LooksRare’s native token LOOKS has grown phenomenally over the past week. Its weekly ROI sits at 86%, which is higher than the combined returns of the top 5 coins by market cap. However, an unimpressive performance across the NFT marketplace brings in a major question regarding LOOKS. Why is the price pumping?

LooksRare Volumes Not Great

At first, one would assume that LOOKS performance would be a direct beneficiary of the NFT marketplace’s growth. While the project’s primary revenue churning machine has correlated with LOOKS’ price action, it does not seem to be the case this time around.

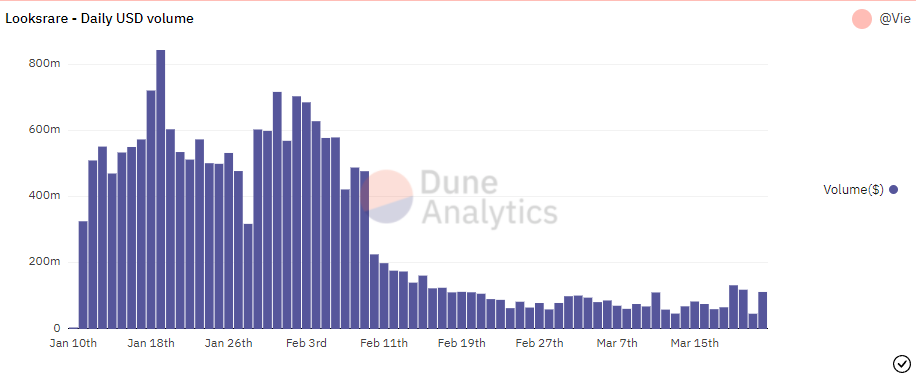

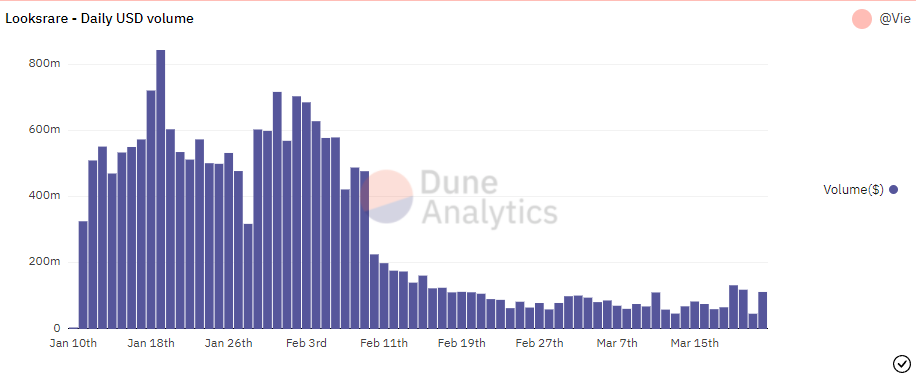

On the contrary, LooksRare’s growth has remained stagnant throughout March. The charts illustrate that marketplaces’ daily volumes remain distant from the figures observed in January and February, averaging around $86 Million in March as compared to $500 Million in the prior months. As a result, the total fees collected in ETH through sales have almost been flat throughout March.

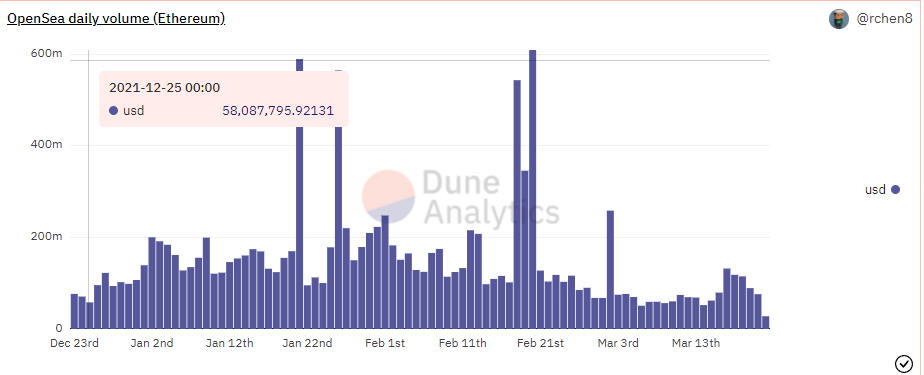

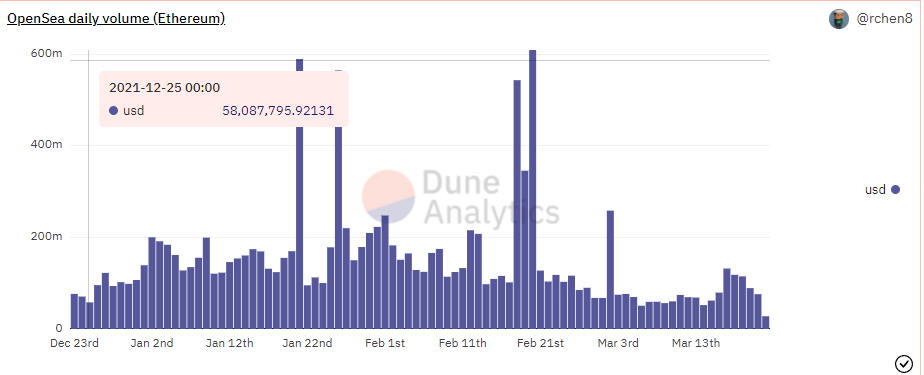

In comparison, the largest marketplace by volume, OpenSea has averaged over $90 Million in volumes over the past week, handily beating those on LooksRare. A side-by-side comparison of the two platforms shows a more drastic picture. Despite the recent volumes put up by LooksRare, its daily transaction count is nowhere close to OpenSea’s numbers. The latter’s transaction count has fluctuated between 90,000-120,000 since last week as opposed to the former’s average of 800.

LOOKS – Hype or Organic?

So why exactly are LOOKS printing solid numbers at a time when its platform is experiencing timid growth? An external factor might be to answer the question.

Bored Ape Yacht Club’s APE coin was launched on 18 March and the crypto community was taken by storm. The token was airdropped to BAYC holders at the launch, while others had to purchase APE tokens through exchanges. To incentivize buying and selling of BAYC NFTs, LooksRare adjusted their reward system to maximize user returns.

While the collective volumes are still low, the platform is attracting BAYC related sales. An update provided by the official Twitter handle showed that the platform generated nearly 13K ETH in trading volumes through BAYC NFT sales. That equates to a dollar value of $84 Million, based on ETH’s current market price.

By extension, one could begin to understand the growing importance of BAYC on LOOKS’ price performance. On the chart, LOOK’s embarked on a rally on 15 March, days before the APE coin was launched. In one week, LOOKS’ value has risen by over 100% within a risk-on broader market, mirroring APE’s triple-digit returns.

With that said, it would certainly be interesting to see if and whether LOOKS’ performance dwindles once the buying euphoria on APE diminishes. At the time of writing, LOOKS traded at $1.78, up by 17% over the last 24 hours.