FTX’s collapse materialized into an industry-wide catastrophe. Most firms associated with it, both, directly and indirectly, felt the pinch. Parallelly, the exchange’s downfall also cleared the path for a bearish extension.

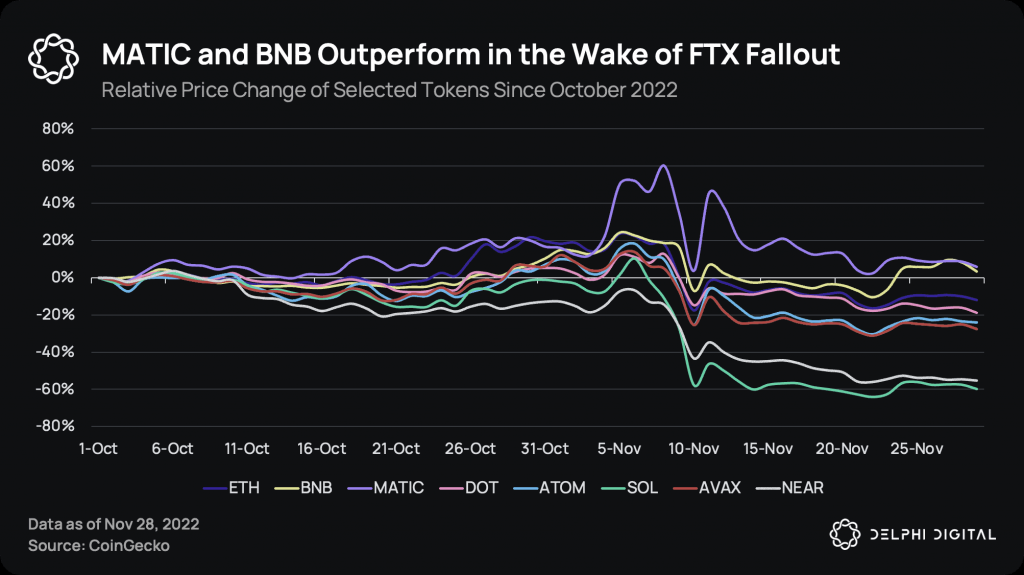

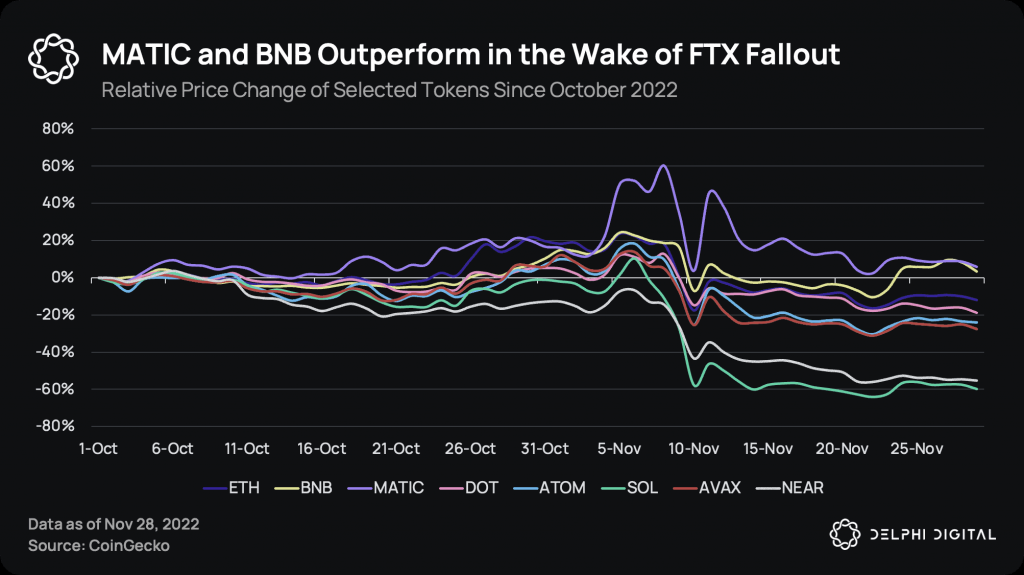

Amid such an environment, only MATIC and BNB tokens managed to fetch meager positive returns to their investors. The price change of most other tokens revolved in the negative territory.

Chalking out the same using Delphi Digital’s analysis data, Chinese Journalist Colin Wu tweeted,

“The Delphi chart pointed out that under the influence of the FTX crash, only MATIC and BNB prices have increased since October, SOL has fallen by 60% and Near has fallen by 55%. FTX and Alameda are the core investors of Solana ecology; FTX and 3AC are important investors of NEAR.“

Investor Profitability and User Growth

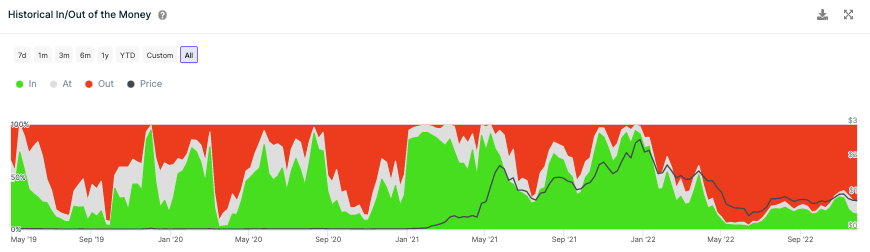

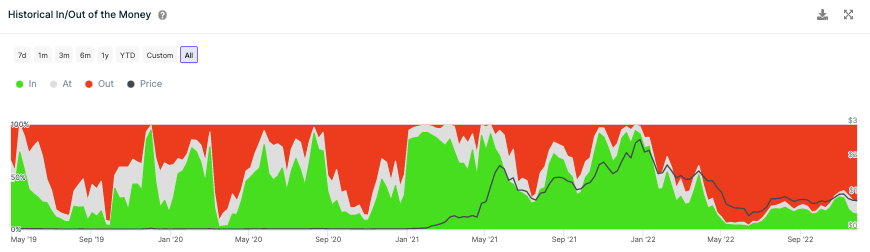

Despite managing to stay afloat, around 3/4th of MATIC investors [73.05%] are underwater or out of the money at the moment. On the other hand, only 14.69% are in gains at the current price, while the remaining 12.26% of them are in a break-even position.

As seen below, this is one of the longest periods in recent history where red dominates the chart. In fact, the trend was completely the other way around this time last year. About 94% of them were in profits towards the end of December 2021.

Also Read: Does Polygon deserve to be in the top 3 with Bitcoin, Ethereum?

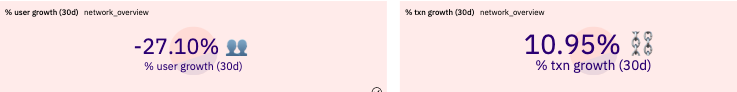

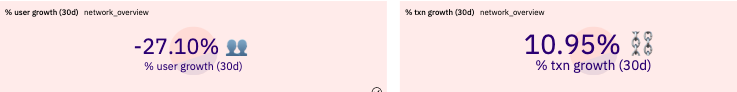

Data from Dune Analytics further brought to light that user growth depleted by 27% over the past 30 days on Polygon. The same hinted that people might be losing their interest in the network.

Nevertheless, existing users have managed to stick around and the cumulative transactions have risen by about 11% in the same period.

The number of investors currently underwater does not serve as an inviting incentive for new participants to enter the ecosystem. So, owing to this and the slowdown in user growth, the path ahead for MATIC to continue outperforming other tokens doesn’t seem to be completely obstacle free at the moment.