XRP JP Morgan news has been creating quite a buzz recently, and actually, there’s good reason for that. The banking giant now considers Ripple a “heavyweight in the age of the CBDCs” while XRP reserves on exchanges experienced a massive 797% surge in just one hour. This XRP JP Morgan development comes right now as analysts are examining how XRP could shape the future of money, along with new XRP price prediction models that are emerging from this institutional recognition.

Also Read: XRP $1,000 by 2030? Pundit Says Five-Digit Surge May Come Sooner

How XRP JP Morgan News, Reserves on Exchanges, and Price Trends Matter

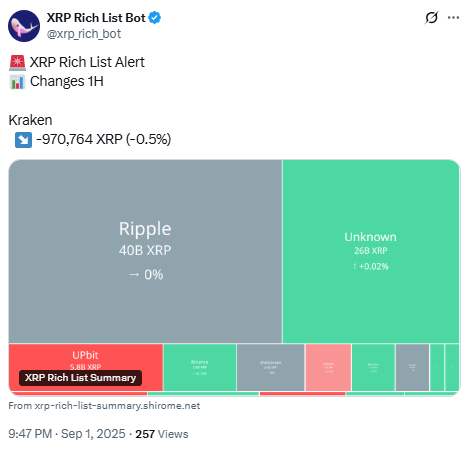

Bitpanda Exchange Experiences Massive XRP Reserve Jump

European platform Bitpanda actually boosted their XRP holdings from 156,323 to 717,208 tokens within 60 minutes – which represents a 797% increase that signals rising trading demand. This XRP reserves on exchanges surge wasn’t just routine maintenance but appears to be tied to growing user interest, even though some market watchers initially thought it might be.

The exchange labeled XRP “highly-sensitive” and highlighted regulatory narratives as key factors to watch right now. At the time of writing, the Altseason Index sits around 61, which suggests altcoin strength against Bitcoin is building up again.

Bitpanda’s deputy CEO Lukas Enzersdorfer-Konrad expressed the belief that:

“Ripple’s native coin would tackle a new all-time above $3.65 once the altcoin season settles in”

XRP JP Morgan Recognition at Money20/20 Conference

JP Morgan’s official Money20/20 materials included Ripple in their “Money reimagined” section, which recognizes the company as a heavyweight player in this space. This XRP JP Morgan acknowledgment came during discussions about Central Bank Digital Currencies and also the future of digital payments.

The panel covered developed economies that are advancing Digital Dollar and Digital Euro initiatives, along with emerging markets where XRP could shape the future of money and financial services. This institutional validation demonstrates how XRP JP Morgan news reflects growing mainstream acceptance, even among traditional banking institutions.

Crypto researcher SMQKE documented this recognition and noted that:

“JP Morgan considers Ripple a heavyweight in the age of the CBDCs”

Market Performance and Price Trends Right Now

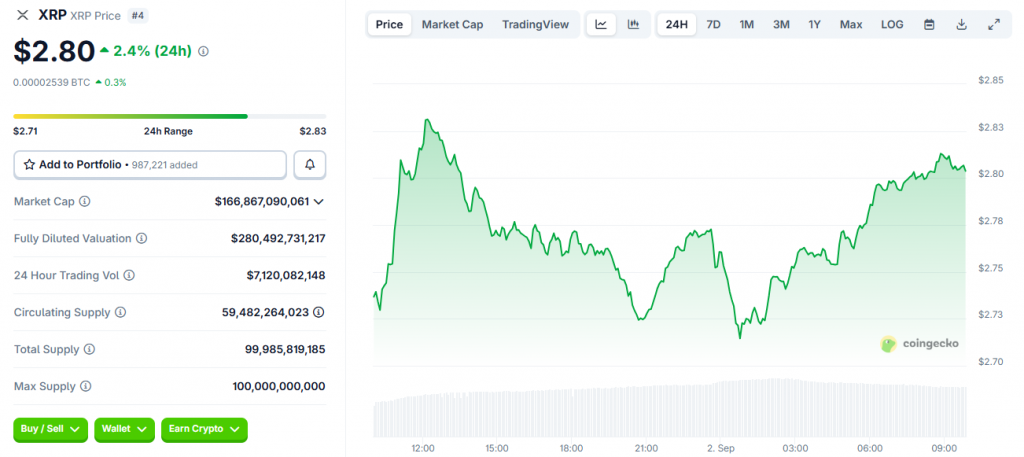

XRP currently trades at $2.80, as CoinGecko reveals, which is down 25% from its recent all-time high. Despite this correction though, XRP reserves on exchanges continue growing, with $14.8 million of $17.74 million daily liquidations being long positions.

The combination of institutional backing and exchange preparation suggests XRP price prediction models may actually need adjustment. Right now, 49 nations are running CBDC pilots while 20 are in development, creating opportunities for XRP to shape the future of money on a global scale.

Also Read: XRP Could See More Adoption Than Bitcoin By 2030

CBDC Integration Strengthens XRP’s Position

With 108 countries exploring digital currencies, XRP’s role in this transformation becomes clearer each day. The XRP JP Morgan recognition comes as Nigeria, Jamaica, and the Bahamas have already launched national digital currencies, while major economies advance their own initiatives.

This institutional validation addresses regulatory uncertainty that has been impacting crypto markets. The growing XRP reserves on exchanges combined with banking sector recognition suggests the token’s utility in cross-border payments is gaining traction among traditional financial institutions, and also among governments that are looking at CBDC solutions.