MiCA bans Tether USDT in Europe, reshaping the stablecoin landscape. This European Union crypto law impacts cryptocurrency markets significantly. It’s changing market share and trading volumes for stablecoins.

To better understand these circumstances, let’s dive right in! Scroll down for more useful information from the Kaiko Research Team.

Also Read: How to Become a Millionaire If SHIB Hits $0.00075 and $0.0075

Analyzing the Impact of MiCA’s Stablecoin Regulations on the Crypto Market

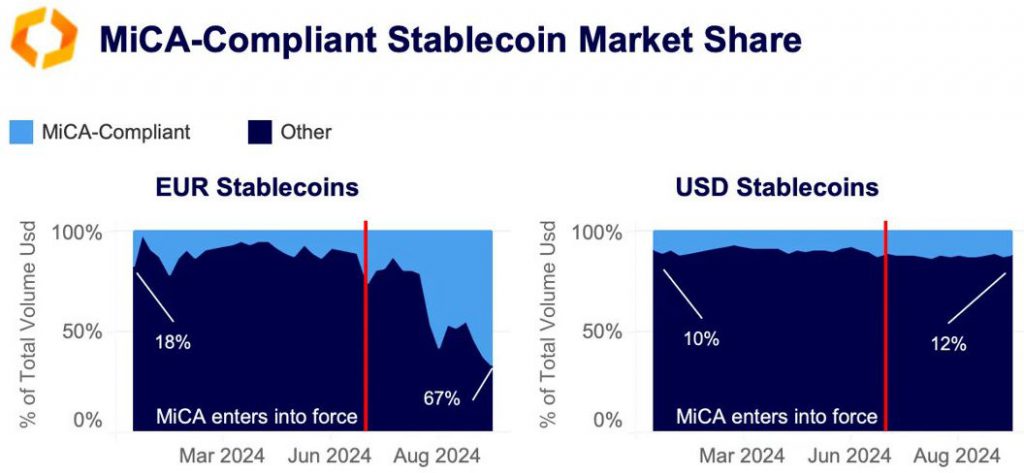

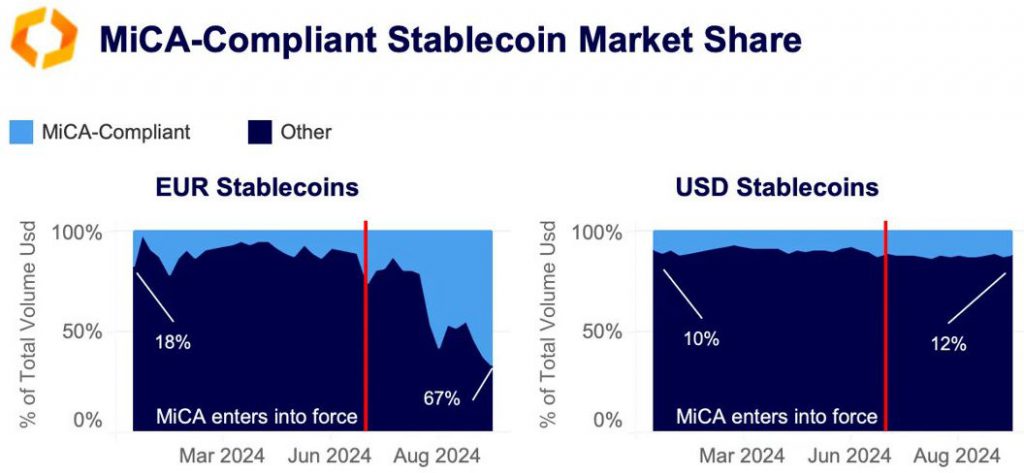

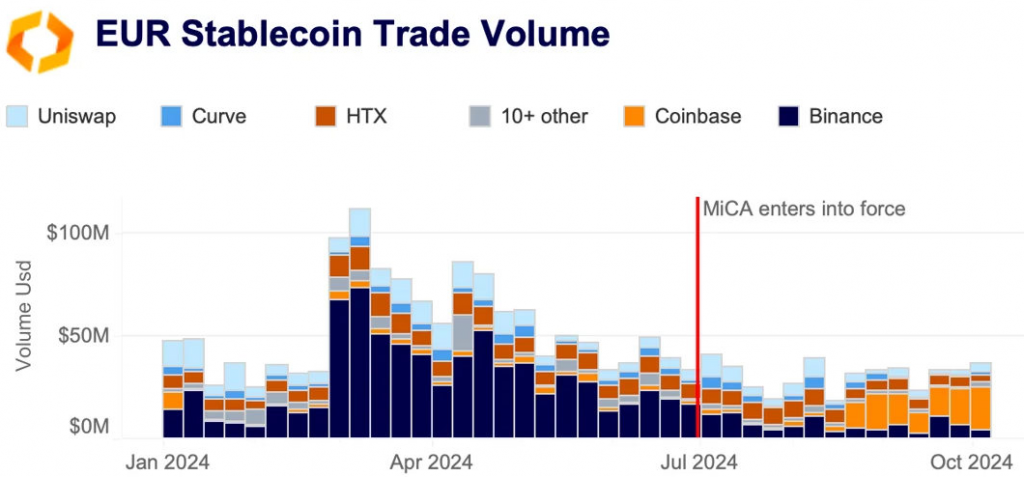

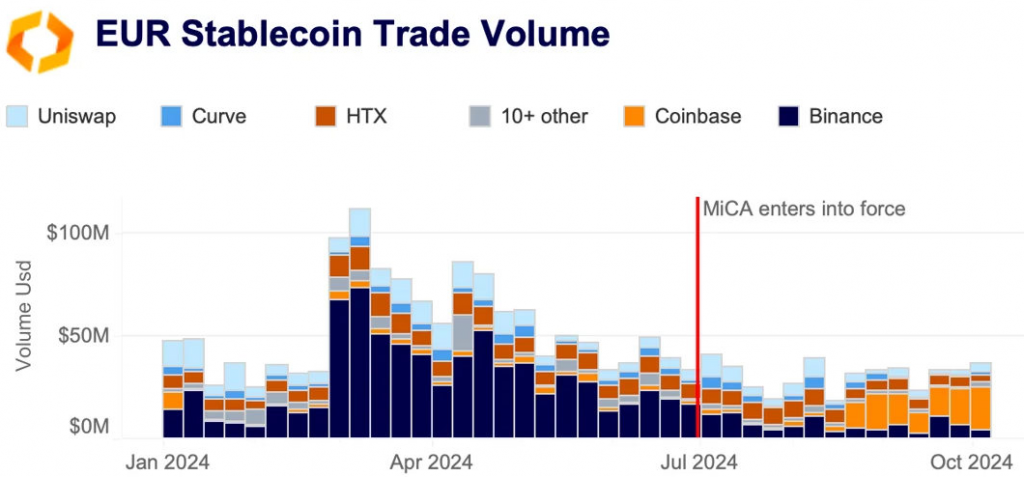

MiCA-Compliant EUR Stablecoins Rise

MiCA-compliant EUR stablecoins now hold a 67% market share, which is quite an amount. Circle’s EURC and Société Générale’s EURCV lead this growth at the time of writing this guide. Coinbase became the top EUR-stablecoin market in August, meaning that is left Binance in the dust.

