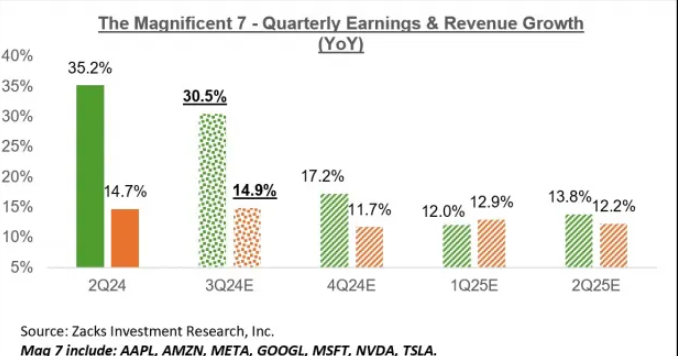

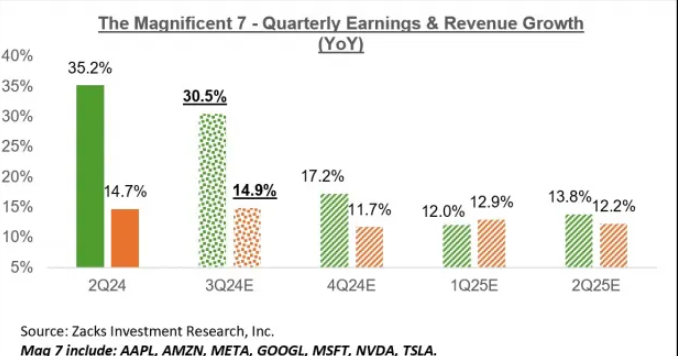

‘The Magnificent 7’ earnings reveal a stark divide in Q3 2024, with tech giants delivering mixed results that have reshaped stock performance expectations.

Of the six companies reporting, Tesla‘s results sparked enthusiasm, while Apple, Microsoft, and Meta faced heightened scrutiny despite beating estimates. The initial financial analysis shows that the group maintained 30.5% earnings growth projections for Q3, though individual performances varied dramatically.

Also Read: Peanut the Squirrel Sparks Solana Meme Coin Frenzy: $200 Target

Tech Giants’ Earnings: Impact on Stock Performance and Investor Confidence

Earnings Momentum

Meta’s earnings jumped 35.4% on 18.9% revenue growth, while Microsoft delivered 10.7% earnings growth with 16% higher revenues. Apple maintained steady performance, with Q3 earnings rising 8.8% to $25 billion on 6.1% higher revenues of $95 billion.

The Magnificent 7 earnings demonstrate sustained momentum across cloud computing, digital advertising, and hardware segments.

AI Investment Impact

These tech giants face mounting pressure as AI infrastructure costs surpass market expectations. Financial analysis reveals that capital expenditure has reached record levels, particularly among cloud providers Microsoft, Amazon, and Alphabet.

Also Read: Shiba Inu: How To Be A Millionaire When SHIB Hits $0.000075?

