With rising geopolitical mayhem that the year 2025 is a heavy witness to, adding to that, JPMorgan has now warned of a palpable oil crash that could hit the crude oil domain hard and fast. Per the banking giant, JP Morgan shared that the crude oil price can crash up to $30 by 2027, owing to the overwhelming market supply dynamics.

Also Read: Deutsche Bank Sets S&P 500 Target at 8,000 by 2026 in Boldest Call Yet

JP Morgan Predicts a Future Oil Crisis

JP Morgan, in its latest publication, has predicted an ominous forecast for the future oil market. Per the banking behemoth, JP Morgan shared how Brent, the leading oil benchmark, can decline to explore $30 price levels, as chaotic and overwhelming market supply elements continue to threaten the current market anatomy.

In addition to this, Goldman Sachs predicts a $53 oil price threshold for 2026, with analysts forecasting that oil will try its best to fall below the $40 mark.

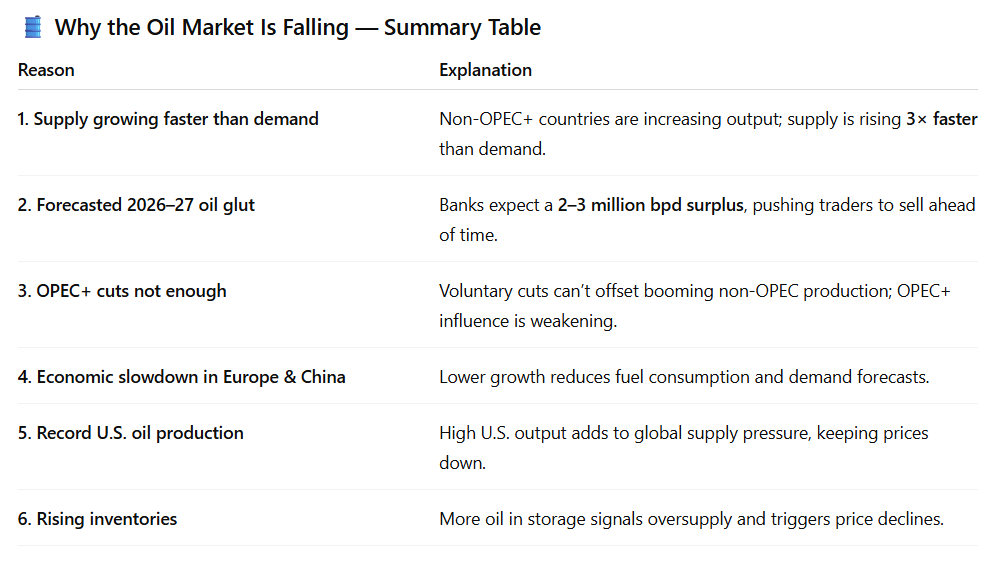

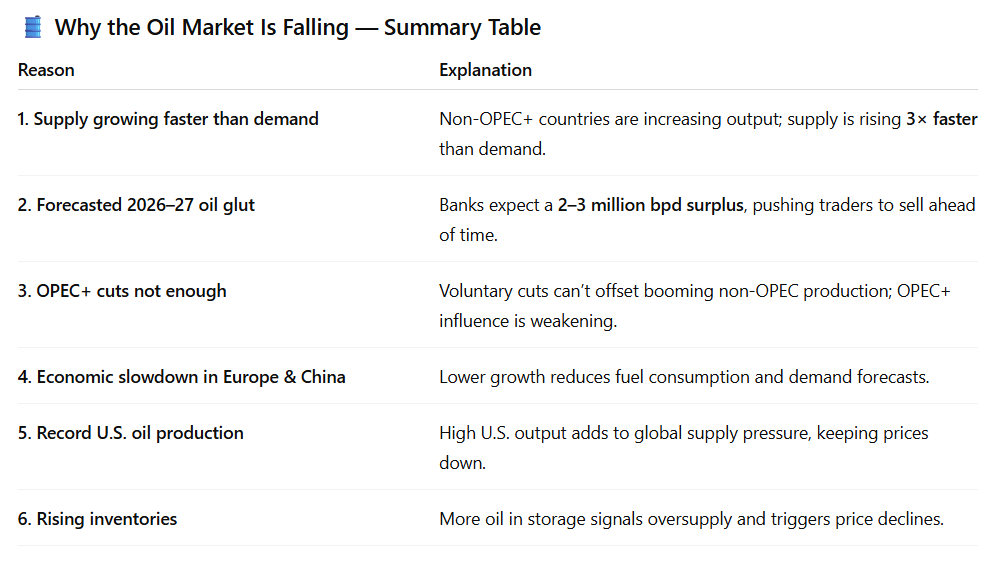

“JPMorgan says a global oil surplus could push Brent into the $30s by late 2027 if supply isn’t cut. Demand is rising, but supply is growing three times faster, mainly from non-OPEC+ producers. A 2.8 million bpd surplus in 2026 could drag prices down, though voluntary cuts could stabilize Brent around $57–$58. Prices have already fallen 16% for Brent and 19% for U.S. crude this year.”

Why Is the Oil Market in Grave Jeopardy?

The dynamics of supply currently overwhelm the oil market. Non-OPEC countries such as the US, Brazil, Canada, and Guyana are pumping more oil, leading the domain’s prices to average at low levels. In addition to this, oil prices tend to fall when countries project a weak economic outlook. For example, Europe and China are projecting low growth, which in turn impacts oil prices.

In addition to this, giants like JP Morgan and Morgan Stanley are predicting a 3 million barrel a day glut, sending the prices into a frenzy today.

Also Read: Bitcoin Has Crashed 21 Times And the Outcome Will Surprise You