The battle for the NFT marketplace is heating up as a new kid on the block LookRare rubs shoulders against crowd-puller OpenSea. A quick recap of this week’s statistics showed that LooksRare’s daily volumes were a standout, while OpenSea’s userbase remained unmatched.

Daily Users Vs Volumes – No change in narrative

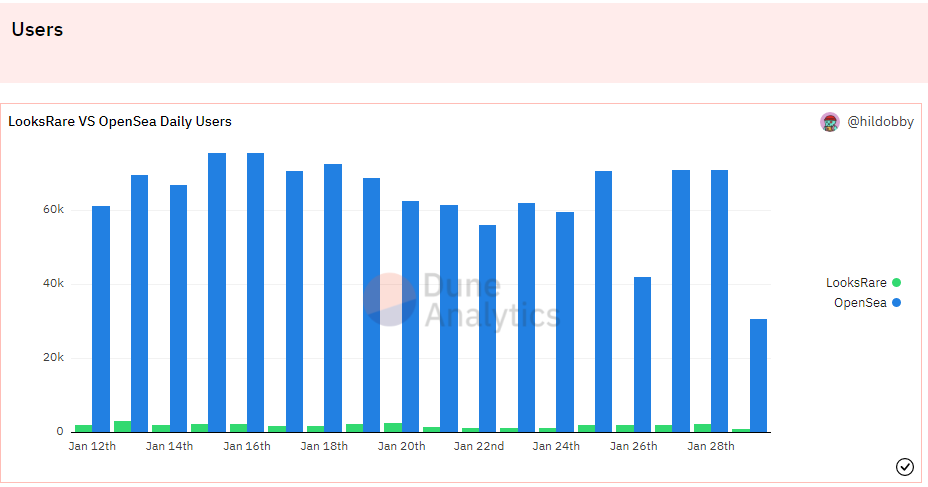

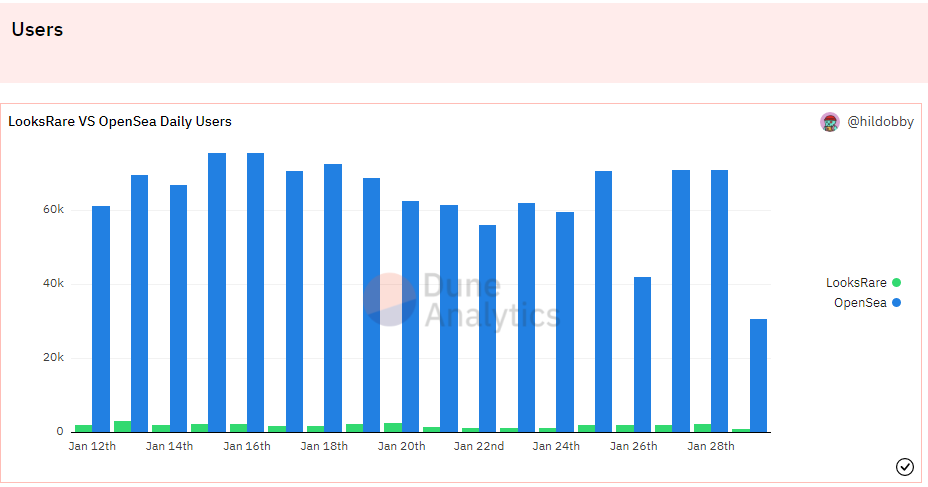

A snapshot of the metrics showed no major changes since 24 January. Although LookRare did note a 19% uptick in its daily users on 28 January after unlocking trading rewards on all of its NFT collections, its users of 2,140 were lower than the peaks hit during week three of January. In comparison, OpenSea recorded daily users of nearly 71,000 on the same day.

