MetaPlanet’s Bitcoin investment strategy has, right now, achieved a historic milestone by surpassing Coinbase’s Bitcoin holdings with 10,000 BTC, and also positioning the Japanese firm as the seventh-largest corporate Bitcoin holder globally. This MetaPlanet Bitcoin investment strategy represents a fundamental shift in institutional crypto investment, and it demonstrates how aggressive acquisition approaches can quickly establish market dominance.

Also Read: Metaplanet Buys Another 1,111 Bitcoin Worth $111M; BTC Eyes $117K

Metaplanet’s U.S. Bitcoin Strategy Signals Major Institutional Shift

MetaPlanet’s US Bitcoin operations received a massive $5 billion capital injection, which marks one of the largest corporate cryptocurrency investments in history. This strategic expansion of MetaPlanet US Bitcoin operations demonstrates the company’s commitment to establishing a dominant position in the American digital asset market while also leveraging favorable regulatory conditions.

Record Purchase Propels Holdings Beyond Exchange Giant

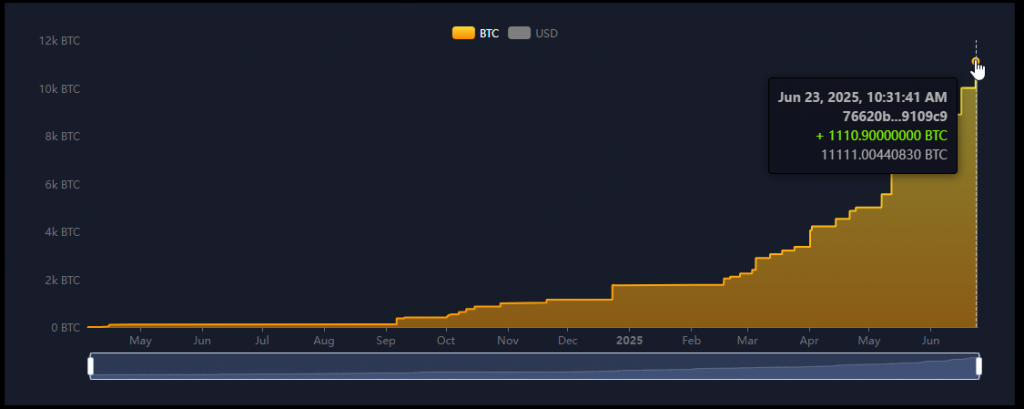

The company’s latest acquisition of 1,112 BTC for 16.88 billion Japanese yen ($117 million) pushed its total holdings to 10,000 Bitcoin, and officially surpassing Coinbase Bitcoin holdings of 9,267 BTC. This achievement in corporate Bitcoin adoption signals a new era where traditional companies can outpace established cryptocurrency exchanges in digital asset accumulation, right now.

CEO Simon Gerovich said:

“The purchase lifted its holdings above Coinbase’s 9,267, according to data on BitcoinTreasuries.com.”

The MetaPlanet Bitcoin strategy of investing has been really successful and the carefulness of the firm in conducting this operation has made it accumulate huge reserves and also reduced risks of market timing. This type of institutional crypto investment has gained the attention of many investors and when the announcement of the same was made the company stock vaulted up by more than 22 percent.

Metaplanet has launched Asia’s largest-ever equity raise dedicated to Bitcoin:

— Simon Gerovich (@gerovich) June 6, 2025

🚀 ¥770.9 billion (~$5.4B) capital raise

📈 555 million shares via moving strike warrants

🥇 First in Japan: issued at a premium to market — enabled by Metaplanet’s high volatility and deep liquidity… pic.twitter.com/UlXHneyDzo

Zero-Interest Bond Strategy Fuels Expansion

MetaPlanet’s board approved $210 million in bonds with no interest specifically to fund additional Bitcoin purchases, and this demonstrates how creative money gathering structures support aggressive digital asset accumulation. This innovative approach to corporate Bitcoin adoption allows the company to leverage debt markets for cryptocurrency investments without traditional interest burdens, at the time of writing.

The company’s ambitious target of holding 210,000 BTC by 2027 represents approximately 1% of Bitcoin’s total supply, and it showcases the scale of their institutional crypto investment vision. This MetaPlanet US Bitcoin operations expansion reflects broader trends in corporate treasury diversification strategies.

Also Read: Saylor Signals MicroStrategy Bitcoin Buy, Predicts $21M by 2046

Market Leadership in Corporate Digital Assets

MetaPlanet’s rise demonstrates how focused institutional crypto investment strategies can rapidly establish market positions, right now. The company’s success in surpassing Coinbase Bitcoin holdings validates the viability of Bitcoin-first corporate treasury approaches, and also encouraging other traditional businesses to consider similar strategies.

The achievement reflects growing confidence in Bitcoin’s role as a legitimate corporate asset, with MetaPlanet’s Bitcoin investment strategy serving as an blueprint for other corporations. This shift in corporate Bitcoin adoption patterns suggests traditional companies may increasingly challenge cryptocurrency-native firms in digital asset accumulation, at the time of writing.

As regulatory frameworks continue evolving, MetaPlanet’s early aggressive positioning in both Japanese and American markets through expanded MetaPlanet US Bitcoin operations positions the company to capitalize on institutional crypto investment growth opportunities.