The Michael Burry strategy has, quite frankly, proven remarkably effective in 2025, with the big short investor significantly outperforming the S&P 500 indexes. His rather impressive recession-proof investments approach and also his somewhat unconventional stock market forecast for 2025 demonstrate why so many investors continue to follow his moves these days.

Also Read: Goldman Sachs: Hedge Funds Make Shocking Bank Stock Move

Outperforming The S&P 500: Michael Burry’s 2025 Playbook

Burry’s Chinese Tech Focus

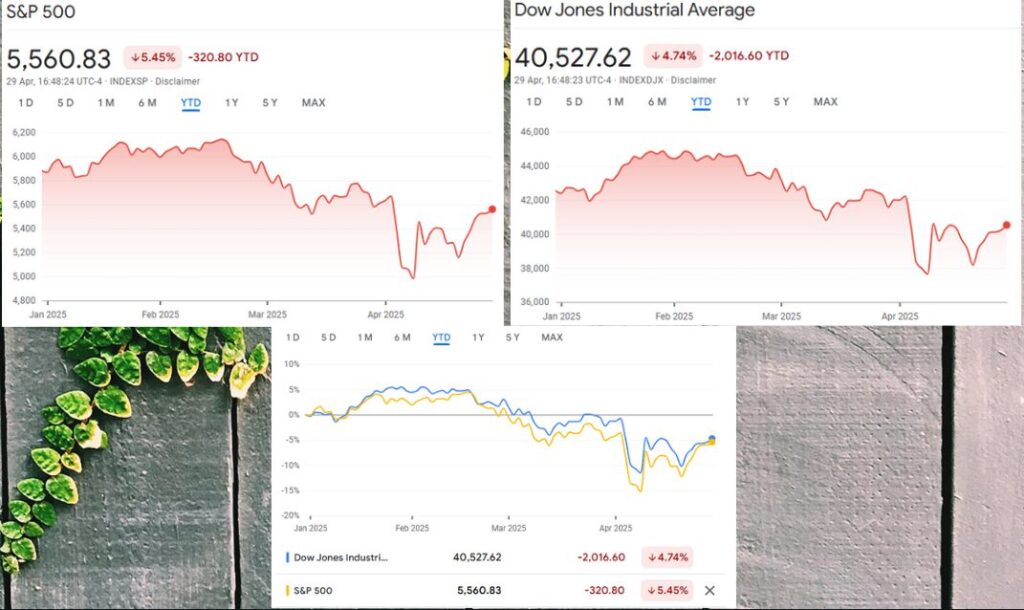

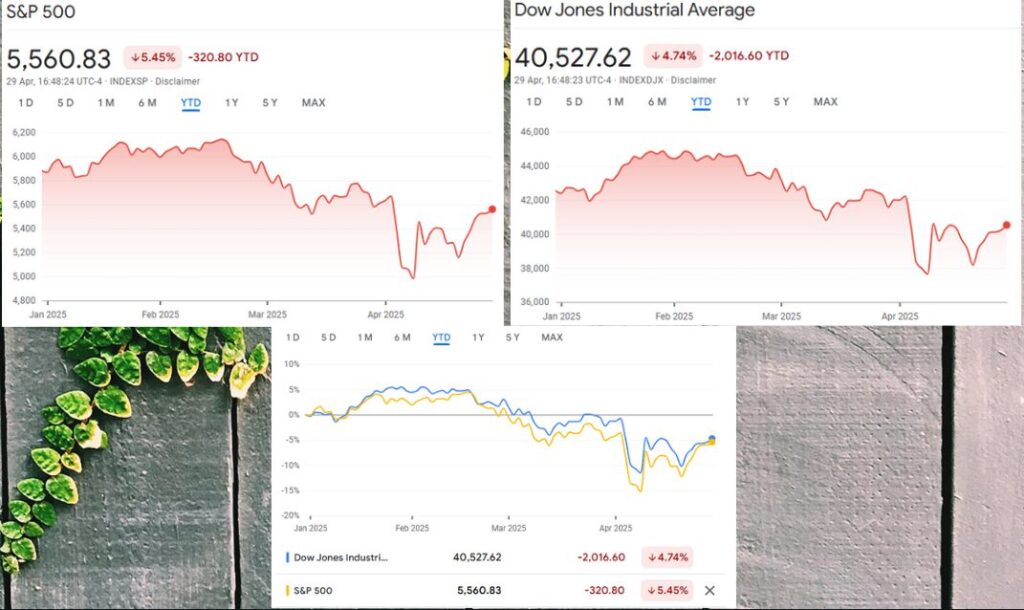

The Michael Burry strategy in 2025 currently centers on Chinese technology companies, with a massive 43% of his portfolio allocated to just three firms. While the S&P 500 has fallen about 5.45% to 5,560.83 points and the Dow Jones dropped approximately 4.74% to 40,527.62 since January, Burry’s big short investor instincts led him to look elsewhere for better returns.

Impressive Returns Beat Market

As of now, Burry’s stock market forecast for 2025 appears to be validated by some truly tremendous results. His Alibaba position (around 150,000 shares) has surged an impressive 40.21% to $118.88, effectively turning $12.7 million into about $17.8 million. Additionally, his JD.com stake (roughly 300,000 shares) gained nearly 29.12%, while Baidu shares also rose by approximately 16.37% year-to-date.

Also Read: Cryptocurrency: Pepe (PEPE) Vs Dogecoin (DOGE): AI’s 2025 Profit Prediction

The Cost of Ignoring Burry

The Michael Burry strategy of focusing on undervalued Chinese tech has delivered some rather remarkable outperformance against the S&P 500 at this point in time. His initial $33.6 million investment grew to roughly $41.9 million, while an equivalent S&P 500 investment would have actually shrunk to approximately $31.8 million. Even popular U.S. stocks like Tesla and Nvidia would have resulted in significant underperformance compared to Burry’s recession-proof investments approach in the current market conditions.

Also Read: Musk’s Big Move: Transitioning Out of DOGE Role Amid Tariff Tensions?

The Big Short Investor’s Edge

The stock market forecast of this big short investor continues to defy conventional wisdom in many ways. Burry’s willingness to make concentrated bets in somewhat overlooked markets demonstrates why his strategy consistently outperforms the S&P 500 during challenging economic conditions like we’re seeing right now. As 2025 progresses, many investors are carefully watching to see if the Michael Burry strategy continues delivering such outsized returns in the coming months.