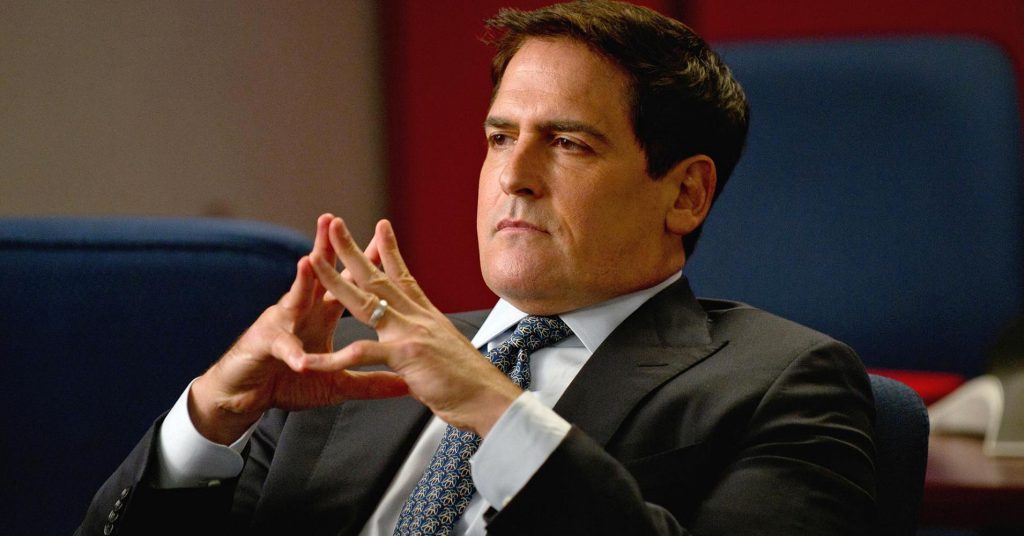

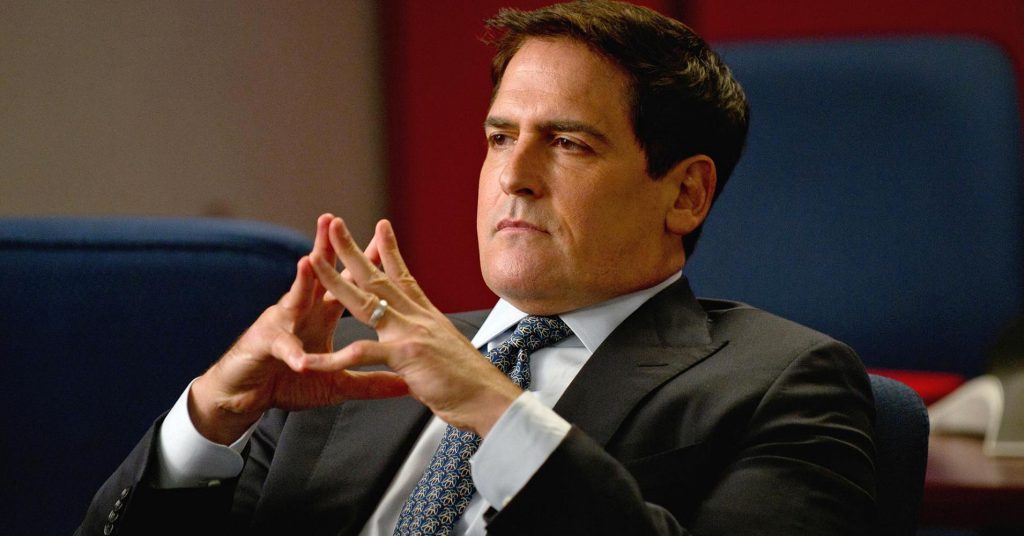

The star of the Shark Tank television series and Dallas Mavericks owner Mark Cuban has warned investors regarding the “unprecedented” aspects of the post-Bitcoin halving market. Indeed, Cuban discussed the impact that the event will have on Bitcoin miners and their revenue.

The highly-anticipated event took place last week and brought with it a plethora of expectations. A host of different analyses discussed the negative impact that was to come from its arrival. Although a price decrease had been called for, the seat has remained steady at $66,000 while increasing 2% on Monday according to CoinMarketCap.

Also Read: Elon Musk & Mark Cuban Join Forces for Legal Battle Against SEC

Mark Cuban Issues Post-Halving Warning

There are few entrepreneurs as prominent or as well-known as Mark Cuban. Not only has he become one of the faces of the popular Shark Tank series, but he is also a notable NBA owner with an immensely successful franchise. Moreover, he has been well known as an advocate for the digital asset sector.

Speaking to The Block, Mark Cuban offered a surprising warning regarding the ‘unprecedented’ post-bitcoin halving market. Specifically, Cuban said that the significance of the event is that “it going to make it harder for miners to get paid.”

Also Read: Mark Cuban Says SEC Crypto Approach Led to FTX Losses

Cuban was correct in this, as the fourth halving event decreased mining rewards from 6,25 BTC to 3.125. Moreover, that depletion will also bring forth a cut to miner revenue or nearly half. However, that is not the most interesting aspect of the event for Cuban.

“The truly interesting question related to the halving is the GPU market,” Cuban told the publication. “Miners need more power. There is unprecedented demand from AI for those GPUs. Will that distort the economics of mining?” Cuban inquired.

The question is incredibly interesting for the infrastructure of Bitcoin mining and the digital asset market. This Bitcoin halving could present a newfound entry point for AI technology in mining. Yet, the Bitcoin mining industry has long attempted to embrace artificial intelligence. This “unprecedented demand” could further that exploration exponentially.