Japan’s US treasury holdings have, at this moment, emerged as a potential bargaining chip in the ongoing tariff negotiations with Washington. Right now, as the Trump administration is pushing forward with its aggressive trade policies, Japan’s rather massive $1.1 trillion stake in US government debt is kind of being viewed through a new and different strategic lens during these economic leverage discussions.

Also Read: De-dollarization in Action: China & Japan Back $240B Yuan-Based Bailout Fund

Exploring How Japan’s Massive US Debt Holdings Create Economic Leverage Amid Rising Trade Tensions

A Significant Financial Relationship

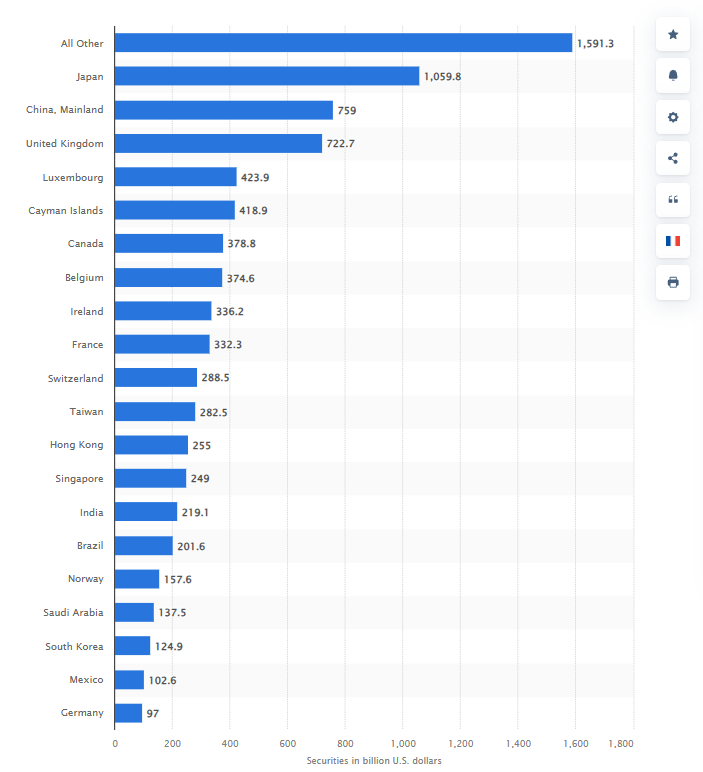

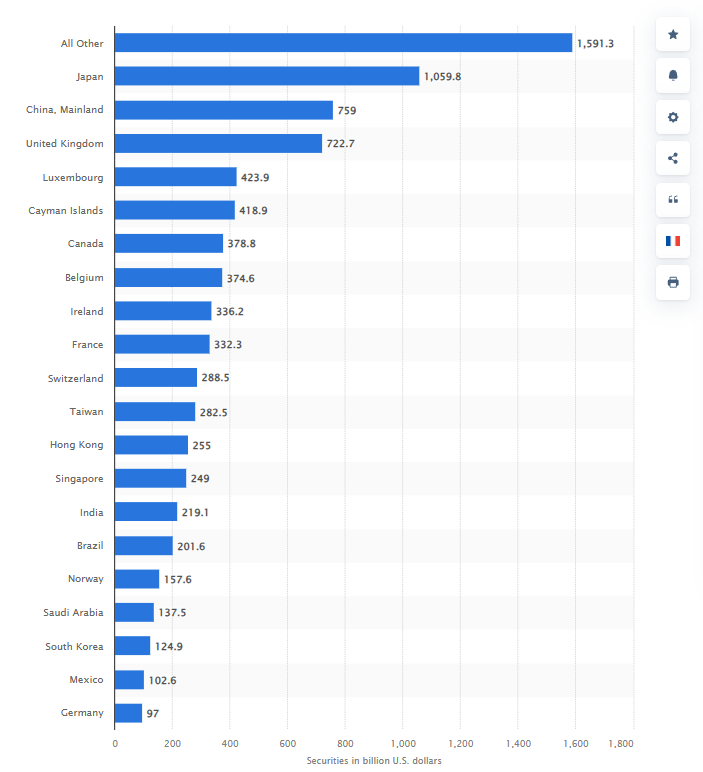

Japan’s US treasury holdings currently amount to approximately $1.13 trillion, and this makes Japan America’s largest foreign creditor. The Trump administration has, in recent months, imposed some significant tariffs on Japanese exports, including a 24 percent ‘reciprocal’ duty that it has currently paused, and these tariffs are now affecting Japan’s vital automotive sector and other industries.

Japan’s Finance Minister Kato has also said that:

“It does exist as a card, but I think whether we choose to use it or not would be a separate decision.”

Strategic Implications

The Japan’s US treasury holdings represent, in many ways, a powerful financial tool that could potentially influence the trade dynamics between the two nations. While Japanese officials had previously ruled out using Treasury holdings as leverage, Kato’s recent comments appear to signal a possible strategic shift in their approach.

Also Read: AI Predicts Odds Of Dogecoin (DOGE) Deployment On X Before 2025 Ends

The Balancing Act

Japan’s US treasury holdings create a rather complex economic relationship where both nations have, frankly, a lot to lose from any drastic actions. A large-scale sell-off could potentially spike US interest rates while also causing the yen to appreciate, which would likely harm Japan’s export-driven economy in various ways.

Takeshi Niinami, senior economic advisor to Japan’s prime minister, is convinced by the fact that:

“Japan has many cards to play in tariff negotiations with the United States.”

Finance Minister Kato emphasized this idea by saying that:

“My comments weren’t meant to suggest selling Treasury holdings.”

Also Read: Shiba Inu Forecasted To Rise 500%, Come Close To ATH of $0.00008616

Looking Forward

The holding position of Japan’s U.S. Treasury assets has achieved an important diplomatic power relocation. Japan maintains its delicate approach to managing US Treasury holdings while signaling its comprehensive geopolitical plan because it stands as a direct US ally amid Trump-era trade tensions against Chinese economic activities.