JP Morgan maintained a neutral stance on Dollar General on October 27, 2025, and this comes as analysts project 21.91% upside potential while the dollar forecast faces growing pressure from BRICS de-dollarization efforts. Right now, the JP Morgan US dollar forecast considerations are intersecting with Dollar General upside potential in ways that are reshaping how investors think about their strategies.

Also Read: Global Dollar Shift Deepens Amid JP Morgan GDP Forecast Alert

Dollar General Stock Outlook And BRICS De-Dollarization Impact Explained

JP Morgan Maintains Neutral On Dollar General With Strong Upside

On October 27, 2025, JP Morgan actually maintained its neutral recommendation on Dollar General, even as the average one-year price target sits at $124.33 per share. This represents 21.91% Dollar General upside potential from the closing price of $101.99, and forecasts are ranging from $80.80 to $145.95 at the time of writing.

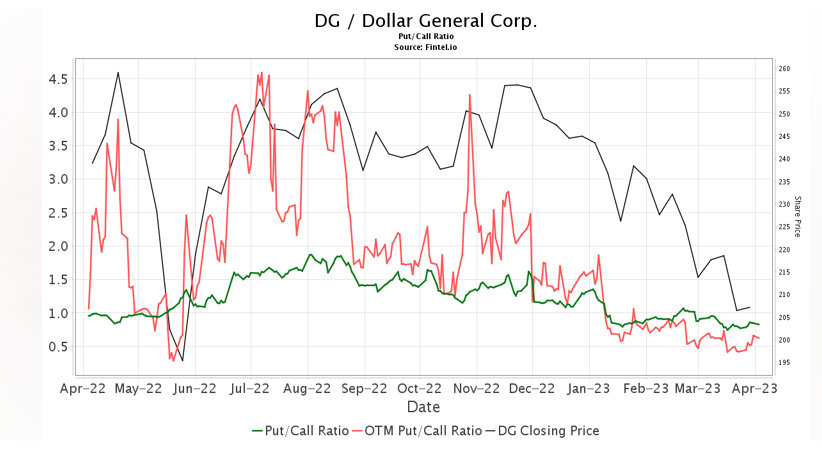

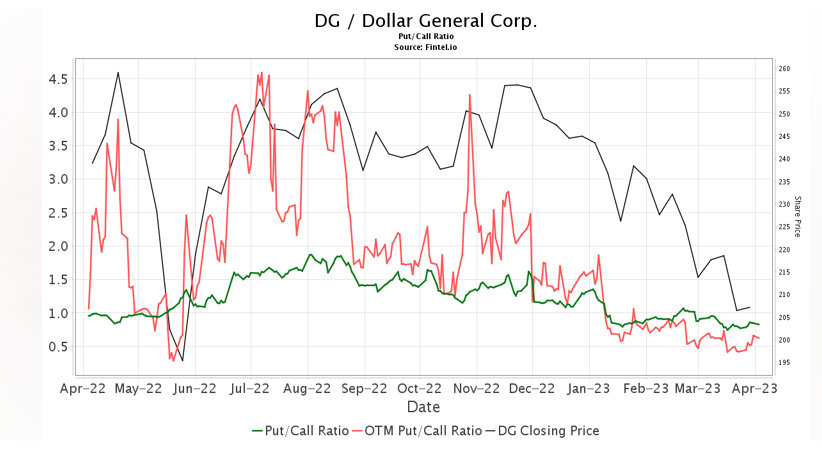

Projected annual revenue for the company stands at $44,463 million, which marks a 6.75% increase, though projected non-GAAP EPS of 15.58 is showing a 2.13% decrease. Institutional ownership increased by 7.75% to 1,738 funds, and the put/call ratio of 0.90 actually indicates bullish sentiment among traders. Capital International Investors decreased their holdings by 55.33%, and this represents one of the more significant institutional exits investors have seen in recent months.

BRICS De-Dollarization Efforts Challenge Dollar Forecast

The BRICS de-dollarization movement is challenging the dollar forecast right now, as BRICS nations hold four of the world’s 10 largest foreign exchange reserves. At the time of writing, these efforts are gaining some real momentum. During discussions around multilateralism and trade, Brazilian President Luiz Inácio Lula da Silva had this to say:

“Resorting to unilateralism undermines the international order…In the face of polarization and the threat of fragmentation, the consistent defense of multilateralism is the only path we must follow.”

India’s External Affairs Minister S. Jaishankar also clarified the country’s position and stated:

“India does not aim to undermine the dollar but seeks practical alternatives for trade settlements where necessary.”

JP Morgan’s US Dollar Forecast And Retail Stock Implications

JP Morgan’s US dollar forecast for 2025 actually shows that America’s economy will grow approximately 2.7%, and this significantly outpaces other developed markets at 1.7%. Interest rate differentials between US 10-year bond yields and those of trading partners have widened to levels that haven’t been seen since 1994, along with other factors that support Dollar strength despite the de-dollarization pressures.

Also Read: Japan’s Megabanks Launch Stablecoins to Power Global Corporate Payments

The dollar general upside potential of 21.91% exists even as BRICS de-dollarization initiatives are building alternative payment systems like BRICS Pay. The JP Morgan neutral stance on Dollar General reflects near-term retail fundamentals, while broader JP Morgan US dollar forecast considerations are addressing long-term currency challenges that are affecting dollar-denominated assets. Right now, investors are watching both the JP Morgan neutral on Dollar General rating and the accelerating BRICS efforts, as these two dynamics intersect in meaningful ways for portfolio decisions.