LooksRare debuted on 10th January and challenged the dominance of the established non-fungible token [NFT] marketplace, OpenSea. On its second day of launch, LooksRare’s trade volumes doubled OpenSea’s and stand far ahead till today. This is because the LooksRare platform has become a hub for wash traders.

Chainalysis defined Wash trading as “executing a transaction in which the seller is on both sides of the trade in order to paint a misleading picture of an asset’s value and liquidity”. The users have claimed airdrops and staked their tokens while collecting a steady stream of LOOKS and WETH rewards at an average of 600% APR, as per 0xWhisky.

It is well known by now that WETH rewards have been almost entirely funded by the wash trading of zero royalty collections like Meebits and Loot to stack LOOKS at a discount. As per some users, this was deliberately included in the tokenomics to inflate the APR in the early stages and make the platform attractive to early users.

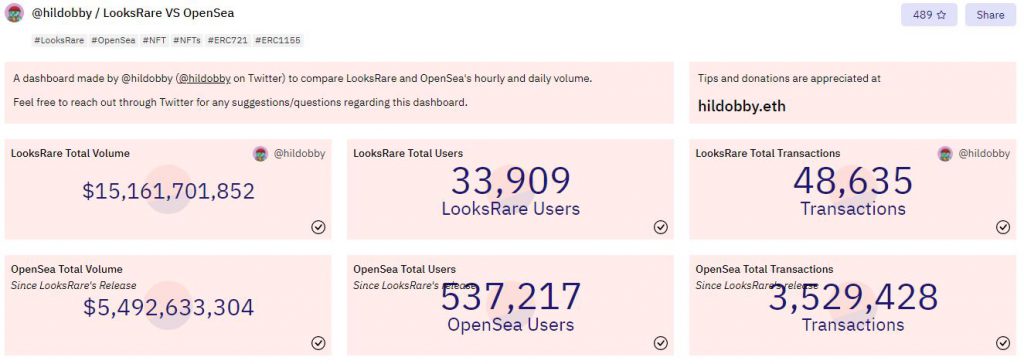

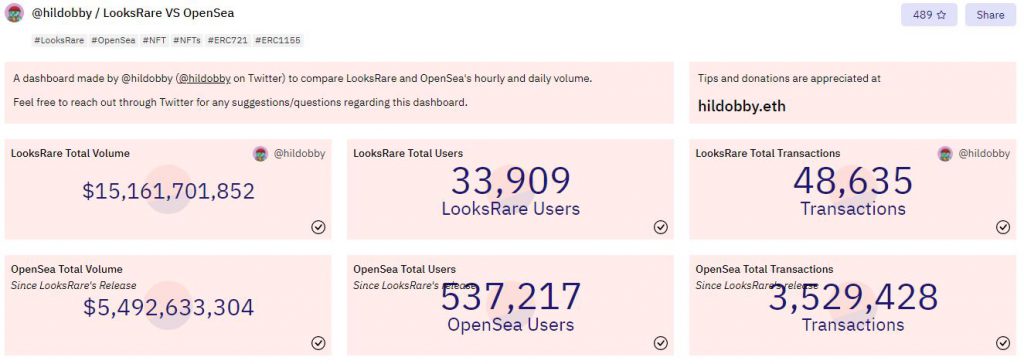

However, when we look at the comparative charts of LooksRare and OpenSea, we see a large discrepancy. The volume of LooksRare does not correlate with daily active users and transaction volume. As per Twitter user @hildobby_, the following were the stats for LooksRare and OpenSea.

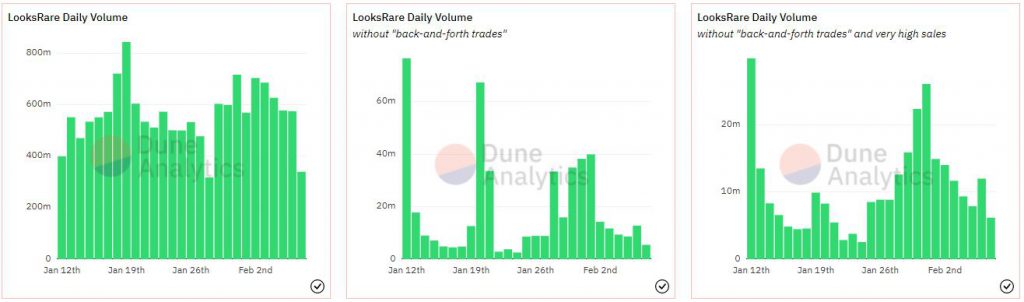

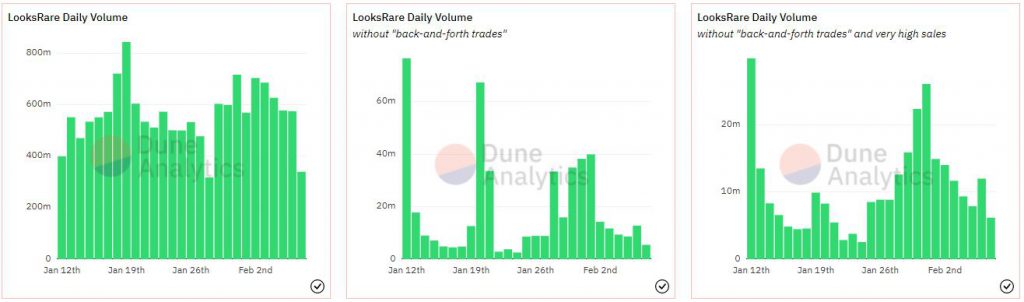

The Twitter user also developed a way to chart out LooksRare daily volume without wash trading and the difference was high.