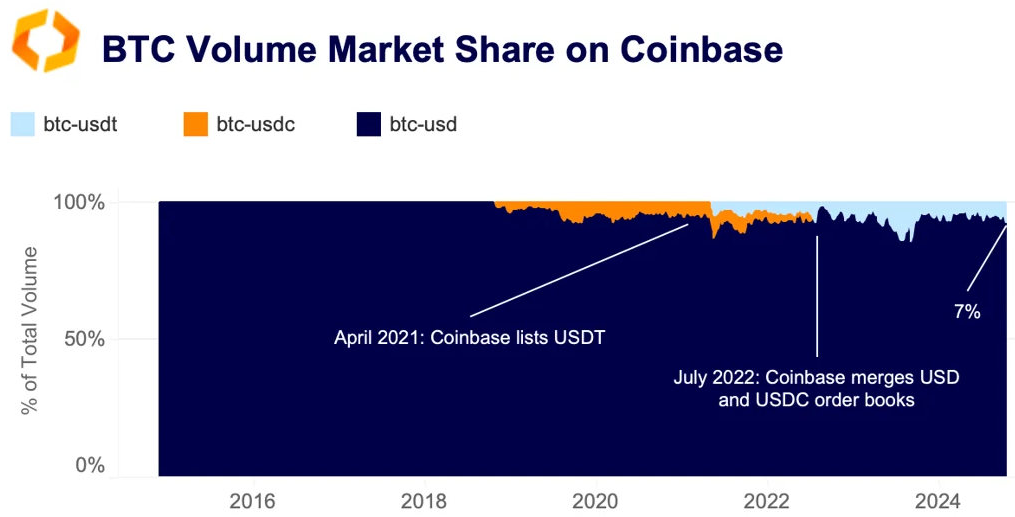

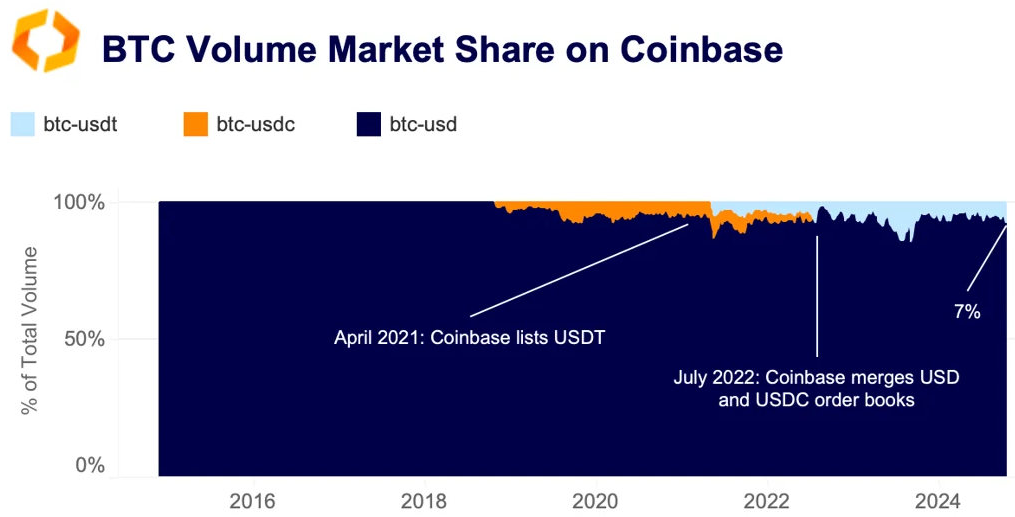

USD Stablecoin Market Shifts

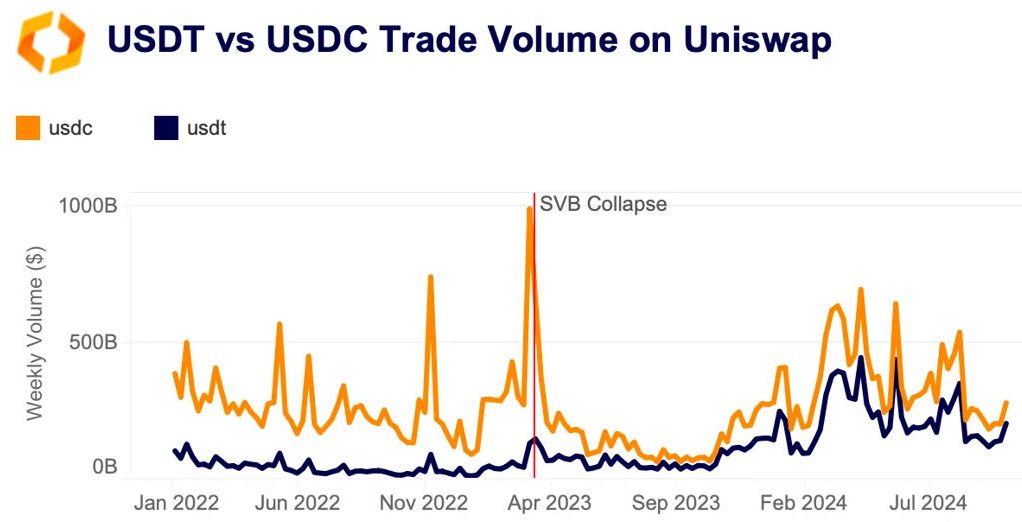

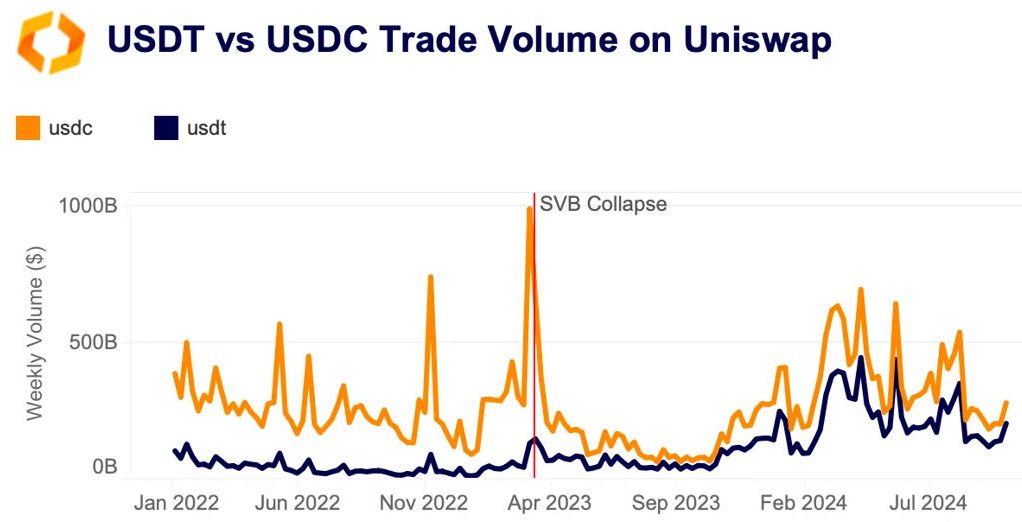

USDC, the largest MiCA-compliant USD stablecoin, grew from 10% to 12% market share. Coinbase’s plan to delist USDT for European users may boost regulated USD stablecoins further.

Also Read: Ethereum Gains 6.9%: Can ETH Hit $2800 This Week

Decentralized Exchanges Feel the Impact

MiCA rules could affect stablecoin dominance on decentralized exchanges (DEXs). DEXs aren’t regulated under MiCA, so they still allow USDT trading. This might attract traders seeking liquidity.

