin gross profits to bitcoin investment on a predetermined and recurring cadence, we sidestep the challenges of market timing. The price of bitcoin can be highly volatile and hard to predict as its price action doesn’t always correlate with existing asset classes.”

Also Read: Cryptocurrency: Top 3 Layer 2 Coins By Development Activity To Buy Now

Jack Dorsey’s Block made its first Bitcoin purchase in October 2020 of 4,709 BTC. Four months later, they purchased over 3,000 more. At present day, Block holds 8,038 bitcoins. According to Block, this represents approximately 9% of Block’s total cash, cash equivalents, and marketable securities. The company’s total Bitcoin stash at today’s price is worth over $489 million.