Mastercard Circle stablecoin partnership is actually enabling USDC and EURC settlement for acquirers in Eastern Europe, Middle East, and also Africa right now. This Mastercard Circle stablecoin initiative marks the first time that the EEMEA acquiring ecosystem can even settle transactions using regulated stablecoins, with Arab Financial Services and Eazy Financial Services as the first adopters.

BREAKING:

— Ash Crypto (@Ashcryptoreal) August 27, 2025

MASTERCARD AND CIRCLE TO ENABLE USDC/EURC PAYMENTS ACROSS EASTERN EUROPE, MIDDLE EAST AND AFRICA.

CRYPTO IS GOING MAINSTREAM 🚀 pic.twitter.com/lLLIimVSbQ

Mastercard & Circle Stablecoin Expands USDC in EEMEA

The Mastercard Circle stablecoin settlement expansion builds upon some existing crypto card solutions like Bybit and also S1LKPAY. USDC EURC settlement EEMEA capabilities are now allowing acquiring institutions to receive settlements in Circle’s fully-reserved stablecoins, which enables real-time stablecoin settlement for merchants across the region.

Dimitrios Dosis, President of Eastern Europe, Middle East, and Africa at Mastercard, stated:

“This is a key move for Mastercard. Our strategic goal is to integrate stablecoins into the financial mainstream by investing in the infrastructure, governance, and partnerships to support this exciting payment evolution from fiat to tokenized and programmable money.”

Real-Time Stablecoin Settlement Benefits

Real-time stablecoin settlement is reducing friction that’s traditionally been associated with high-volume settlements. Stablecoin payments EEMEA merchants can now access faster, and more efficient payment solutions through this expanded infrastructure.

Kash Razzaghi, Chief Business Officer at Circle, had this to say:

“Expanding USDC settlement across Mastercard’s vast network of acquirers in Eastern Europe, the Middle East, and Africa is a pivotal step toward truly borderless, real-time commerce.”

Also Read: Binance Unlocks Instant Crypto-to-Fiat Transfers for European Users

USDC Growth and Regional Impact

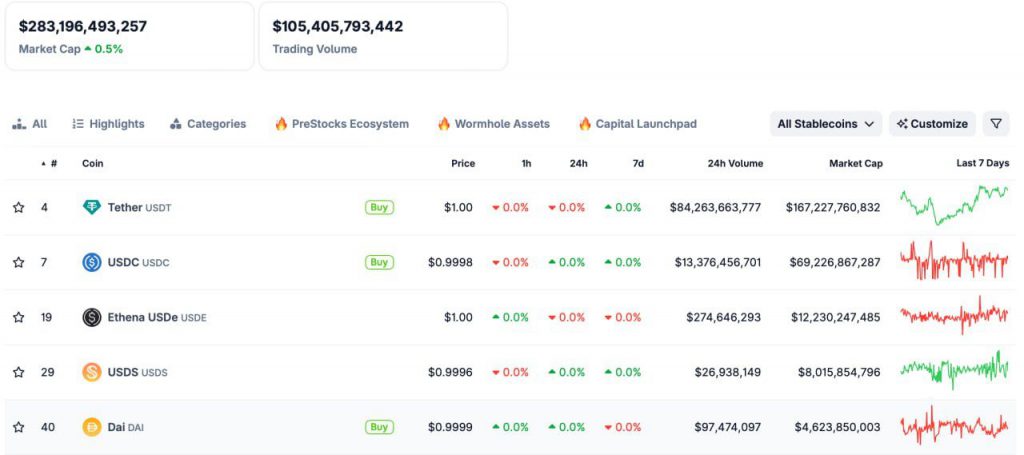

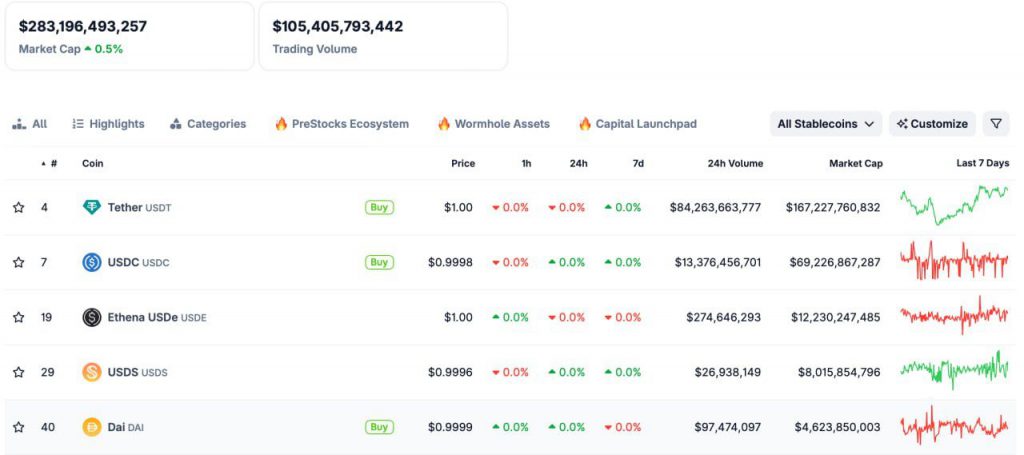

USDC circulation actually reached $65.2 billion by August 2025, which represents a 90% year-over-year growth. This stablecoin payments EEMEA merchants initiative leverages USDC EURC settlement EEMEA capabilities to transform regional commerce in a significant way.

Samer Soliman, CEO of Arab Financial Services, stated:

“As the first acquirer in the region to pioneer USDC stablecoin settlement, we are delivering a strategic and transformative solution. This innovation provides the future-ready infrastructure our clients need to stay competitive.”

Also Read: Circle (CRCL) vs. Strategy (MSTR): Which is the Best Crypto Stock

The Mastercard Circle stablecoin partnership demonstrates how real-time stablecoin settlement can bridge blockchain-native assets with traditional commerce infrastructure, positioning both companies at the forefront of digital payment evolution across emerging markets right now.