Shiba Inu is one of the most versatile coins, be it in terms of its meme status or regarding its growing SHIB ecosystem. The token keeps attracting investors from all corners of the world, keenly exploring various investment positions that they think they can invest in for better profit prospects. Both long and short positions have delivered great profits to users, but what if an investor ends up playing both sides? Here’s a new SHIB hedge explained in detail to help make the most out of the coming altcoin season.

Also Read: New Prediction Says $11,000 in Shiba Inu Could Turn $500,000 in 2030

Shiba Inu: Long and Short Positions Explained

Long and short positions in cryptocurrency refer to nuanced trading techniques. As BitStamp explains about opening short positions in an asset, this would simply mean earning a profit from an asset’s falling price. On the other hand, going long would refer to earning a profit from an asset’s rising price.

Long positions are often more favored and desired by seasoned crypto investors due to their low risk and volatility. Shorting comes with a little risk but has a tendency to deliver a profit with a unique approach and methodology.

Can One Open Both Long and Short Positions for This Asset?

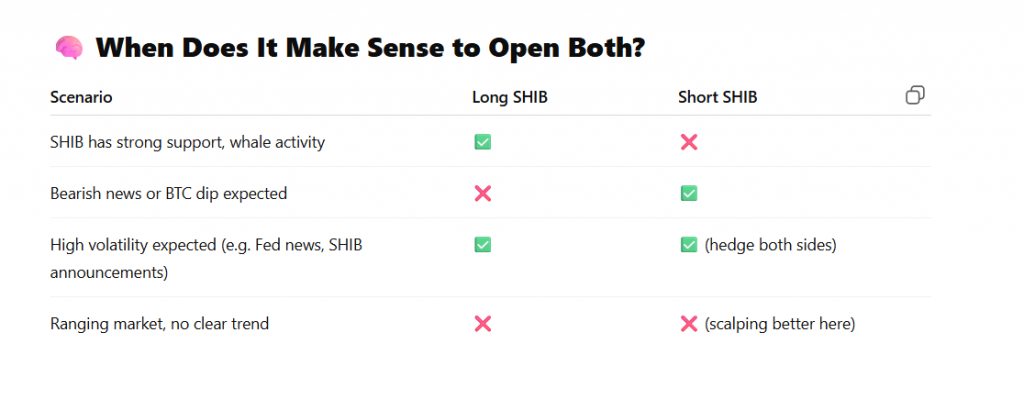

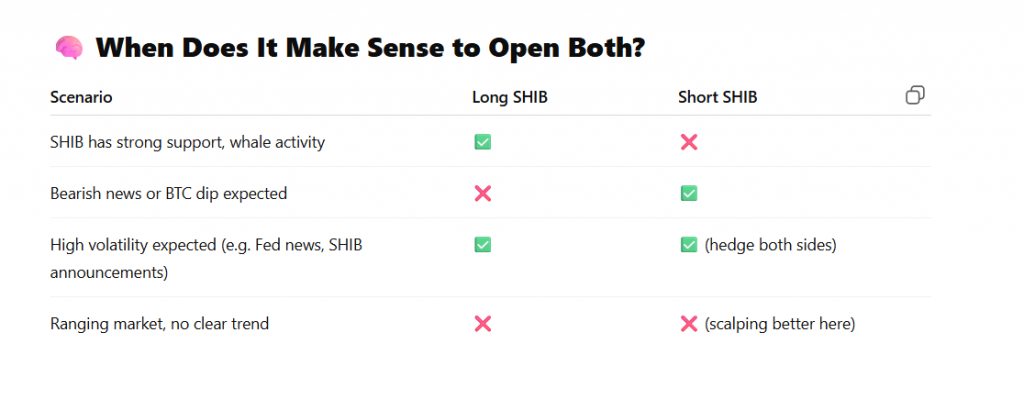

The answer is yes. Investors keen on pursuing both positions can open long and short-term SHIB positions under these circumstances.

For instance, a long SHIB position would be favorable when the token shows rising momentum and increased whale activity. Opening a short position during this time will incur extra losses for investors.

When the market is riddled with bearish news or is showing signs of a potential collapse, then opening short positions on SHIB may help investors greatly.

In addition to this, an investor can open both a short and long-term position with SHIB only when circumstances favor high volatility (FED or SHIB announcements), helping the token skim through both scenarios. For example, rising SHIB burns and its ascent to $1 could be one of the most bullish times to open a long and short position.

Lastly, if the market is ranging, showing no clear trends, then it’s best to avoid opening any position on Shiba Inu.

Also Read: Can SHIB Hit $1 by 2030? 2.8-Year Hold Time Signals Shift