Japanese crypto firm SBI Holdings has signed a basic agreement for a business partnership with the $2 trillion oil giant Saudi Aramco. The Japanese firm has said it is considering a partnership with the Saudi oil company.

According to a Dec. 11, 2023 report, the partnership will include the construction of semiconductor factories in territories of Japan and Saudi Arabia. Moreover, the deal will involve co-investing in each other’s digital asset portfolios, including crypto.

Also Read: Top 3 Cryptocurrencies to Watch This Week

The collaboration will involve three parts. First will be the cooperation and mutual investments in the cryptocurrency field. The second will include discovering and supporting Japanese crypto start-ups interested in expanding to Saudi Arabia. And thirdly, the launch of projects related to semiconductors.

Is the Japanese crypto firm bullish on the Middle East?

The Middle East has emerged as one of the most friendly regions regarding crypto. SBI Holdings has actively pursued its interest in the region and has also announced plans for a “SBI Middle East” in Riyadh. Such an initiative aims to promote Japanese cryptocurrency start-ups in Saudi Arabia.

Also Read: Crypto: Standard Chartered and SBI to Invest $100 Million in UAE.

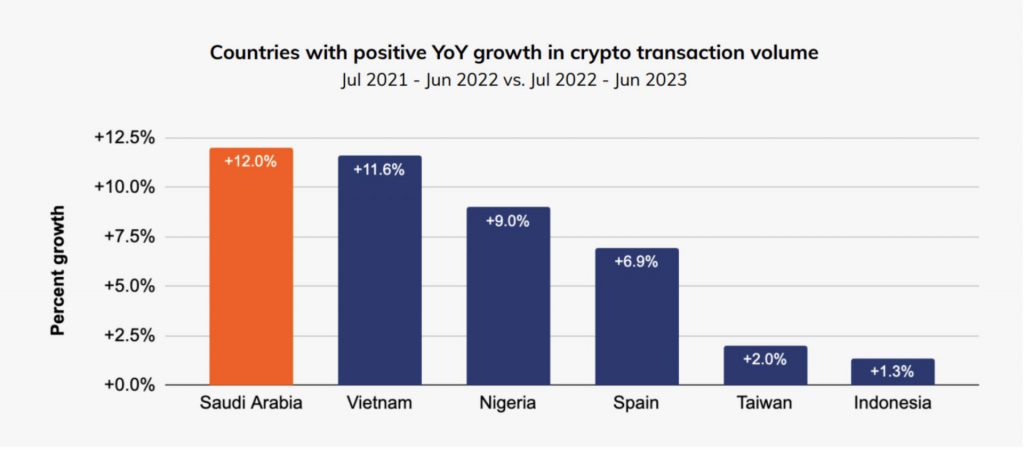

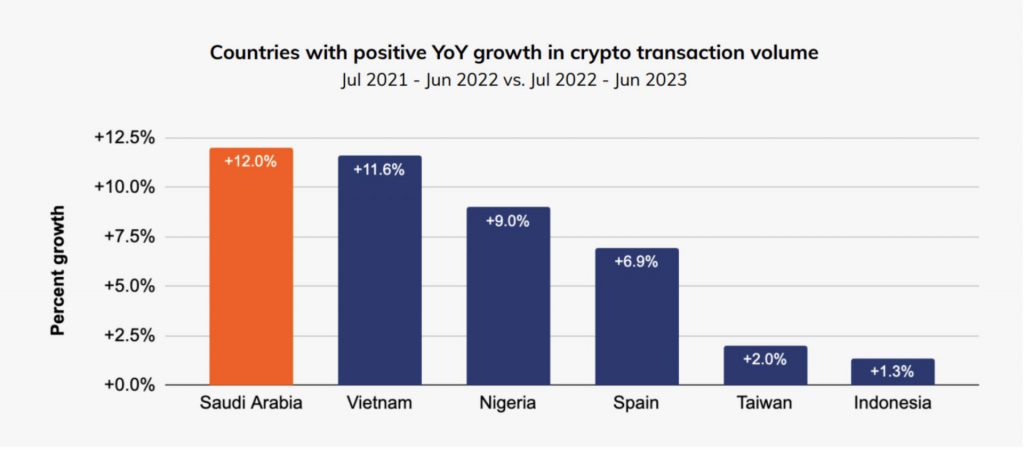

On the other hand, Saudi Arabia aims to become a crypto hub in the Middle East, rivaling that of UAE (United Aram Emirates). According to a report by Chainalysis, Saudi Arabia led globally with a 12% year-over-year (YoY) crypto transaction volume growth. Between July 2022 through June 2023, transaction volume surged to nearly $31 billion.

Additionally, Chainalysis data has shown that the Middle East and North Africa (MENA) has the sixth largest crypto economy in the world. Between July 2022 and June 2023, the Middle East and North Africa (MENA) crypto economy was worth around $390 billion. Despite the increasing numbers, the region’s cryptocurrency market is still behind North America and Western Europe.