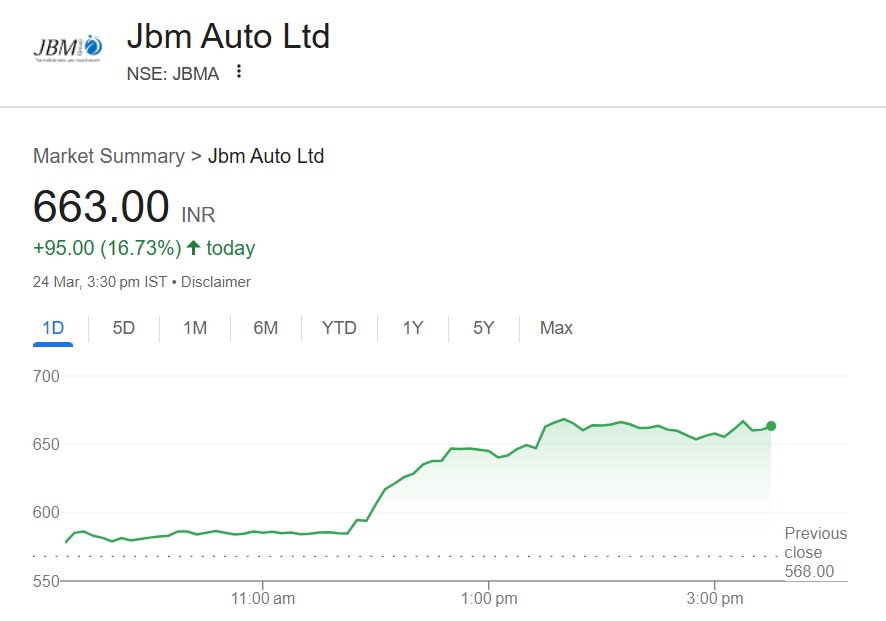

Shares of JBM Auto (NSE: JBMA) surged a record 16.73% on Monday spiking 95 points in the day’s trade. The stock gained strong volumes with 1.2 crore shares changing hands on the National Stock Exchange before the closing bell. This is more than the combined and overall volume of the last 20 trading sessions put together.

Also Read: Morgan Stanley Lowers Tesla Stock Price: Trouble Ahead For TSLA?

The spike in price comes after Sensex rose 1.40% on Monday rising 1,078 points while Nifty shot up 1.32% and is up 307 points. JBM Auto shares printed its first ever massive surge today generating phenomenal returns to investors. Holders who took an entry position today turned an investment of Rs 1,00,000 into 1,17,000 during the six-hour trading session.

Also Read: Shiba Inu: SHIB’s Price 1 Year From Now

Why Are JBM Auto Shares Rising?

The shares of JBM Auto are rising double-digits because the board of Mahindra & Mahindra (M&M) is in early talks with SML Isuzu’s promoter Sumitomo Corporation, to acquire their stake held in the company, reported CNBC-TV18. M&M is looking for a valuation of around Rs 1,400 – ₹1,500 per share, amounting to Rs 950 crore.

Also Read: Bitcoin: AI Predicts BTC’s Price For March 31st 2025

JBM Auto is the front-runner to acquire the promoters in SME Isuzu that made its price surge in value today. Its price during the closing bell stood at Rs 663 and is up nearly 30% in the last trading sessions. The stock is attracting heavy bullish sentiments and could spike further in the coming days.

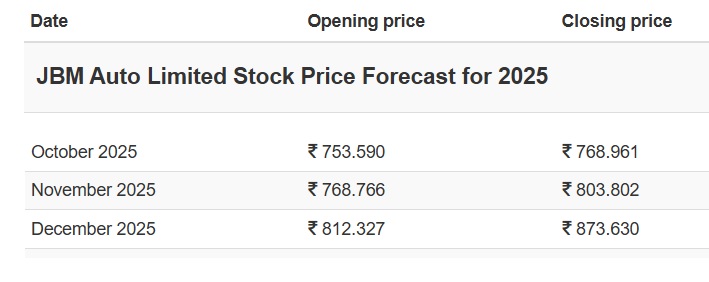

Leading on-chain metrics and price prediction firm Wallet Investor has painted a bullish thesis for JBM Auto shares this year. According to the latest and revised price prediction, the stock could end 2025 at a high of Rs 873. That’s an uptick and return on investment (ROI) of approximately 31.6% from its current price of Rs 663. Therefore, an investment of Rs 1,00,000 could turn into Rs 1,31,600 if the forecast turns out accurate.