Loopring was one among the few alts that managed to grab eyeballs on Wednesday. From the daily lows of $0.8060, the coin went on to clinch $1.2332 – a level last visited in mid-January.

The blockchain project’s collaboration with video game retailer GameStop was the main catalyst that instigated Loopring’s 50% pump.

Despite yesterday’s upswing, LRC was miles away from its $3.85 peak attained in November last year. However, there are a couple of positive takeaways too. Loopring’s price has already broken above the downtrend line and has been trading above its SMA over the last few days. Both indicate signs of strength.

Curiously, the token displayed similar movements on its chart in October too before pulling off a 932% rally. In fact, per popular crypto analyst Kevin Svenson, if the market witnesses an alt-season anytime soon, LRC could be “one of the top movers.” Svenson also asserted that the tokens usually move up with “tons of velocity” and have already bottomed out as well.

Does Loopring’s ‘top mover’ bias hold any water?

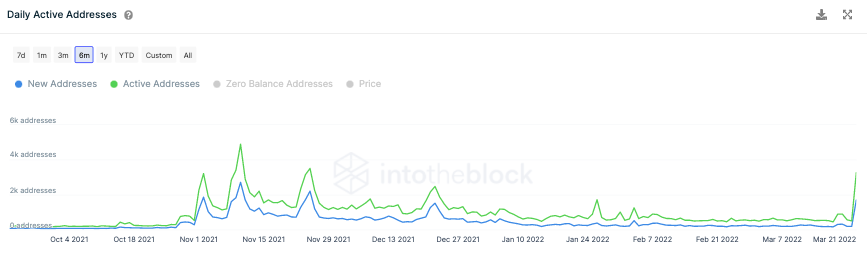

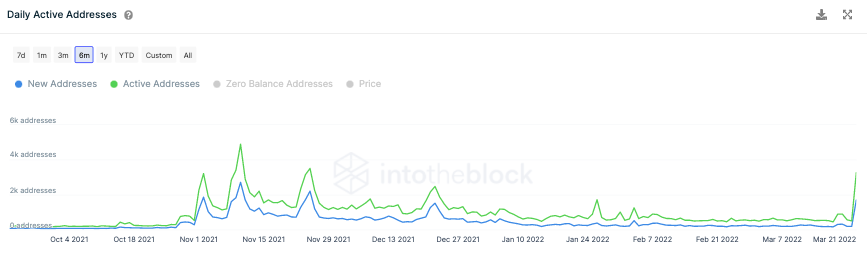

Well, the state of Loopring’s metrics has dramatically improved over the past day. Take the case of the active and new addresses itself, for instance. On the chart, both the indicators registered noteworthy spikes, bringing them at par with the highs registered during last year’s November.

The same indicates the gurgling interest of market participants concerning Loopirng. At press time, the former metric [active addresses] stood at 3.26k while the latter [new addresses] reflected a value around 1.69k.

The cumulative exchange outflow volume witnessed a similar spike yesterday, indicating the presence of buying momentum in the Loopring market. From the usual readings of 1-8 million tokens, the outflow swelled upto 32 million LRC on Wednesday.

Attaining peaks, undoubtedly, is an achievement. However, being able to sustain around the same is a challenge. If LRC can maintain the same polished readings on its metrics, then it could outpace other coins in terms of growth. But, if their state ends up deteriorating, then LRC would have to take a backseat.