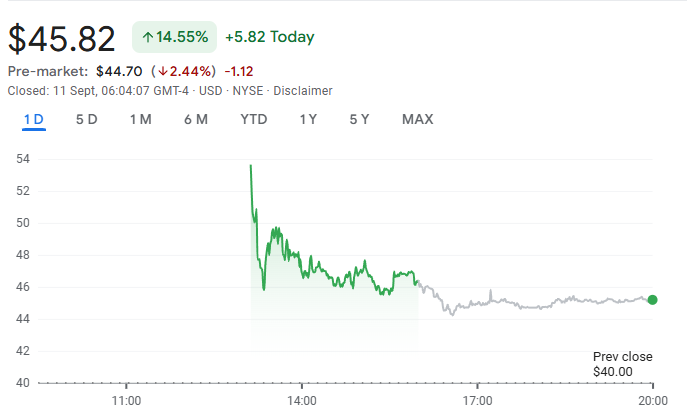

Klarna stock actually surged 33% on its NYSE debut Wednesday, and shares opened at $52 before closing at $45.82. The Swedish fintech raised $1.37 billion through its IPO, even though they reported a $153 million net loss for the first six months of 2025. Klarna stock price today reflects strong investor demand right now, with the offering being priced at $40 per share – which was above the expected $35-$37 range.

Klarna Stock Surges 33% On Market Debut And Latest Price Updates

The Klarna stock market debut valued the company at $17.5 billion, and this marks a significant recovery from its $6.7 billion private valuation back in 2022. KLAR stock news highlights how the buy-now-pay-later leader successfully navigated market volatility after initially postponing its IPO in April due to some tariff-related uncertainty.

Financial Performance Shows Mixed Results

Despite the successful Klarna stock debut, the company’s financials present some challenges right now. Revenue actually increased to $1.52 billion for the first half of 2025, up from $1.33 billion year-over-year. However, net losses were widened to $153 million compared to $38 million in the same period last year.

CEO Sebastian Siemiatkowski had this to say:

“This moment feels surreal. When we started Klarna back in 2005, it was just a wild idea — me, Niklas, and Victor, fumbling around, trying to make shopping and payments smoother for people.”

Strong User Growth Drives Market Confidence

KLAR stock benefits from impressive user metrics, with 111 million active users and also 790,000 merchant partners. The company processed $112 billion in gross merchandise value over the past 12 months. In the US market specifically, Klarna reported 33% quarterly revenue growth.

Siemiatkowski stated:

“Going public in New York is huge. It’s not just a milestone; it’s a statement. It’s proof that a bunch of stubborn dreamers from Stockholm can take on the world — and win.”

Also Read: Klarna IPO to Raise $1.27B as KLAR Stock Debut Values Firm at $14B

Expansion Beyond Core BNPL Services

The Klarna stock price today reflects investor confidence in the company’s banking expansion. Klarna has launched debit cards along with deposit accounts in the US, with 700,000 Americans already signed up and 5 million on the waiting list right now.

Siemiatkowski noted:

“I think that there is this demand and people want something else from their bank.”

The successful KLAR stock market performance demonstrates strong institutional appetite for fintech companies with diversified revenue streams and proven growth models at the time of writing.

Also Read: Does Best Buy Accept Klarna or Afterpay?