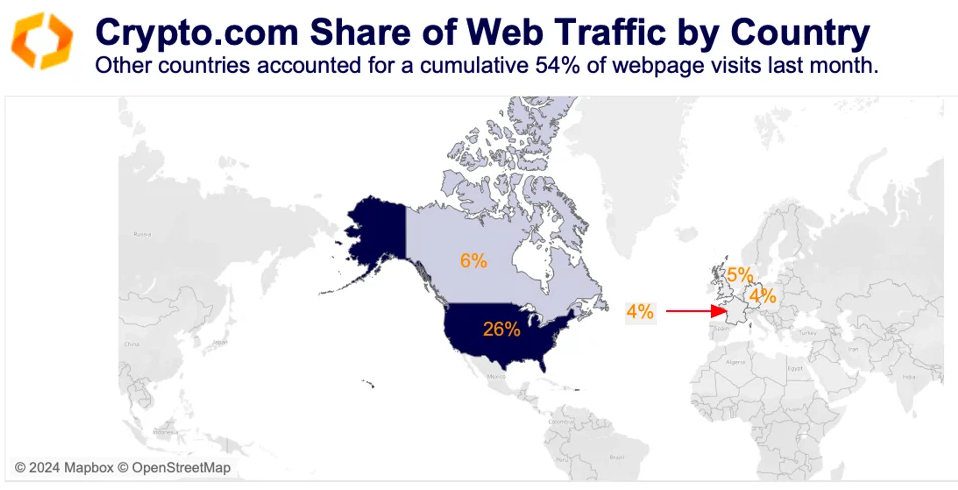

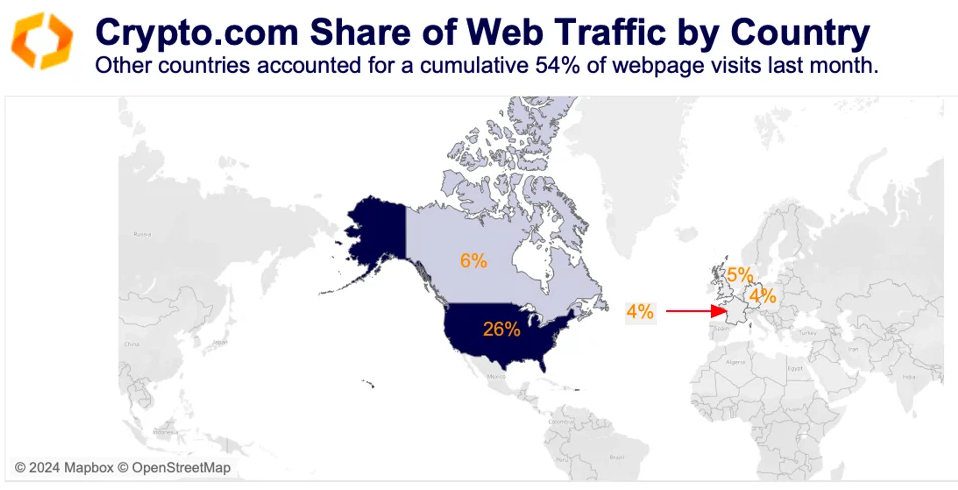

Crypto.com Challenges SEC

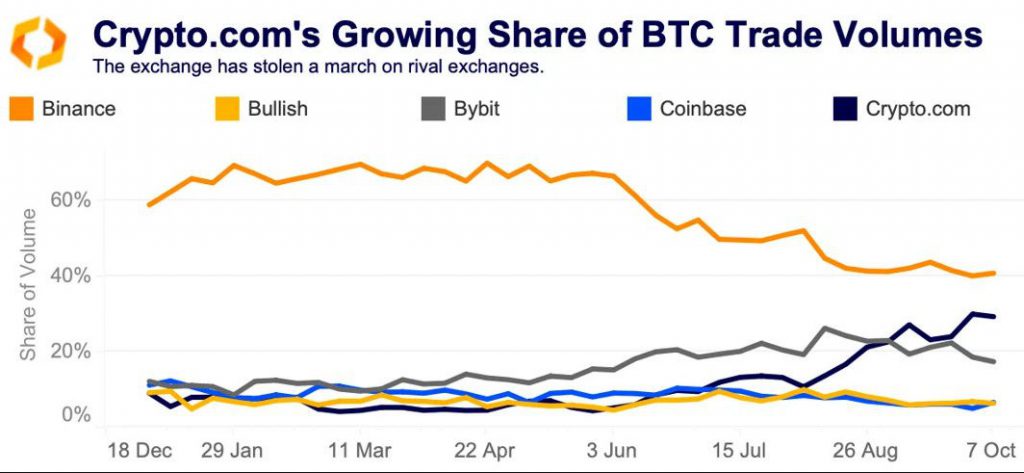

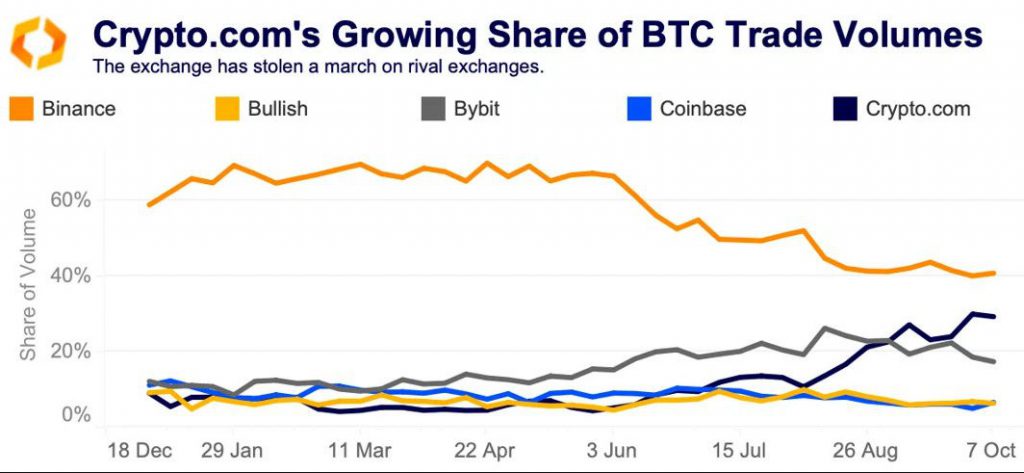

Crypto.com sued the SEC, disputing claims that some cryptocurrencies are securities. This lawsuit comes as Crypto.com gains BTC trading market share.

Market Volatility Concerns

Europe’s Tether USDT ban raises volatility and liquidity concerns. U.S. exchange Bitcoin market depth fluctuated. Coinbase’s 2% BTC depth fell 46% after Cumberland charges were announced.

