JPMorgan blockchain clearing firm partnership with Marex actually creates the first 24/7 blockchain payments system for institutional settlements right now. The collaboration enables blockchain payment settlements through JPMorgan’s Kinexys platform, and Marex clearing services is becoming the first to offer round-the-clock programmable payments that address financial market volatility concerns.

How JPMorgan and Marex Enable 24/7 Blockchain Payment Settlements

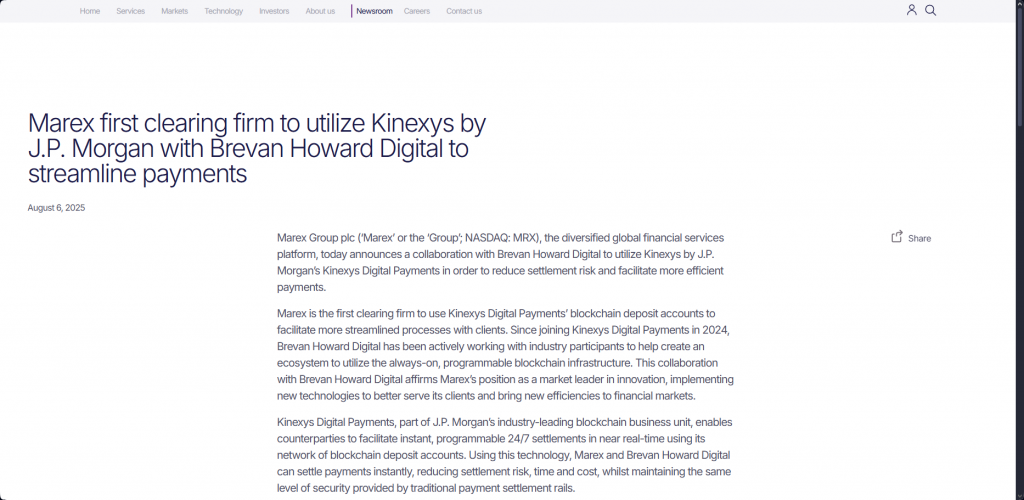

Marex Group has become the first clearing firm to actually utilize JPMorgan blockchain clearing firm infrastructure through the Kinexys Digital Payments platform. This partnership with Brevan Howard Digital enables 24/7 blockchain payments that operate continuously, even reducing settlement risk during financial market volatility periods.

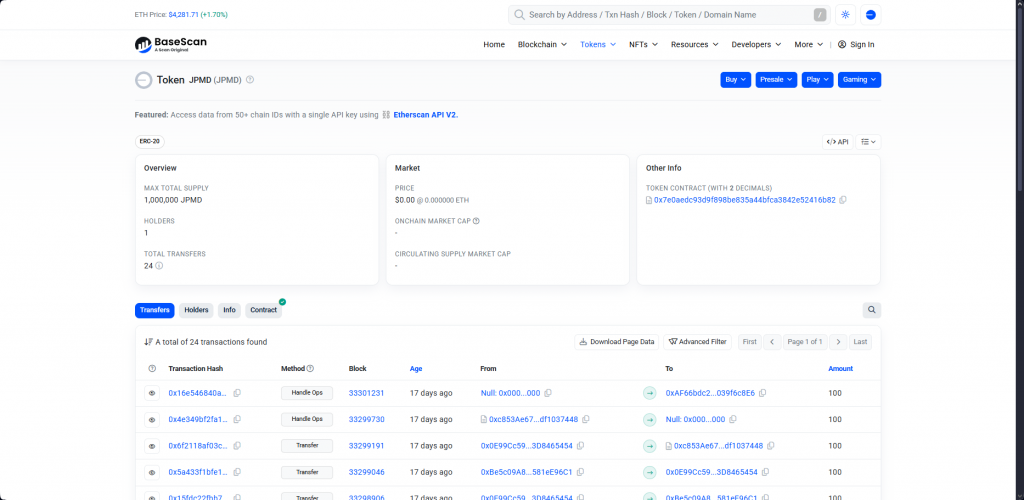

The JPMorgan blockchain clearing firm system processes over $1 billion monthly in corporate settlement transactions right now. Marex clearing services now leverage this programmable infrastructure to facilitate instant blockchain payment settlements, along with eliminating traditional banking hour constraints.

Terry Hollingsworth, Global Head of Futures & OTC Clearing Sales at Marex, stated:

“Kinexys by J.P. Morgan is the next generation of financial market infrastructure. By enabling programmable payment and settlement, the platform leverages automation to unlock the utility of assets and reduce risk. As a firm with innovation and client service at our core, we are proud to collaborate with Brevan Howard Digital on this forward-looking initiative, bringing greater operational efficiency to our clients as well as the wider market.”

Also Read: US Stock Market Rally Not Over, Will Go Much Higher, Says JP Morgan

Real-Time Settlement Innovation

Since joining Kinexys Digital Payments in 2024, Brevan Howard Digital has actually worked to create an ecosystem utilizing always-on blockchain infrastructure. The JPMorgan blockchain clearing firm partnership demonstrates how institutions embrace 24/7 blockchain payments to enhance efficiency during financial market volatility periods.

Adam Gibbons, COO at Brevan Howard Digital, had this to say:

“This is yet another tangible example of how blockchain technology can drive efficiency gains and strengthen risk management controls. At Brevan Howard Digital, we remain at the forefront of adopting innovative digital solutions to help deliver the best possible outcomes for our clients. Our collaboration with the teams at both of these organisations is a clear demonstration of that commitment.”

The platform enables automated cascade payments through Marex clearing services, and even reduces operational risks through real-time position settlement with minimal dependency on traditional bank liquidity windows.

Akshika Gupta, Global Head of Client Solutions at Kinexys by J.P. Morgan, stated:

“Marex and Brevan Howard Digital utilizing the growing Kinexys Digital Payments network to make seamless, 24/7 settlements represents a significant milestone in the advancement of financial market infrastructure. We have been a pioneer in digital payments on blockchain, and this work highlights our dedication to continuing to drive progress and deliver cutting-edge infrastructure for our clients and the industry at large.”

Also Read: What Does JP Morgan Say About De-Dollarization?

This JPMorgan blockchain clearing firm initiative establishes new precedents for institutional blockchain payment settlements right now, enabling Marex clearing services to offer continuous operation aligned with global trading requirements while maintaining institutional-grade security standards.