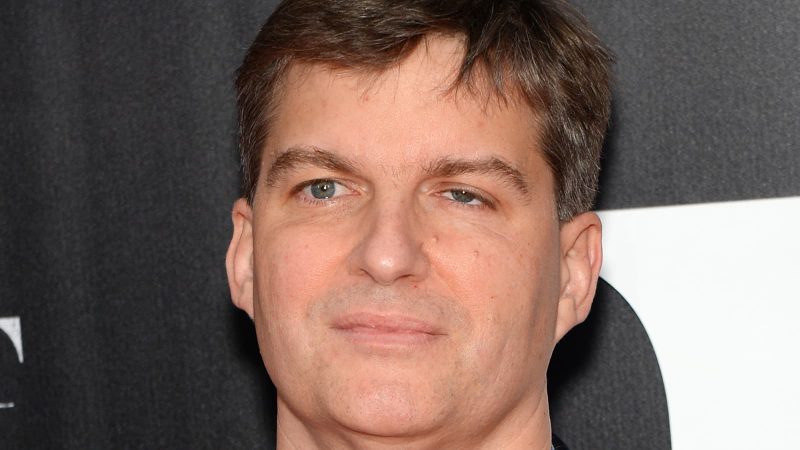

It may be a name that is unfamiliar to you, but it remains among the most well-known in the finance sector. Michael Burry is a stock market expert who rose to prominence for his part in the mortgage crisis that hit the US in 2008. Respected by many in the finance sphere, let’s take a look at who Michael Burry is and what his net worth is.

A man who has been a finance expert and the subject of a major motion picture, there is no shortage of intrigue in the life and character of Michael Burry. Yet, let’s uncover how this has translated to his investment portfolio and his approach throughout his investment career.

Who is Michael Burry?

For those who are unaware of his name, Michael Burry is an investor and asset manager who rose in relevance due to the 2007 mortgage crisis. Specifically, Burry was known as the man who predicted the development. Leading to his starring portrayal in “The Big Short,” but more on that later.

Burry was born in San Jose, California, on June 19, 1971. Moreover, he attended Santa Teresa High School before attending the University of California in Los Angeles. There, Burry acquired a degree in economics and began to embrace his interest in value investing. Interstingly, Burry actually acquired a medical degree from Vanderbilt University School of Medicine.

Following his academic career, Burry began his investment career, making some impressive returns on assets and different funds. Subsequently, he would establish his hedge fund, Scion Capital. Burry would then become revered for his investment strategies, setting the stage for the $100 gain he would receive amidst the predicted collapse of the subprime market in 2007.

How He Made His Money

Michael Burry’s wealth was accumulated through a lot of different arenas, most notably in his investment portfolio. Specifically, Burry was known for a host of acquisitions throughout his career, yielding as much as $100 million.

Additionally, Burry was the asset manager for two hedge funds, where he executed various profitable ventures. Those two entities were Scion Capital and Scion Asset Management. Moreover, both endeavors brought impressive returns to the wealth of the investment expert.

Burry also made a clear profit during the subprime mortgage crisis. Specifically, Burry would use credit default swaps to collect $800 million in profits for his clients as well as the real estate market during the financial crisis. Burry was one of the first to see the crisis coming, and his analysis brought forth a lot of gains.

Burry has also embraced other wealth acquisition methods, such as stock holdings, home loans, and real estate. Due to the housing crisis, Burry was able to make more than $700 million in returns.

Conversely, Burry has also engaged in the digital asset industry. Specifically, he has invested in certain meme tokens, NFTs, and some cryptocurrencies. Subsequently, Burry has been outspoken about the inherent volatility of the market.

Michael Burry’s Net Worth

Currently, Michael Burry is estimated to maintain a net worth of $300 million. However, there is still the possibility for the number to ascend. Specifically, Burry reopened his SChian Asset Management hedge fund and is an exempt reporting advisor. Moreover, he has kept a focus on investing in gold, farmland, and tech stocks.

Additionally, Burry reportedly has $31 million worth of put options at ARK Investment Management, opening another potential money-making avenue. Recently, Burry has been conducting investments with an eye on the current economic state of America.

Burry has recently sold tech stocks and invested in companies that could withstand a recession. Specifically, Burry has invested in various private prison companies as well as telecommunications firms such as Qurate Relatina and Charter Communications. Subsequently, he joined his farmland and gold investments with his stock portfolio.

The Big Short

As previously mentioned, Michael Burry’s role in the 2008 housing collapse was the inspiration behind the film, The Big Short. Moreover, the film seems to be the biggest pop culture contribution to Burry’s career. Standing as the project that most people know him by.

In the 2015 film, Burry is portrayed by actor Christian Bale in the movie that was based on the 2010 book, The Big Short: Inside the Doomsday Machine by Michael Lewis. Directed by Adam McKay, the movie chronicles the housing bubble that triggered the financial crisis of 2007. Subsequently, showing Burry as one of the main entities in predicting the development.

The film was a critical success and brought Burry’s name before a mainstream audience. Moreover, it was known for the ways in which it explained finance concepts like subprime mortgages to viewers who may not have understood facets of finance like them.

Conclusion

Michael Burry’s net worth and his success are the byproducts of risk and reward in the investment sector. Moreover, the former hedge fund manager has proven his unique perspective on risk and reward. Thus, using this to accumulate massive wealth

Burry is known for his market knowledge and is proof of what good analysis can bring. This isn’t to say that anyone is one financial concept away from being the next Burry, but it is a good lesson regardless. Understanding the market, and knowing the risk associated with each asset, can position you better for gains.