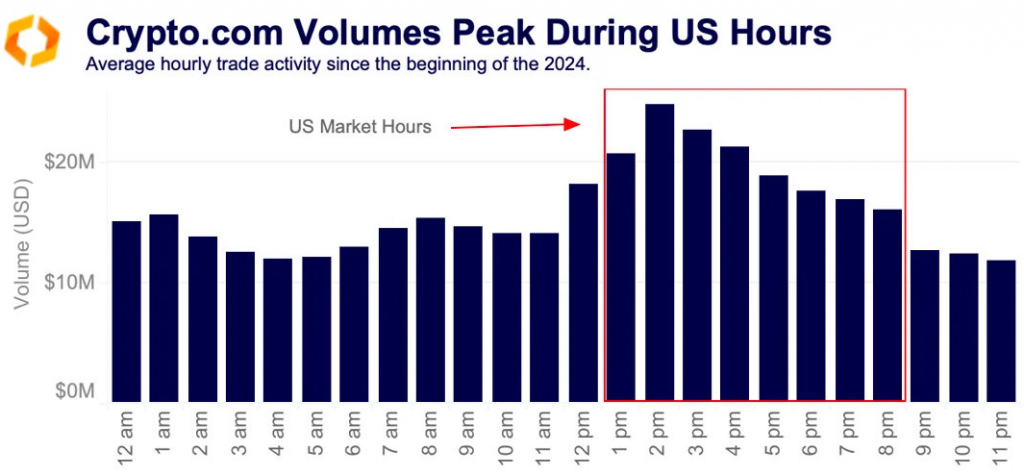

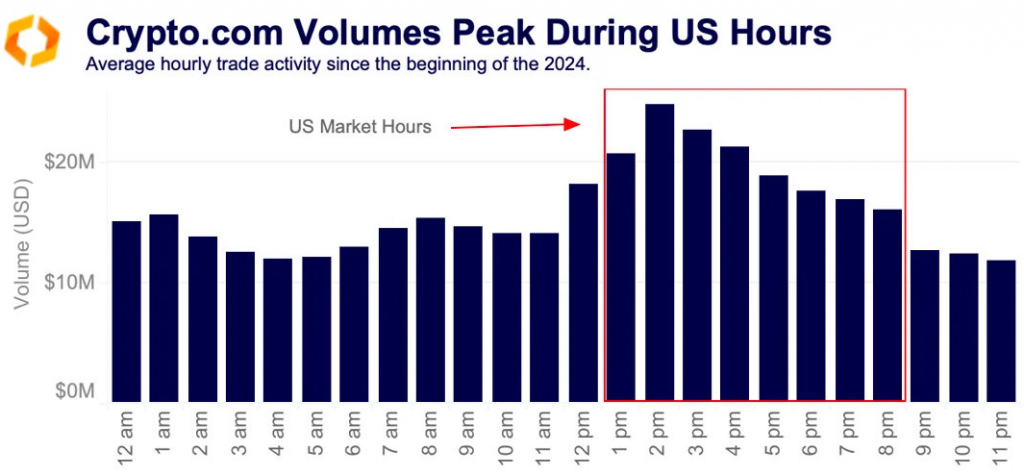

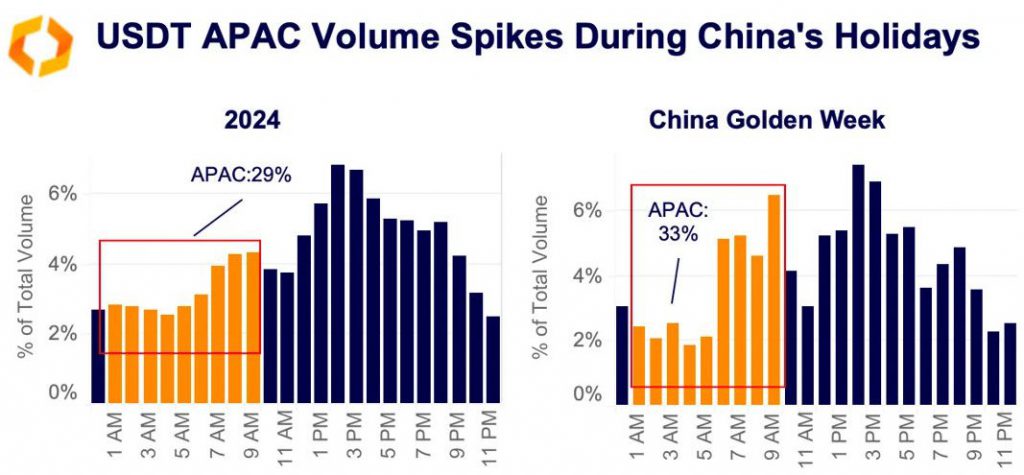

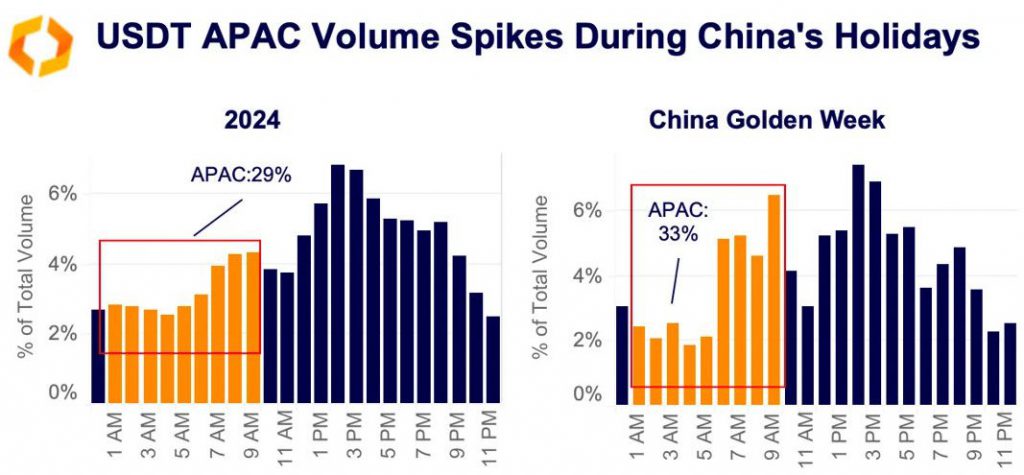

Regional Trading Patterns

USDT-USD trading volume peaks during APAC hours. This suggests that Asian-based traders are converting crypto to fiat more often.

Also Read: XRP Expected to Rise: Analysts Predict $0.75 Soon

MiCA’s implementation and the Tether USDT ban in Europe have reshaped the stablecoin market. Crypto participants now adapt to new regulations and changing trade patterns.