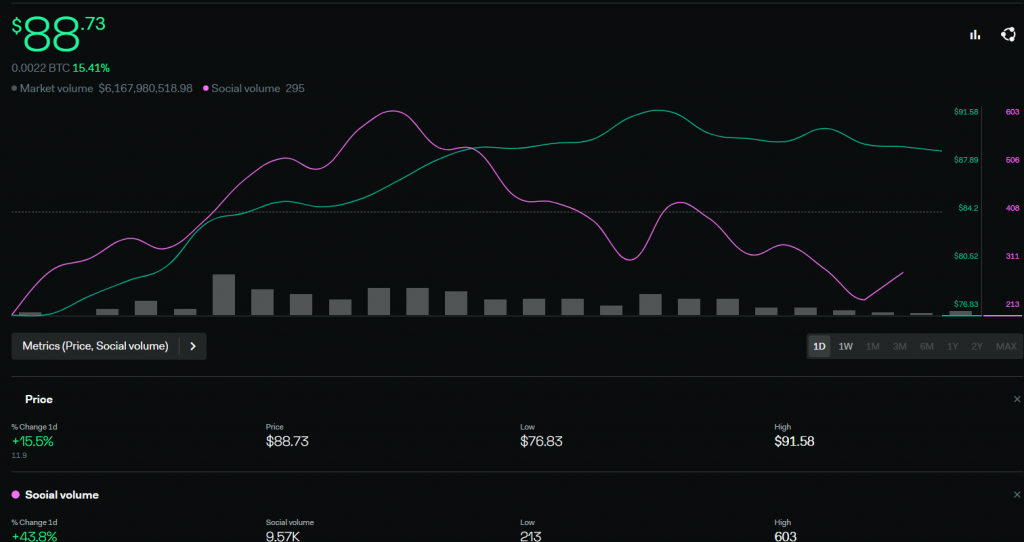

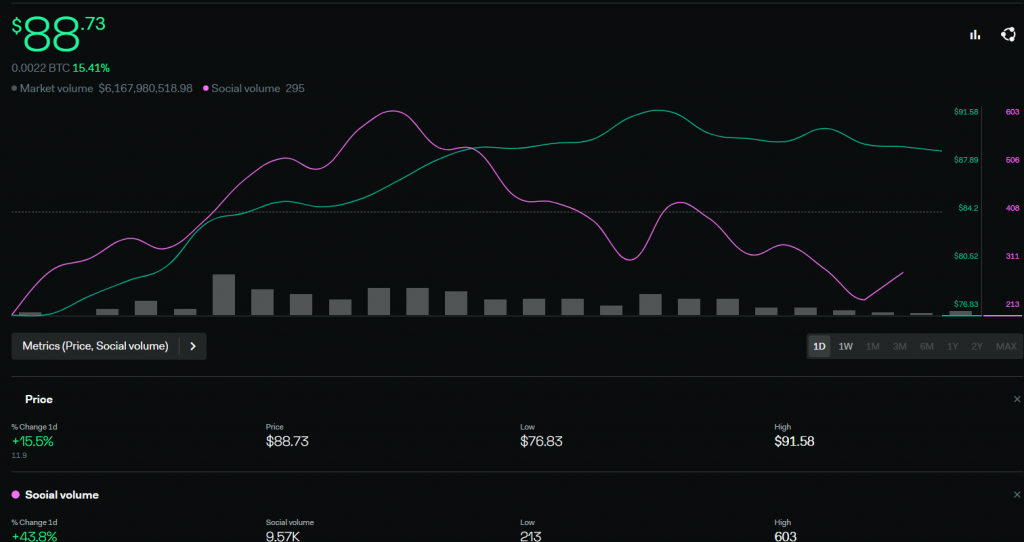

Investments into top 10 altcoin LUNA increased greatly of late, with the alt stealing most of the crypto limelight with a 15% price hike on 18 April. However, the technical chart presented a few near-term challenges that could separate a temporary rise from an extended rally.

Resulting from $75 support, LUNA’s daily hike came after a 3-week long downtrend which cut nearly 40% of its value from ATH levels of $120. Although yesterday’s spike was LUNA’s biggest in nearly two months, several technical barriers still had to be clear for LUNA to revisit this ATH. More specifically, LUNA had to advance above the daily 20 and 50 SMA’s and topple $96-resistance to open a route towards $120.

While breakouts in choppy markets are harder to achieve, recovering fundamentals made for an interesting outlook. After slipping constantly for 12 days, Terra’s Total Value Locked made up for lost ground, rising by $2 Billion in the past 48 hours. Liquidity protocols Anchor and Lido, both of which account for over 90% of Terra’s overall TVL, were largely responsible for the overall uptick. TVL represents the total amount of money tied up in smart contracts and other staking apps. An increase in a cryptos’ TVL shows rising interest in the network and the same tends to tip over to the price as well.

Secondly, LUNA’s spike was creating FOMO (fear of missing out) among other market participants as well. Its daily social volume climbed by 44% as users circulated LUNA posts on social media platforms. This could lead to more short-term buy orders.

Buy Setup On LUNA

External factors made a compelling argument for a LUNA breakout above $96. The move could create room for another 23% upswing and bring the price closer to an ATH of $120. Investors can get into early positions and set up buy orders at $96, with take-profits at $120. A stop-loss can be kept at $83. The trade setup carried a 1.64 risk/reward ratio.