The cryptocurrency market hoards several assets in its ecosystem ranging from meme coins to metaverse tokens. Despite Bitcoin’s dominance over the industry, a metaverse token was making headlines throughout the week. Decentraland’s MANA was the talk of the town following a 93% increase in its price over the last fourteen days.

At press time, MANA was trading for $0.6223 with a 5.80% daily drop. However, following a 42% surge this week, MANA managed to rise to a high of $0.75. This level was achieved after the asset briefly breached its resistance level of 0.74.

The above chart indicates that MANA moved past a prominent resistance level of $0.43 last week. However, if the asset plummets from its current zone, it could drop down to $0.365 which has been a major support level for the cryptocurrency.

In addition, the Relative Strength Index [RSI] indicator highlighted how MANA was being overbought. On-chain analytics firm, Santiment recently revealed that since Jan 13, MANA has been experiencing a daily increase in transactions of more than $100,000.

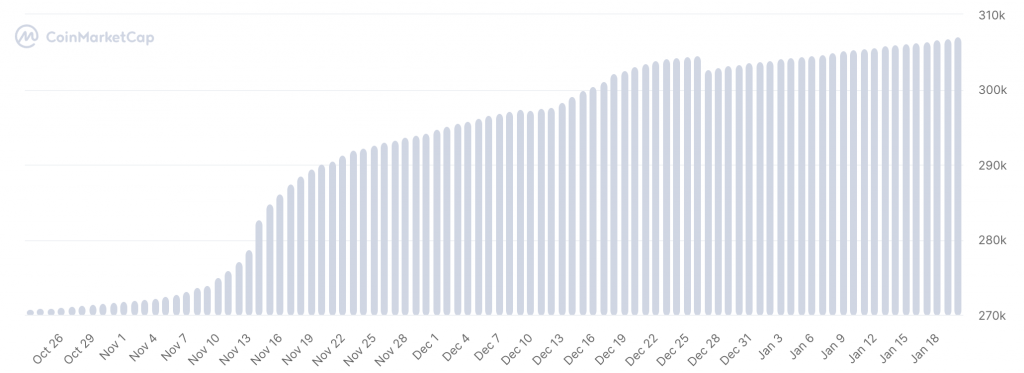

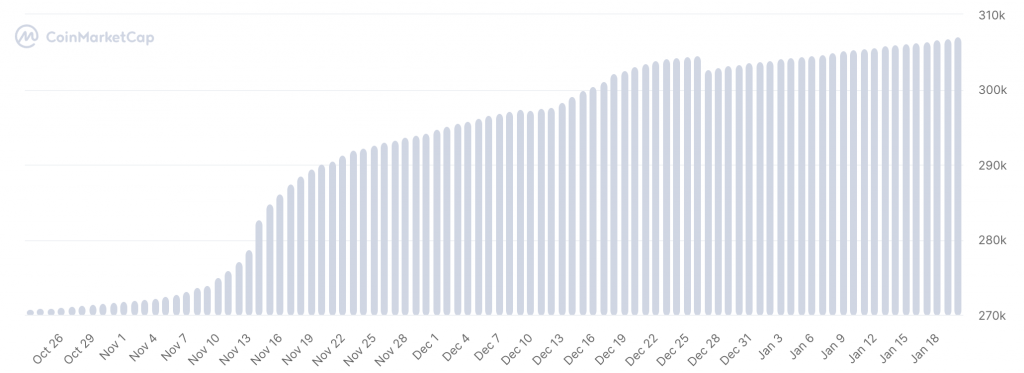

The asset was spiking the interest of its holders and the rest of the community as well. So much so that the cryptocurrency was recording a significant rise in its total addresses. Currently, MANA’s holder count is at a 3-month high of 306,915.

Will MANA’s rumored association with Genesis disrupt the asset’s rally?

While the overall sentiment around the asset is bullish, MANA could break its hot streak. Earlier today, cryptocurrency lender Genesis filed for bankruptcy. Soon after, speculations about how Stellar [XLM] and Decentraland were the creditors of the bankrupt firm began making the rounds.

It was brought to light that a firm Heliva International Corp. was owed $55 million by Genesis. This company reportedly lists Decentralnds’s CFO Santiago Esponda as the point of contact. However, Decentralnad’s COO, Ryan De Taboada went on to deny the information. Nevertheless, the rumor had already gained traction on social media.

This could also be the reason behind the asset’s current plummet.