READ ALSO: Katsumi Governance Token to Increase the ‘Burn’ Rate of Kishimoto Inu; Here’s How

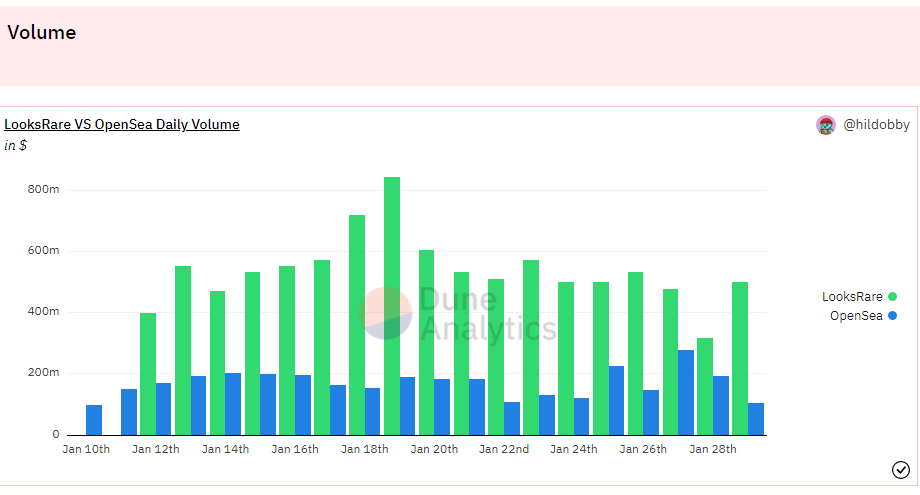

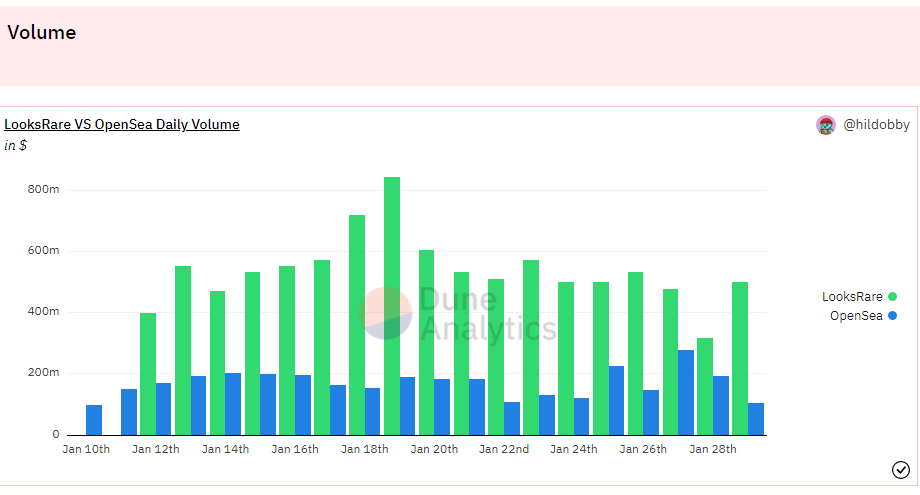

Meanwhile, LooksRare’s daily volumes in terms of USD continued to be its greatest arsenal. Its daily volumes clocked in at nearly $500 Million, outpacing OpenSea’s by a full $400 Million at the time of writing.

The stark difference in LooksRare’s daily volumes and userbase continues to be a focal point in its coup against OpenSea, with Arcane Research making some serious allegations (5th bullet point under slide 9) against the nature of its trades. For the moment though, platform staking is LooksRare’s ultimate selling point but it is doubtful how the userbase will hold up once staking rewards are slashed in half on 10 February.

Where does that leave $LOOKS?

LooksRare’s native token LOOKS seems to have been given the benefit of doubt. Since its launch, the token has provided a monthly ROI of nearly 100% although periodic sell-offs in the broader market have diminished its weekly returns to 24%. Either way, these returns still outpace those seen in any of the top 15 coins by market cap.

