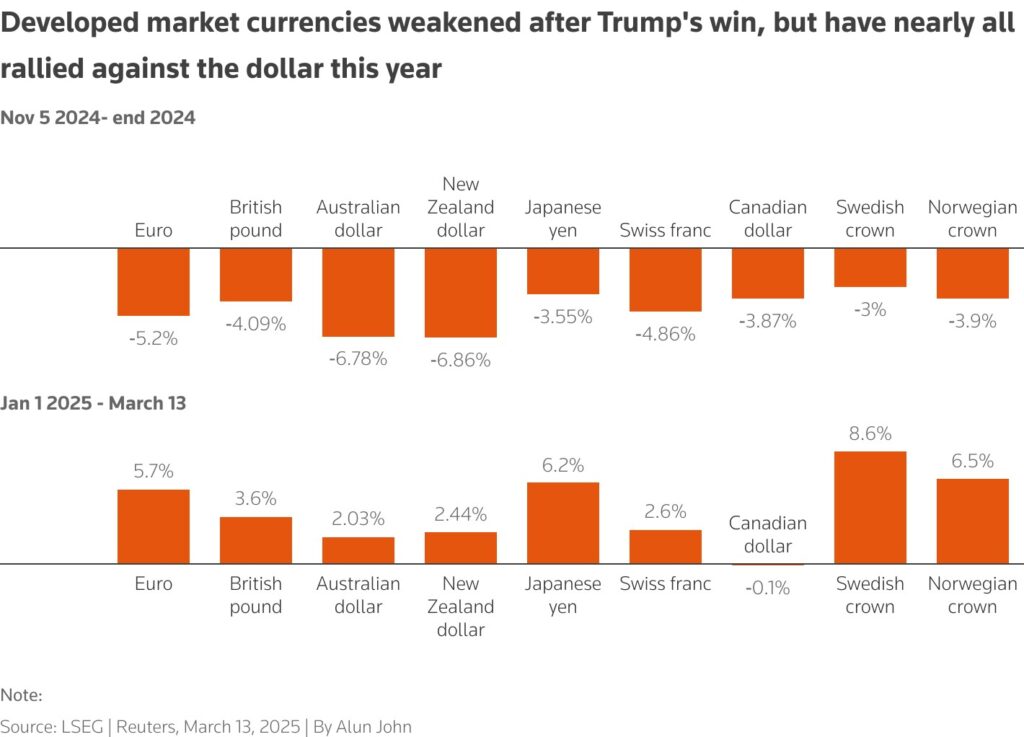

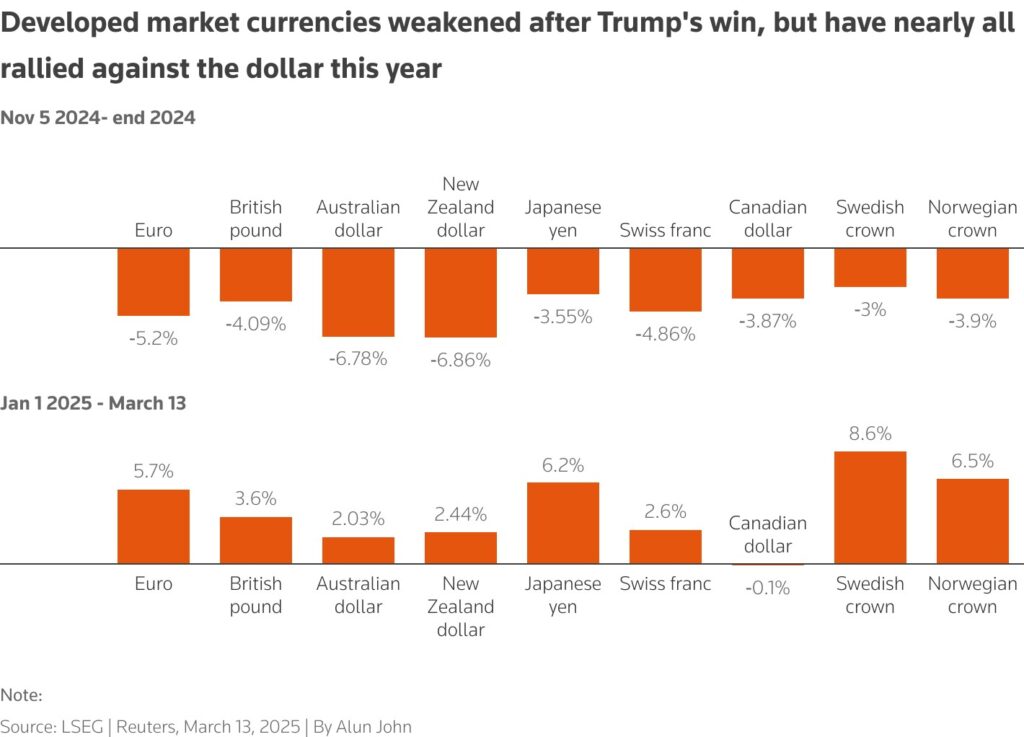

The big currency winners in 2025 are everybody except the US dollar, reported Reuters. The DXY index, which tracks the performance of the US dollar against a basket of six currencies shows the greenback falling to a low of 103.60 this month. It fell from a high of 109.80 early this year to a low of 103.60. That’s a decline of nearly 4.5% year-to-date and is a steep dip in the forex markets. Local currencies have outperformed the US dollar this year as the greenback remains on the back foot.

Also Read: De-Dollarization: 10 US Sectors Vulnerable To Tariffs & Dollar Decline

US Dollar Falls Against 8 Local Currencies in 2025

The mighty US dollar has plummeted against eight out of nine leading local currencies in 2025. The main culprit that weakened the USD is the trade tariffs imposed by Trump that caused disruption in the forex sector. The tariffs are dividing the markets as investors are sending mixed reactions in the indices.

Also Read: Cardano Prediction: AI Sets ADA Price For March 31, 2025

Below is the list of leading local currencies that the US dollar has dipped in 2025:

- Swedish crown -8.6%

- Norwegian crown -6.5%

- Japanese yen -6.2%

- Euro -5.7%

- British pound -3.6%

- Swiss franc -2.6%

- New Zealand dollar -2.44%

- Australian dollar -2.03%

The US dollar briefly outpaced the Canadian dollar by a mere margin of 0.1%. If not, the US dollar would have been down against all nine out of nine leading local currencies this year. Trump’s tariffs have disrupted the normal flow of trade and caused a rift among America’s allies. Several countries in Europe have called for ending reliance on the US and boosting trade with other nations.

Also Read: Solana: Can $5000 Worth Of SOL Become $500,000 By 2030?

The European Union (EU) is also extending cordial ties with China and other nations to keep their economy intact. Therefore, the US dollar is now having more enemies than ever before and local currencies are challenging its dominant position.