Revenue and Beat Rates

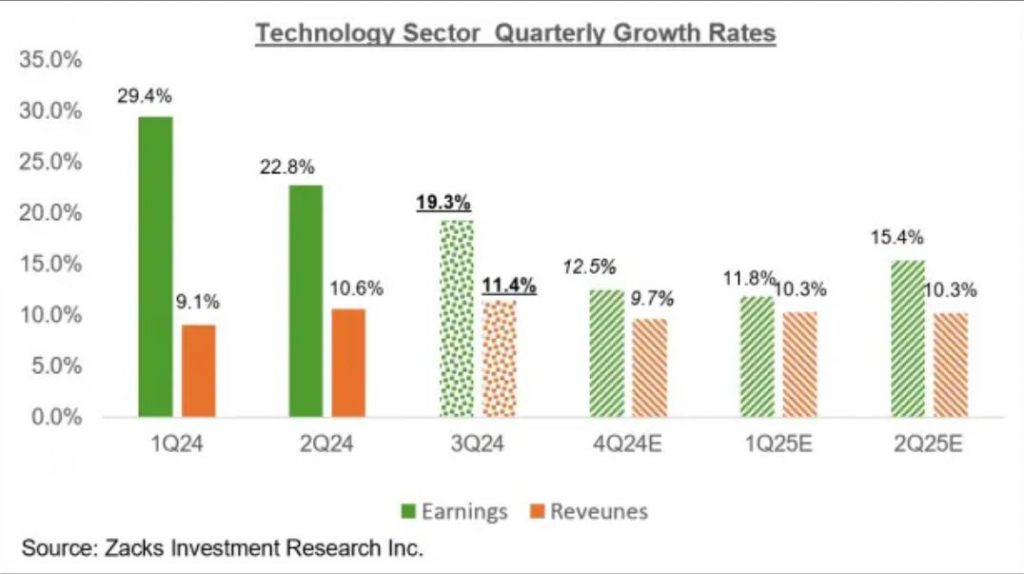

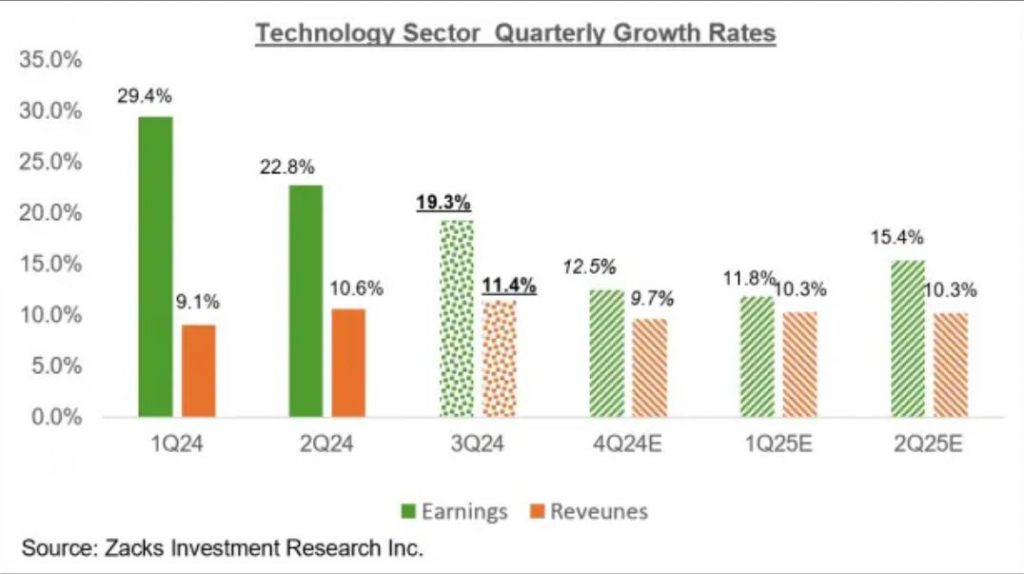

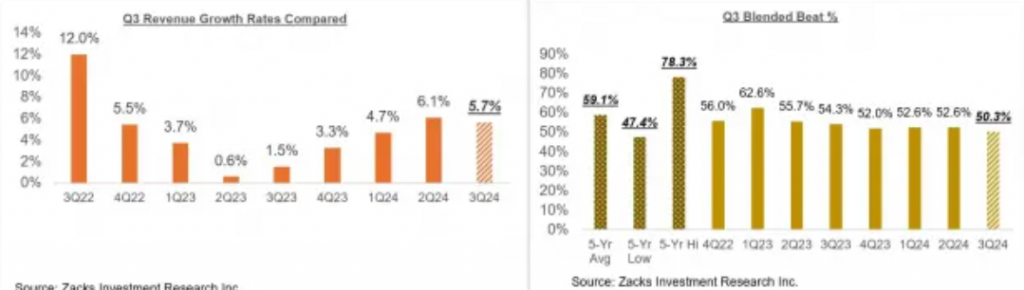

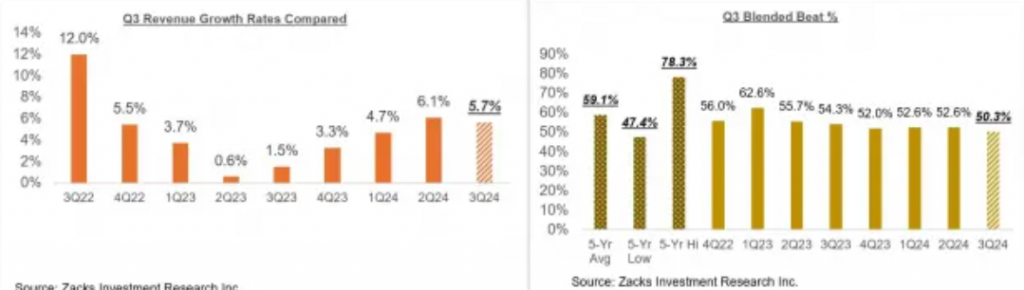

Technology sector stock performance shows earnings growth of 29.4%, outpacing revenue growth of 9.1%. Investor insights point to strong Q3 beat rates at 74.9% for earnings estimates, though revenue beats moderated to 68.2%.