READ ALSO: Dogelon Mars Emerges As The Most Viewed Crypto In North America

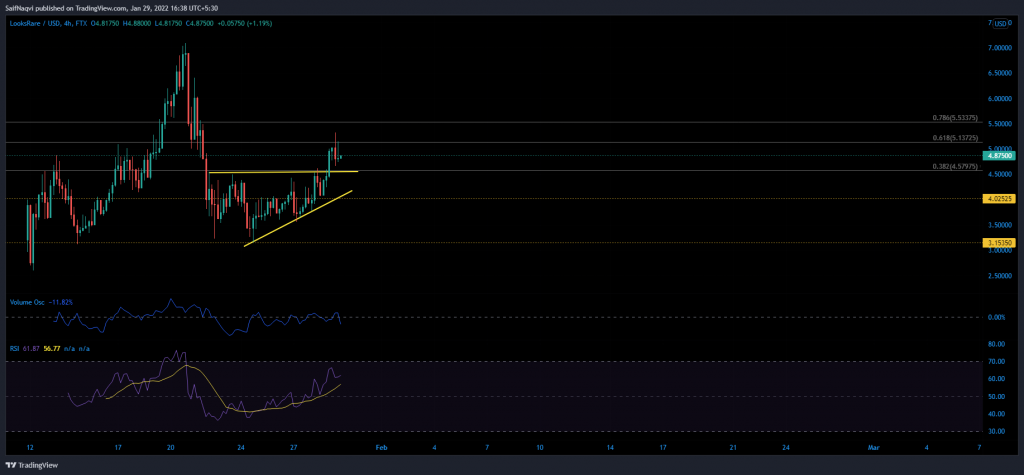

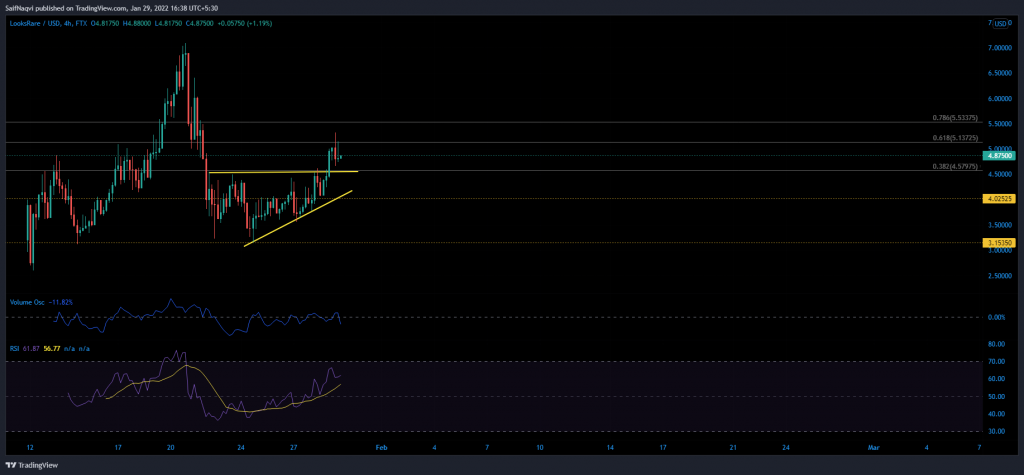

LOOKS 4-hour time frame

The LOOKS/USD trading pair seems to be doing exceptionally well after noting an ascending triangle breakout. Its price was currently parked above the 38.2% Fibonacci level following a 17% jump over the last 24 hours. A quick technical analysis revealed that LOOKS could advance by another 13% provided the volumes oscillator remains close to the half-line and RSI holds above 55. However, a retracement was expected after LOOKS tests its 78.6% Fibonacci level.

Conclusion

There are some viable grounds to ship OpenSea and LooksRare in the same boat. However, LooksRare seems to be enjoying its honeymoon period right now and it is uncertain whether its userbase would match up OpenSea’s daunting numbers. In fact, it would not be totally outlandish to consider that LooksRare’s userbase would start to dwindle once staking rewards are cut in February.