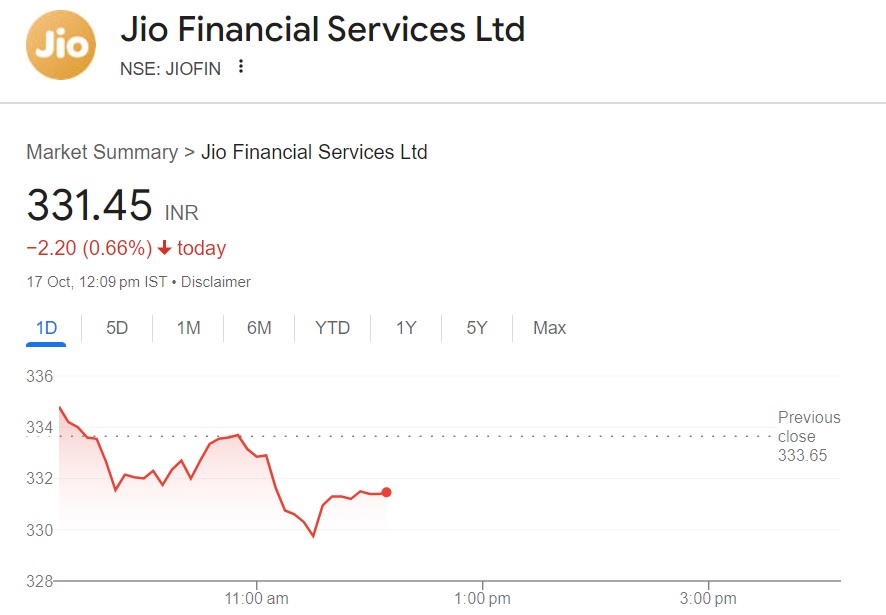

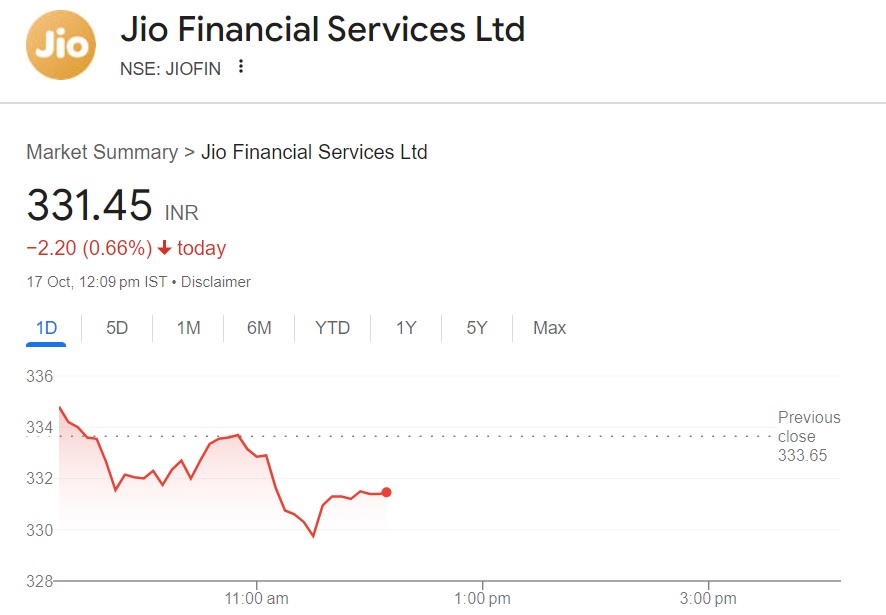

Jio Financial shares are on a downward trend as it failed to snap its five-day losing streak. The stock was traded in red for five consecutive days and was trading at the 331 price level on Thursday. It is now at its March 2024 low, and the fall is making investors jittery.

Also Read: Citi Bank Gives Latest Price Target For Nvidia Stock

The bloodbath in the stock market in October is brutal as Sensex shed more than 2,000 points in a month. On the other hand, Nifty is down nearly 650 points and the slump is getting bigger each day. This is affecting Jio Financial shares as institutional investors are pulling the plug from the stock markets.

Also Read: Alphabet: Truist Financial Gives GOOGL Updated $220 Target

Profit bookings and sell-offs caused the markets to dip after the Sensex peaked at 85,000 and Nifty soared to 26,000. Institutional funds, including foreign direct investors, booked profits while retail investors are holding their bag of losses. The ongoing dip looks lucrative for retail investors as they get to accumulate Jio Financial shares for a lesser price.

Also Read: Is Apple (APPL) the Best Stock in Warren Buffett’s Portfolio?

Jio Financial Shares Price Target: Hold, Buy or Sell?

The current price prediction for Jio Financial shares remains bearish across the broader market. Several analysts have given a ‘sell’ call as the stock could dip to the 320 level next. The bearish sentiments have gripped the markets and the downturn could most likely continue in October.

Also Read: Top 3 Cryptocurrencies That May Rally Over 30% This Weekend

Therefore, taking an entry position in Jio Financial shares, currently at 331, is still considered high. A recent price prediction indicates that the stock could fall from Rs 324 to Rs 320 next. Taking an entry position now could deliver losses, and going long after it hits the 320 price range is recommended.

While the short-term remains bearish, Jio Financial shares are on the path to deliver solid long-term profits. The collaboration with BlackRock for mutual funds could bring in billions of dollars of investments. This makes the stock lucrative if investors take long positions for ten years or more.