The trading volume between Malaysia and BRICS countries reached a staggering 818 billion ringgit in 2024 (equivalent to $195 billion). This accounts for over 35.2% of Malaysia’s overall total foreign trade turnover, according to the latest data from Bernama.

Apart from the trading volume, investments from BRICS countries in Malaysia touched 105 billion ringgit (equivalent to $25 billion). The development helped Malaysia enter a larger section of the international markets by attracting additional investments and capital.

Also Read: Canada Joining BRICS Boldly Confronts US Economic Power Play

The investments come as Malaysia is now a BRICS Partner Country along with 11 other nations. The partner countries include Algeria, Belarus, Bolivia, Cuba, Kazakhstan, Nigeria, Thailand, Turkey, Uganda, Uzbekistan, and Vietnam. Also, Indonesia was a partner country but is now an official BRICS member and was inducted in 2025.

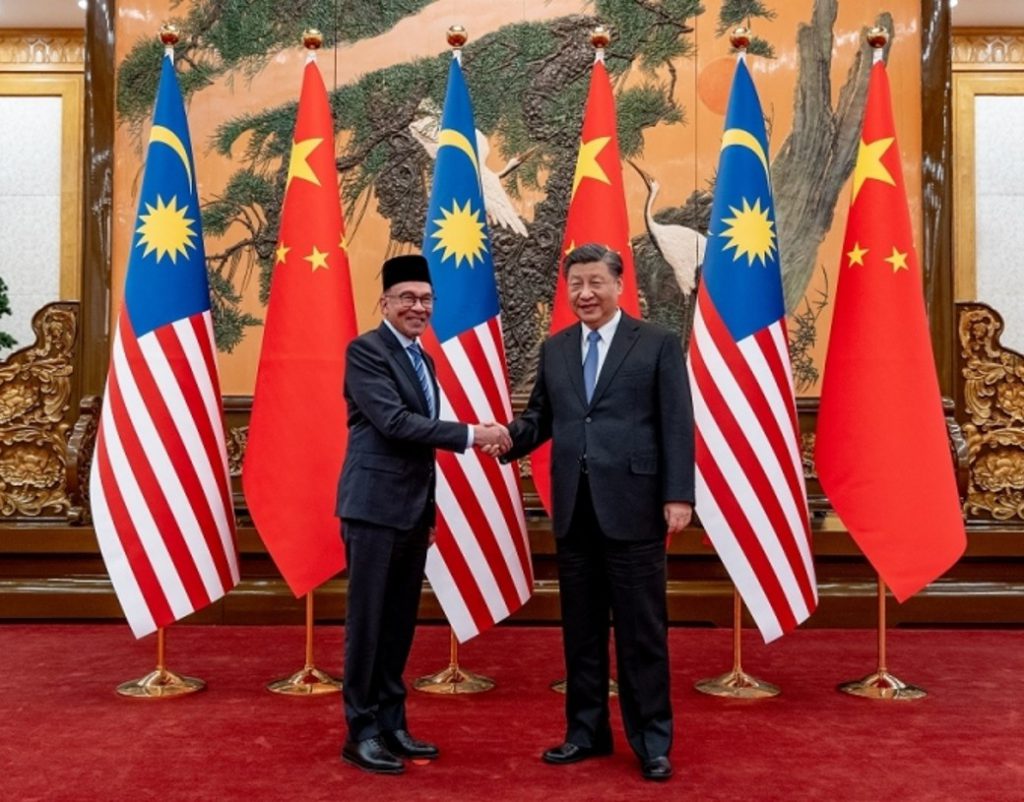

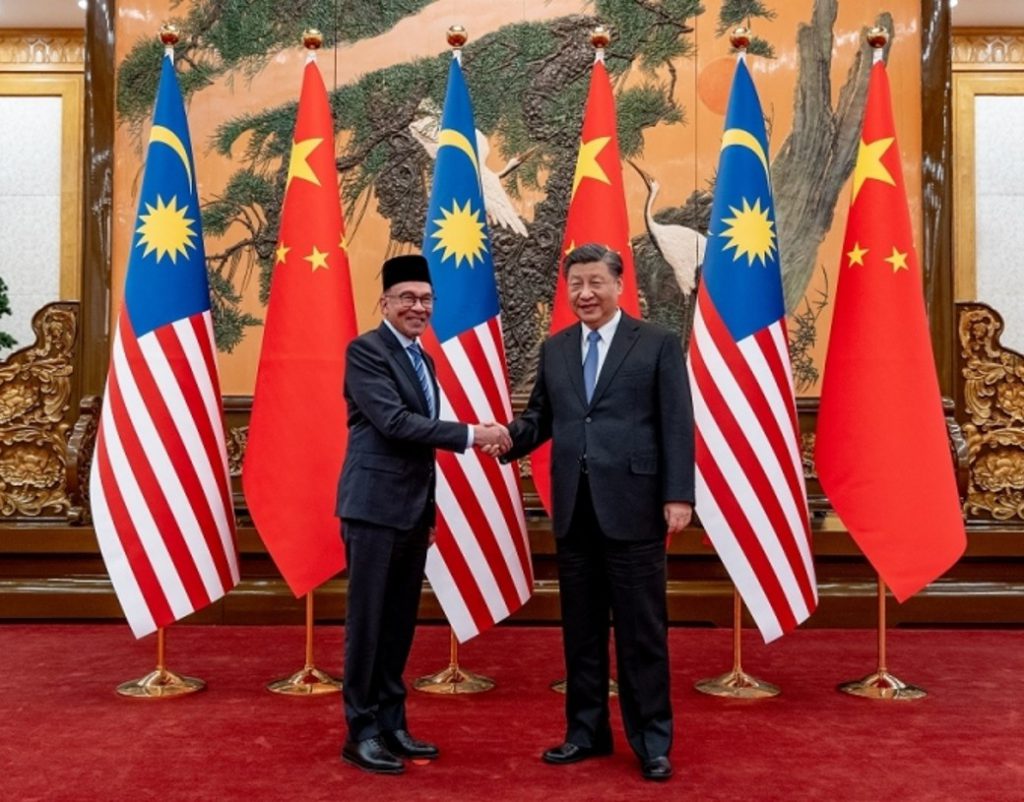

“Although Malaysia is not yet a full member of BRICS, it is already benefiting from economic relations with the countries of the association, as most of them are trading partners and stable sources of foreign investment in Malaysia,” said Prime Minister Anwar Ibrahim.

Malaysia Gains From Being a BRICS Partner Country

Malaysia is benefiting financially from BRICS by being a partner country of the alliance. After Trump imposed tariffs on the Global South, Malaysia assured to strengthen co-operation in trade and investments with BRICS members. “Malaysia’s commitment is to strengthen a rules-based and inclusive trading system. Together, we build a more just and progressive global economic future,” said Tengku Zafrul, Minister of Investment, Trade and Industry.

Also Read: BRICS Allows 183 Companies Direct Market Access to Bypass Tariffs

Trump’s tariffs are also making Malaysia stick with BRICS and ASEAN alliances for trade and economics. Developing countries are banding together to dodge US tariffs and initiate new trade deals with member alliances. They are aiming to uplift their economies without the support of the US dollar and depend on local currencies. This makes them stronger during economic turbulence and allows them to bypass the US dollar for trade and tariffs.