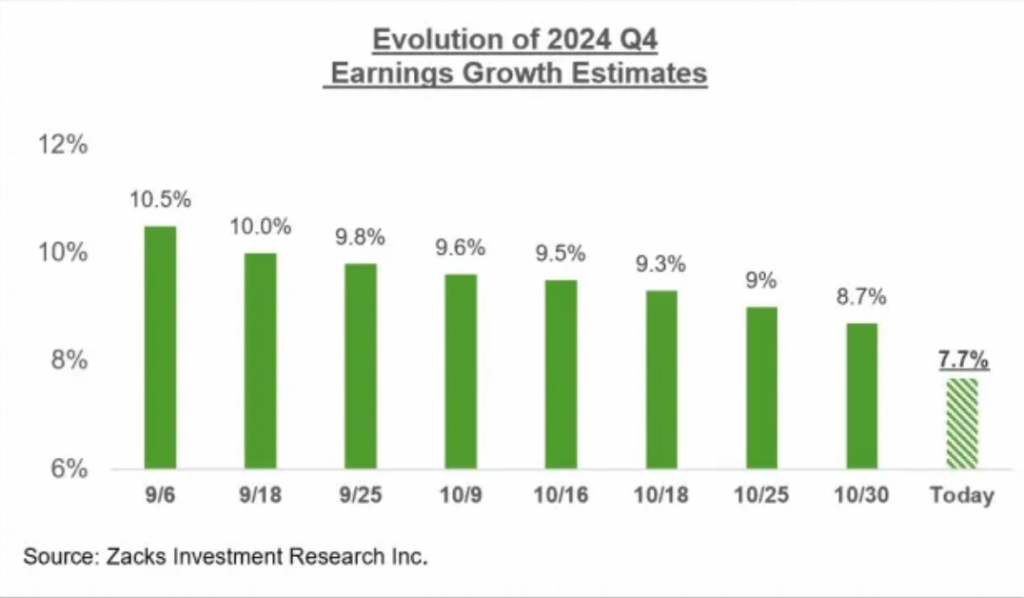

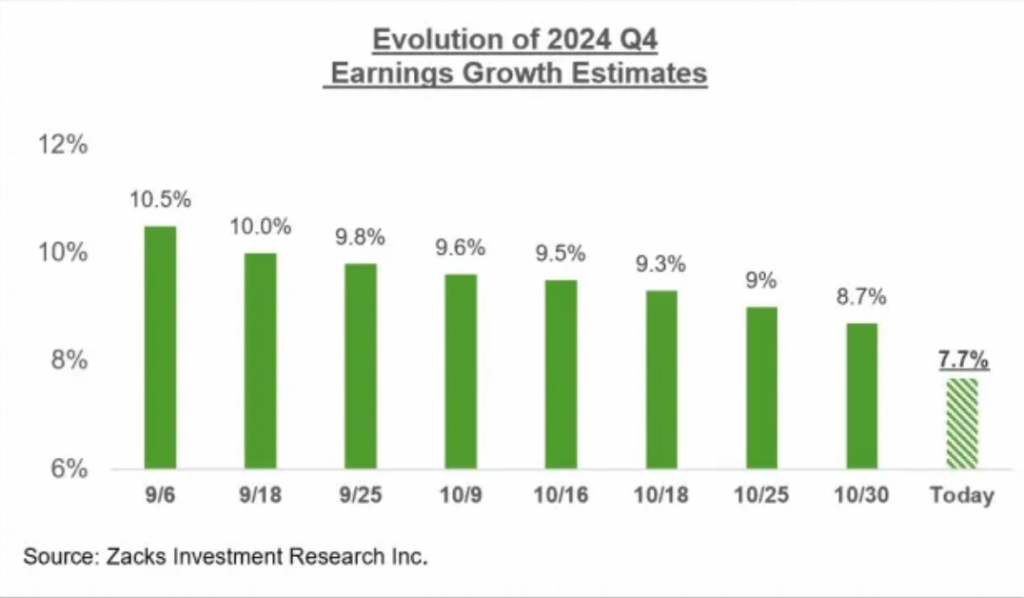

Forward Outlook Trends

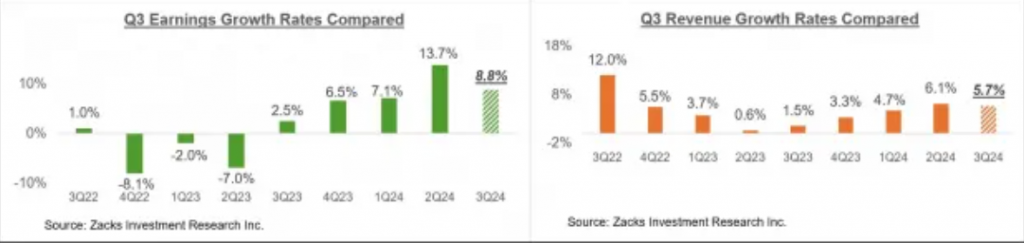

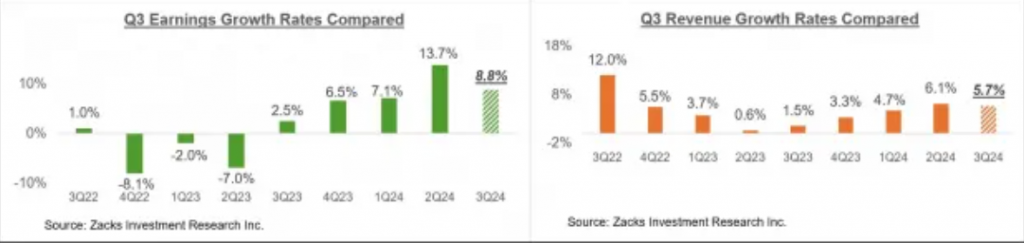

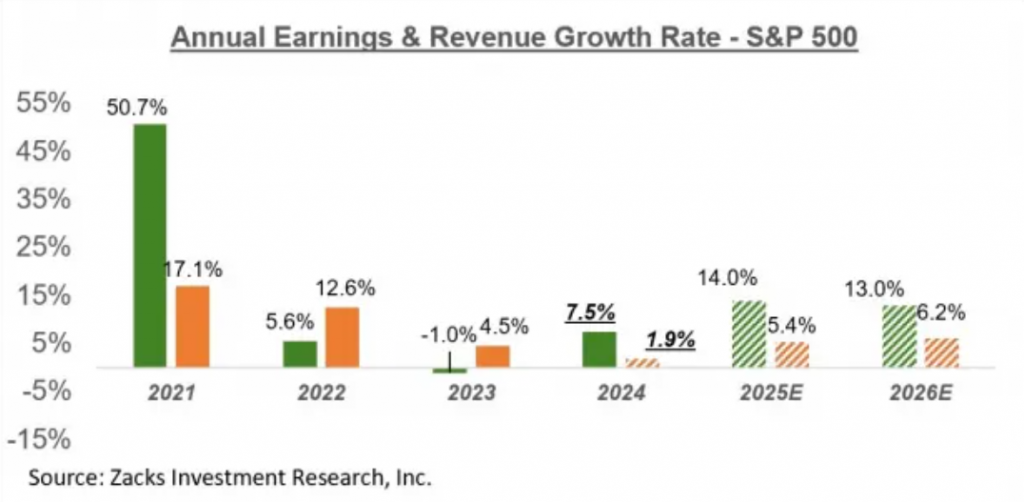

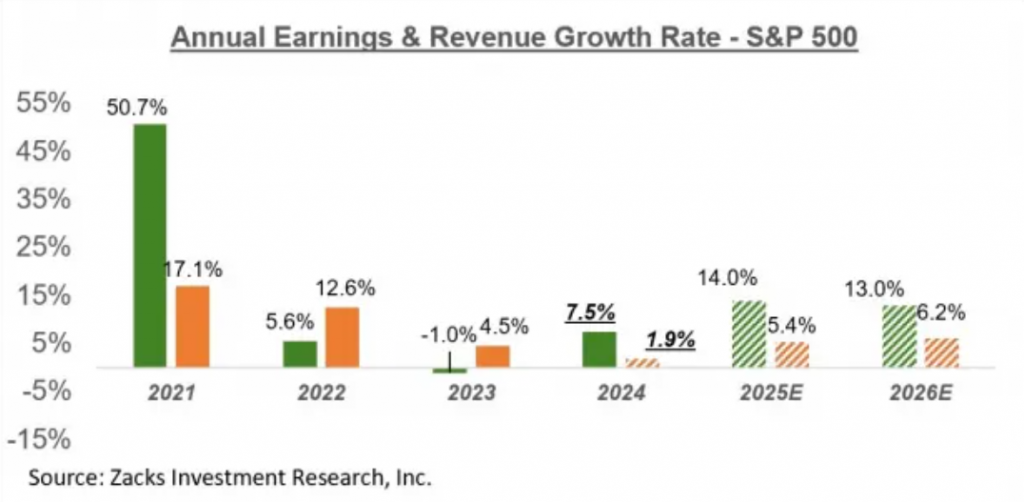

Annual growth projections indicate sustained expansion, with tech giants maintaining leadership despite cost pressures. Historical data shows the sector rebounding from 2022’s contraction to deliver consistent growth through 2024.

Market Leadership Position

The latest investor insights highlight shifting dynamics within the group. While some companies navigate AI transition costs, others demonstrate strengthening core businesses. Financial analysis indicates continued dominance in market capitalization despite recent volatility.

“The market overall has been disappointed with mega tech guidance, especially with regard to Meta’s AI expenditures as well as slower than anticipated integration of AI into Microsoft’s cloud platform,” notes LPL Financial’s chief global strategist Quincy Krosby.

Vanguard’s chief global economist, Joe Davis, observes:

“Tomorrow’s labor report is the last important economic indicator before the Federal Reserve meets again. Despite disruptions from Hurricane Helene and the Boeing strike, we expect the labor market remains on strong footing.”

Analyst Louis Navellier notes: “Despite the big pullback today, the trend remains positive, and earnings beats overall have not disappointed.”

The Magnificent 7’s stock performance reflects their evolution, with Krosby adding:

“There’s a nearly palpable narrative taking hold that the election – rather than offering the market a sense of certainty – will do just the opposite causing volatility to spike significantly higher.”

Current trends suggest these tech giants will maintain market influence despite near-term challenges.

Also Read: 750 Convenience Stores in the US Accept Cryptocurrencies & Stablecoins

Stock performance metrics show some resilience amid shifting macroeconomic conditions. That said, investor confidence still remains strong in the long-term prospects. This happens despite immediate concerns over AI investment costs and election-related uncertainty.