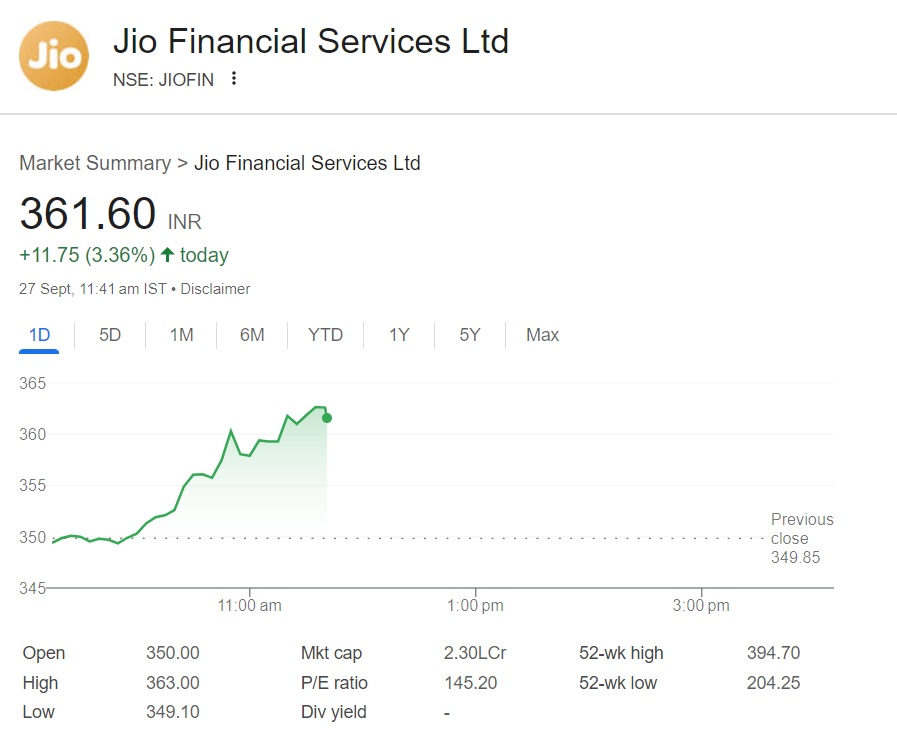

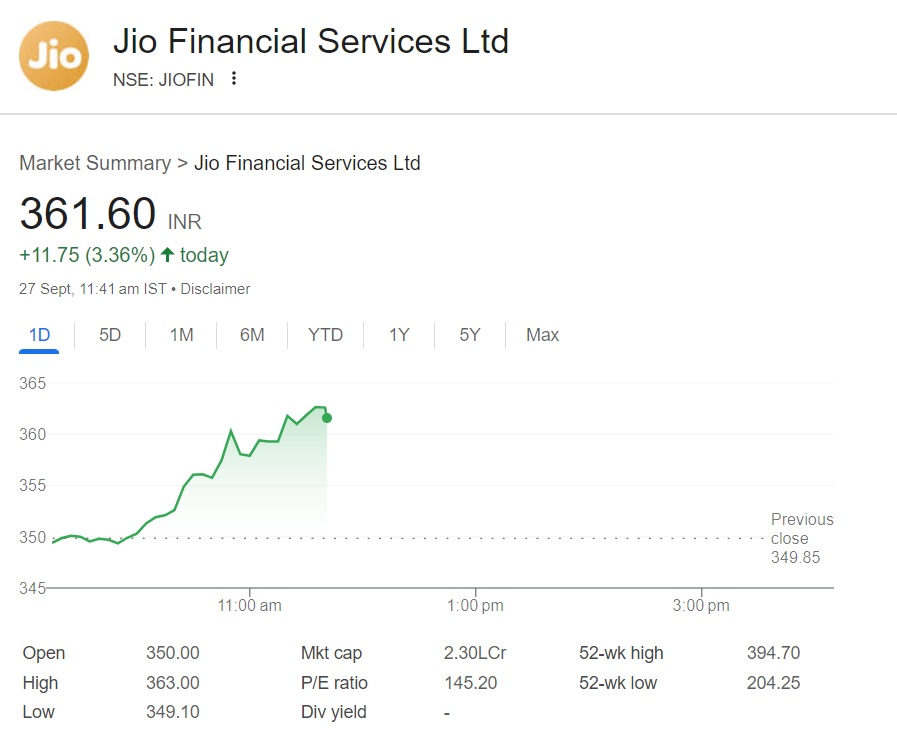

Jio Financial Services shares have surged close to 4% on Friday’s opening bell. The stock is attracting heavy bullish sentiments after ending its consolidation phase. Its price was consolidating between Rs 325 and 340 level for nearly two months, and it experienced a breakthrough this week. It is currently trading at the price range of 361 and hit a day’s high of Rs 363.

Also Read: 2 Nasdaq Stocks to Buy Before They Surge 50% and More

It broke the resistance level of Rs 350 this week and sustainably scaled up in the charts since Wednesday. The shares of Jio Financial Services spiked nearly 12 points on Friday by rising 3.36% in the day’s trade. The leading financial stock is now eyeing the 400 mark and could reach a new all-time high.

Also Read: Tesla US Stock: Will TSLA Breach Target Price Of $310 Anytime Soon?

Jio Financial Services Shares: Price Target of 400 Next?

Taking an entry position in Jio Financial shares even at the current levels could be profitable for investors, said stock market expert Kush Ghodasara. The analyst predicts that if the stock breaks through its resistance level of Rs 370, the next target could be Rs 400. He also explained that the stock looks good on the charts and has the potential to reach the 400 mark next.

Also Read: US Stock: Apple Price Prediction For 2025

“The stock looked good on charts (Jio Financial shares). It has been consolidating in a strict range for the last two months. So, one can buy around Rs 340 levels for potential upside targets of Rs 370-400,” market expert Kush Ghodasara told Business Today TV.

It had reached an all-time high of 394 in April this year before sliding in the charts. Investors who brought the dips on Jio Financial shares are currently sitting in profits. It is estimated that it could breach its ATH of 394 and touch the 400 mark in the short term. This puts the stock in the buy zone for investors to make use of the price rise to book profits.