You can find an explanation about the mechanics here.

At press time, the first image represented a total daily volume on the platform to be close to $339.30 million. However, when the “back-and-forth trades” or wash trading were discounted, this value shrunk to $5.46 million. Additionally, the user offered a third representation of daily volume without wash trading and included very high sales and the volume was slightly high but not as high as it looks- $6.19 million.

Well, LooksRare did a splendid job in growing the marketplace and user base through its reward system and offering massive returns to the users. This also pushed some users to jump ships and come to LooksRare, however, this growth will be hit if the wash traders stop doing what they do.

But will they?

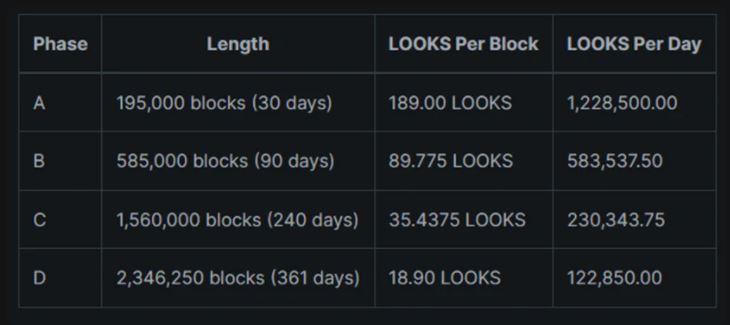

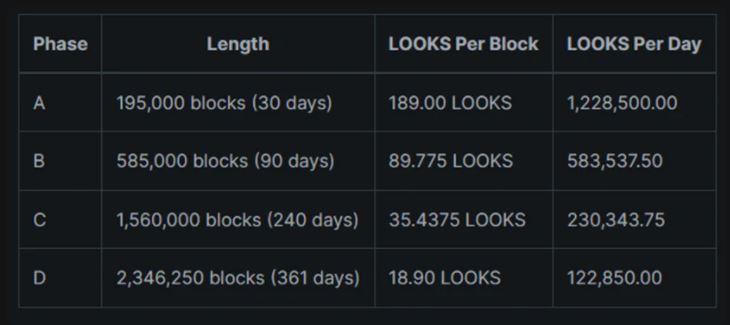

LooksRare halving chart

LooksRare is approaching an exit for its Phase A at 195,000 blocks. As the platform enters Phase B there will be visible changes in LOOKS distribution, which has been a cause of concern for many.

However, despite rounds of speculations these wash traders are not done yet.

As per data offered by Twitter user @ElYogui_PA, for a price of $4 per LOOKS, daily volume maxed out at around $500 million to maximize profits.

However, when the rewards would be halved, the daily volume would max out at $250 million. This highlighted that room for arbitrage was still plenty. 0xWhisky added in the latest blog that if the ceiling was to be pushed back to the Phase A levels, the value of the token needed to hit $8.

They added,

“Furthermore, most of the wash traders have been accumulating and staking their LOOKS. Why would they stop wash trading if it meant everything they’ve accumulated became worthless?”

As the LOOKs halving nears, we may see a prominent downtrend in the spot market. The value of the token was already seen slipping and it could accelerate by 10th February. 0xWhisky noted to different dumps play out. He stated,

“We have the paper hands selling their bags out of fear the wash traders will stop trading and we also have the riskier sellers looking to predict the pre-halving dump and buy back at lower prices. Both of these parties will be very vocal and negative once they’ve exited their position and will try to convert more stakers into sellers. Beware of the FUD.”

What should LOOKS holders expect?

Meanwhile, on 10th Feb, the high APR may also note an obvious drop as staking rewards and trading rewards are halving. This meant that LOOKS percentage along with WETH percentage will halve as well as traders adjust to the new volume ceiling.

The APR may drop at around 150-200% as per 0xWhisky and predicted that the APR will remain above 100%. They added,

“At this point, we should see the riskier investors flood back in after the price of LOOKS bottoms out and a slow reversal will start. There is also a large number of first-time buyers that have been sitting on the sideline expecting a bottom on February 10th which might result in LOOKS bottoming out the day prior. This is an obvious entry point for most.”

As the halving comes to an end, wash traders may remain in the market and new users will also hop on to the platform. As the inflows of LOOKs get slashed into half, it will create more upside pressure. However, what if the LOOKS value hits $8?

“[…]wash traders will have the exact same incentive they had in the first phase of looks distribution and everything will be back to normal, aside from the LOOKS APR which will forever remain cut in half for phase B.”

After 90 days period, the community will welcome Phase C which will mark the end of the wash trading era. It will also unlock seed investors’ funds which may result in damaging dumps. Nevertheless, the real impact of Phase B and C will only be realized in time.

At the time of press, LOOKS value had fallen to $3.66 as the bloodbath continued in the market.