Ethereum’s hold over the DeFi space remained undisputed for quite a while. However, JPMorgan proposed that this dominance would soon be taking a hit.

Decentralized finance popularly known as DeFi emerged as a prominent space of the crypto-verse. Taking a leaf out of the banks’ books, DeFi began offering bank-like services to its users. But, unlike banks, DeFi took the decentralized path. Bitcoin took a backseat while Ethereum presided over the DeFi space.

Ethereum certainly paved the way for many projects that have garnered immense success over the years. So much so that they are called “Ethereum Killers.” JPMorgan believes that these networks could diminish Ethereum’s hot streak in the DeFi province.

“Ethereum killers” to give ETH a run for its money: JPMorgan

The Ethereum network has a lot to offer. Despite being home to several triumphant projects, the network’s scaling issue has been a major flaw. In order to address this, the developers of the Ethereum network steered towards sharding. This process involves the splitting of the network into numerous fragments. Labeled as one of the most complex Ethereum scaling solutions, the final phase of the process would be completed only in 2023.

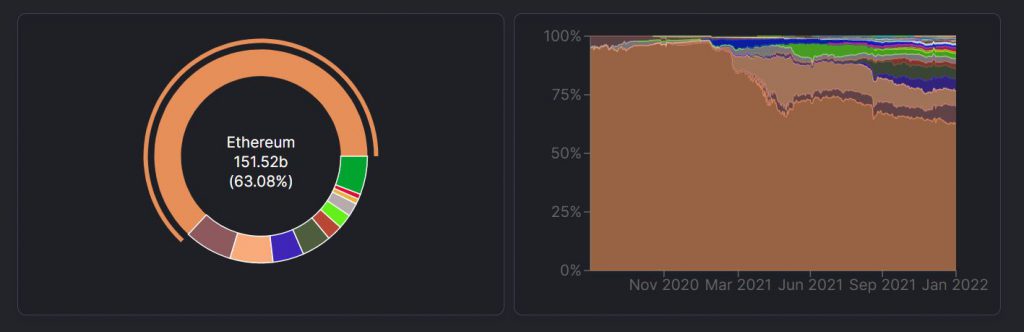

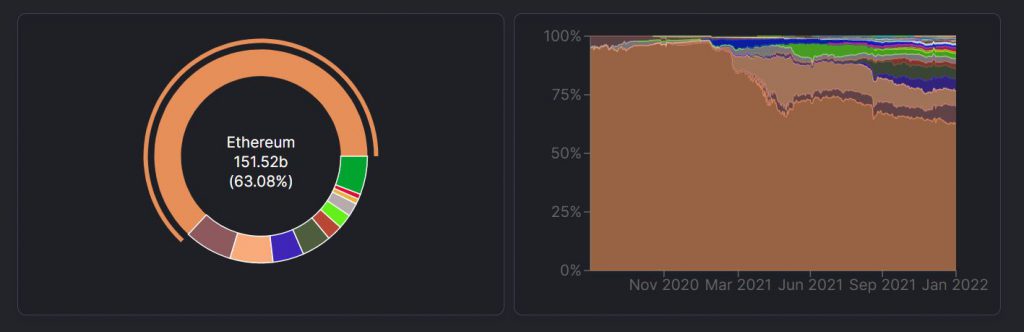

Analysts at JPMorgan Chase speculate that the arrival of this scaling solution could be a little too late. Analyst Nikolaos Panigirtzoglou implied that the 70% market share, the network entails in DeFi, could take a major hit. At the beginning of 2021, Ethereum’s market share was at a high of almost 100%, however, it declined to 70% over the last couple of months.

Pointing out that the “optimistic view about Ethereum’s dominance is at risk,” Panigirtzoglou added,

“[Scaling] which is necessary for the Ethereum network to maintain its dominance, might arrive too late.”

Emerging projects like Solana, Terra, Avalanche, and Binance Smart Chain have been attaining immense traction as well as funding. The popularity and enormous funding that these projects have been amassing are being reflected in terms of adoptions and usage.

Further elaborating on this, JPMorgan indicated the inability of Ethereum to regain supremacy following the completion of its scaling. The JPMorgan report further read,

“In other words, Ethereum is currently in an intense race to maintain its dominance in the application space with the outcome of that race far from given, in our opinion.”

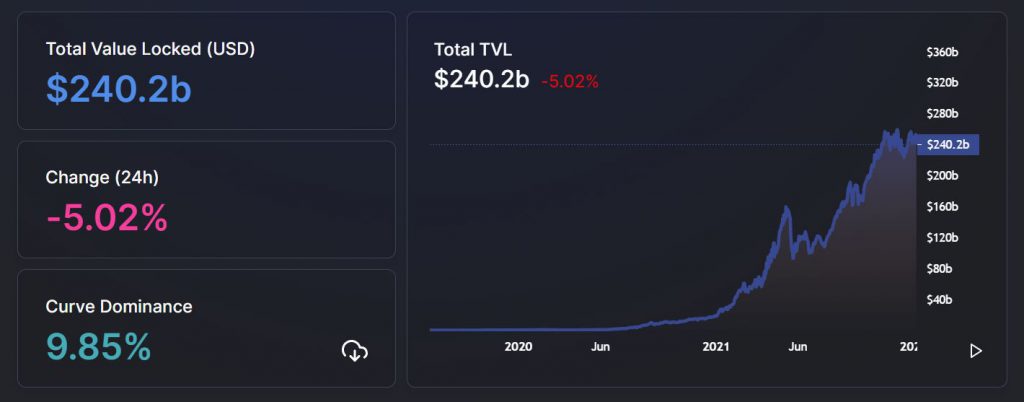

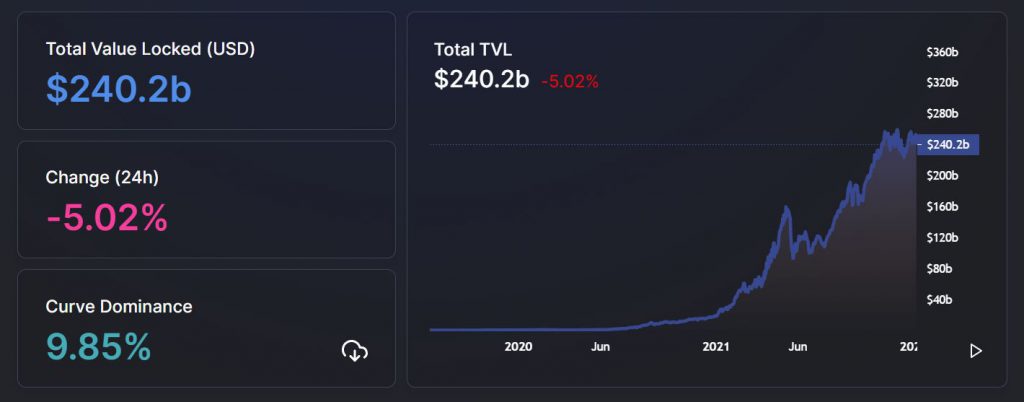

According to defillama, the total value locked in all chains is currently $240 billion. Ethereum comprises $151 billion of the total share.